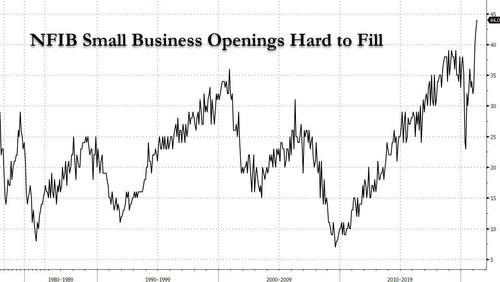

It Has Never Been More Difficult For Small Businesses To Fill Job Openings

When we looked last month at how “Biden’s Trillions” in fiscal stimulus policies have crushed small and medium businesses, where millions of workers would rather stay home and collect extended unemployment benefits, leaving mom and pop companies scrambling to hire workers or otherwise hike wages squeezing already razor thin margins (to the benefit of mega corporations which can be comfortably cash flow negative thanks to their access to capital markets, putting America’s vibrant SMEs out of business), we pointed to the just released NFIB Small Business survey which found that a record 42% of respondents said they have job openings that could not be filled.

As NFIB Chief Economist Bill Dunkelberg put it last month, “Main Street is doing better as state and local restrictions are eased, but finding qualified labour is a critical issue for small businesses nationwide.” He also explicitly admitted that Biden’s “trillions” in stimulus are behind this predicament: “Small business owners are competing with the pandemic and increased unemployment benefits that are keeping some workers out of the labor force.”

And for those readers quick to bash potential employers for being stingy and not simply raising wages to find qualified employees, a net 28% of owners reported raising compensation (up three points) and the highest level in the past 12 months, while another 17% plan to raise compensation in the next three months. Still, as we noted, with the labor shortage well ahead of wage hike plans, one things is clear: profits margins – if only for small businesses – are about to collapse, making the big megacorporations winners once again.

* * *

So fast forward to today when this morning we got the latest NFIB Small Business Survey for the month of April, which had some modest good news, namely that the Optimism Index rose to 99.8 in April, an increase of 1.6 points from March (if below the 100.8 expected) and up 4.8 points over the past three months since January.

Alas, there was more of the same bad news, with the latest report finding that the labor shortage has gotten even worse as a record 44% of owners reported job openings they could not be filled. In other words, it has never been more difficult for a small business to find new hires.

“Small business owners are seeing a growth in sales but are stunted by not having enough workers,” said NFIB Chief Economist Bill Dunkelberg.

“Finding qualified employees remains the biggest challenge for small businesses and is slowing economic growth. Owners are raising compensation, offering bonuses and benefits to attract the right employees.”

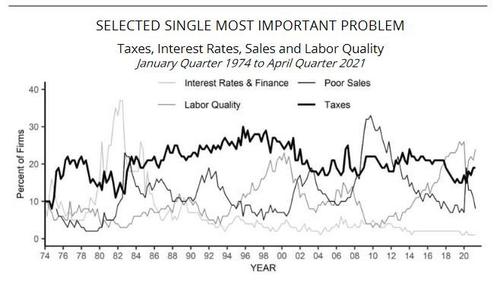

Linked with this, while just 8% cited labor costs as their top business problem, a whopping 24% said that labor quality was their top business problem, unchanged from March and the top overall concern.

As the NFIB pointed out in a separate small business Jobs Report released last week, April was the third consecutive month with a record-high reading of unfilled job openings among small businesses.

“The tight labor market is the biggest concern for small businesses who are competing with various factors such as supplemental unemployment benefits, childcare and in-person school restrictions, and the virus,” said NFIB Chief Economist Bill Dunkelberg.

“Many small business owners who are trying to hire are finding themselves unsuccessful and are having to delay the hiring or offer higher wages. Some owners are offering ‘show up’ bonuses for workers who agree to take the job and actually show up for work.”

And some more statistics from the NFIB’s Jobs Report:

- Ninety-two percent of those owners hiring or trying to hire report few or no “qualified” applicants for the positions they were trying to fill in April. Thirty-one percent of owners reported few qualified applicants for their open positions and 23% reported none.

- 59% of small business owners reported hiring or trying to hire in April, up three points from March’s reading. Owners have plans to fill open positions with a seasonally adjusted net 21% planning to create new jobs in the next three months.

Finally, the latest confirmation that the inflation spike will be anything but “transitory”, a net 31% reported raising compensation, the highest level in the past 12 months. A net 20% of owners plan to raise compensation in the next three months.

And with that we now await the latest JOLTs report, coming up in a few minutes, which we expect will reveal a number of job openings that is at or near all time highs, as all companies – not just small businesses – find it is impossible to compete with Uncle Sam’s generous handouts.

Tyler Durden

Tue, 05/11/2021 – 09:36

via ZeroHedge News https://ift.tt/3f98LV3 Tyler Durden