“This Is Not Transitory”: Hyperinflation Fears Are Soaring Across America

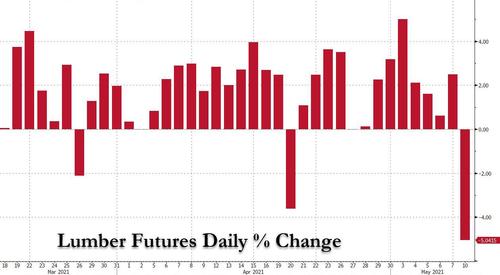

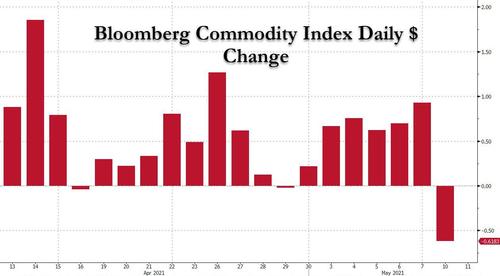

There was some good news for the (transitorily hyper–)inflation-ravaged US economy today when copper, wheat and lumber futures all fell after days of surging – in the case of the latter, the first drop in 13 days…

… pushing the Bloomberg commodity index lower after six straight days of gains.

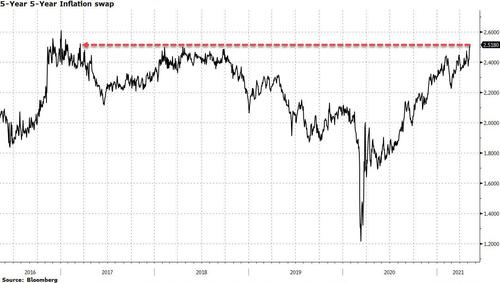

Yet while today’s boiling-off in commodities may have been a faint validation of the Fed’s claim that this inflation is “transitory”, inflation pressures are unmistakably building, with Bloomberg’s Vince Cignarella noting that the five-year/five-year inflation swap is above 2.5% and rising: “that’s the highest since January 2018 and just 10 basis points below levels we saw in January 2017.”

Why is this important? As Cignarella explains, “Inflation swaps are used by financial professionals to mitigate/hedge the risk of inflation and are considered reasonably accurate estimates for the break-even rate for the period in question. They’re also helpful to central banks and dealers who are trying to determine the market’s future inflation expectations.”

In short, the market is looking at all the signals and is growing convinced that whatever “this” is, it is not transitory.

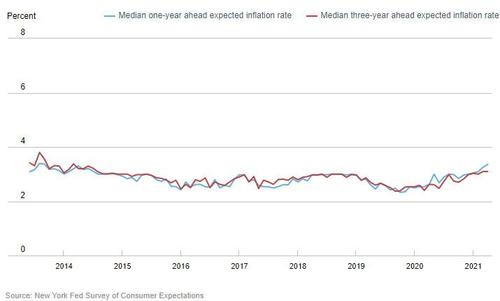

And it’s not just finance pros who are calling the Fed’s bluff: according to the New York Fed’s survey of consumer expectations, median 1-year and 3-year inflation expectations by ordinary Americans jumped to a multi-year high of 3.4% and 3.1% respectively, the highest since September 2013.

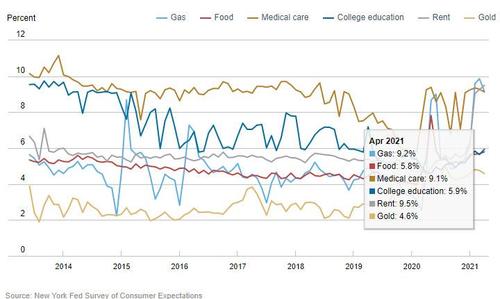

Digging through the details reveals an even more alarming picture: over the next year consumers anticipate gasoline prices jumping 9.18%, food prices gaining 5.79%, medical costs surging 9.13%, the price of a college education climbing 5.93%, and rent prices increasing 9.49%!

This is hardly a “transitory inflation” expectation, to the contrary – expectations for sharply higher inflation are become firmly ingrained.

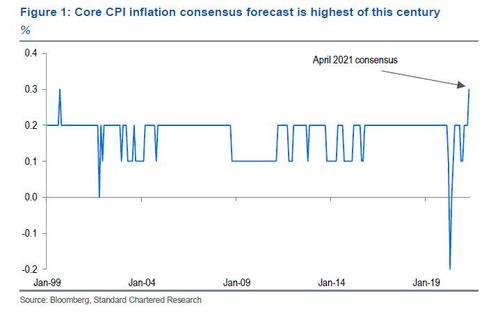

But wait, there’s more: the CPI report on Wednesday is also expected to show price pressures leaped in April, and not just on a distorted year-over-year basis (where the base effect makes readings meaningless). The 0.3% core CPI M/M increase will be the highest print this century!

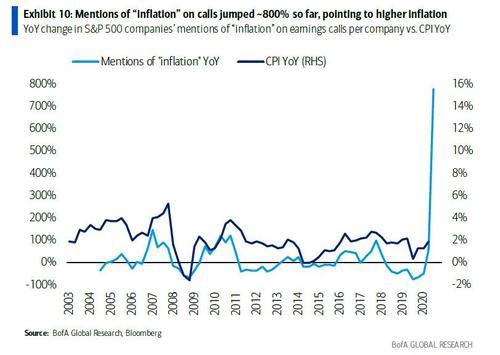

It gets worse: one week after we showed that mentions of “inflation” on company earnings calls have now quadrupled YoY; and have jumped nearly 800% YoY…

… as companies now openly freak out about soaring costs which they generously pass on to consumers, prompting BofA to conclude that “on an absolute basis, [inflation] mentions skyrocketed to near record highs from 2011, pointing to at the very least, “transitory” hyper-inflation ahead.”

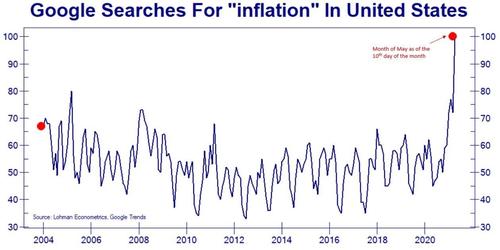

Maybe the hyperinflation will be transitory – if so, it would be the first time in history – but the soaring prices have clearly sparked a panic amid the broader population as the following chart of google searches of “inflation” shows.

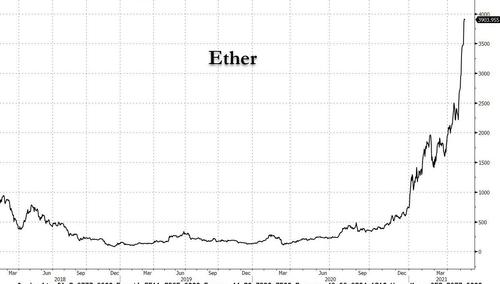

And so, with most assets now “fixed” by the Fed, with bonds having lost all their inflationary signaling as they now trade in a world of implicit yield curve control, and with stocks already in a massive bubble, is there any wonder why the chart of the latest crypto darling du jour – Ethereum – which so far has not been “micromanaged” by the Fed (unlike the central bank’s old nemesis, gold), looks the way it does…

… when increasingly more see the crypto asset class as one of the few remaining hedges for inflation, as even Bloomberg’s John Authers recently admitted.

Tyler Durden

Mon, 05/10/2021 – 22:50

via ZeroHedge News https://ift.tt/2R13QxB Tyler Durden