Japanese Investors Panic After Stocks Tumble And BOJ Does Not Buy ETFs

Something took place on Tuesday that has happened just once since 2016: Japan’s Topix index (which is widely viewed as more representative of Japanese equities than the Nikkei) tumbled by 2% in the morning session…. and the BOJ did not intervene.

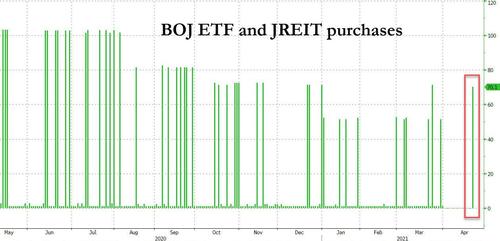

Why is this notable? Because – in a world where everyone is now completely used to Plunge Protection Teams and central bank bailouts as if it is a perfectly expected event – this was only the second time since at least 2016 that the Bank of Japan did not make an ETF purchase after the Topix fell more than 1% in the morning session. The only other time? April 21, when the Topix also tumbled 2% in the morning session and the BOJ was nowhere to be seen.

To be sure, the BOJ’s lack of intervention was to be expected: as a reminder, the central bank tweaked its ETF purchase program at the March meeting, with changes that came into effect in April. As part of its policy review, the BOJ on March 19 said it would buy ETFs as needed, scrapping the previously 6T yen annual target, but keeping its 12T yen upper limit on purchases

Until last month, the largest drop the BOJ would tolerate without buying ETFs was the 0.89% full-day decline on Feb. 24; In other words, any time the Topix would drop by 1% or more, the BOJ would step in or else there would be a market crash. Furthermore, before this year, the BOJ typically bought if the Topix fell more than 0.5% in the morning session.

This changed on April 20, when the Topix tumbled more than 2% in the morning session and contrary to trader expectations that they would get bailed out, the BOJ did not intervene, and led to a panicked stock dump in the morning of April 21, at which point the BOJ had no choice – it had to buy ot else it would suffer a far worse crash. And buy it did, purchasing 70.1b yen on April 21, the day after it so miserly withheld its bailout of Mrs Watanabe.

As Bloomberg notes, “today’s lack of action by the central bank may further fuel speculation that the bank will only step in if the drop in the AM session exceeds 2%; previously the bank had bought after a 0.5% decline.”

So keep a close eye on Japanese stocks, where frentic investors will likely test the BOJ’s resolve again by dumping stocks if only to test the new level of the “Kuroda Put.” And woe to Japan if there is a second 2% – or bigger – drop in a row in the Topix and still no BOJ bailout.

Tyler Durden

Tue, 05/11/2021 – 20:45

via ZeroHedge News https://ift.tt/3tGAQYW Tyler Durden