Goldman Scrambles To Comfort Its Clients Who Are Freaking Out About China’s Soaring Prices

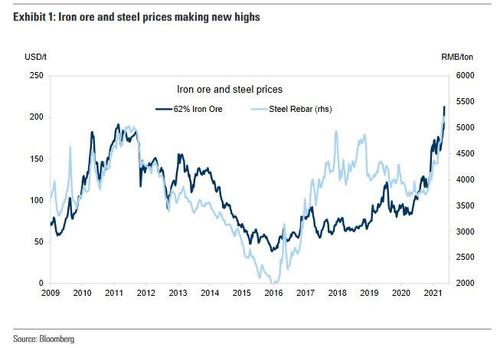

It’s hardly a secret that commodity and raw material prices in China have been soaring: this was confirmed by last night’s April PPI inflation print which surprised the market to the upside and reached 6.8% Y/Y, the highest since 2017.

The frenzy culminated with Monday’s 10% one-day jump in iron ore prices which, as Goldman’s China strategist Hui Shan wrote this morning, “brought many questions from clients regarding the impact of upstream price increases on the Chinese economy and monetary policy” especially when it comes to the threat risk of tighter monetary policy/rate hike by the PBOC.

So to address these growing concerns that China may be in the early stages of commodity hyperinflation, Goldman addresses these questions below in collaboration with its commodities strategists.

Q: Is China demand as strong as the commodity prices suggest?

Based on our reading of both macro data (e.g., PMI and exports) as well as micro data (e.g., steel consumption and air pollution), we think on-the-ground demand remains solid. Our equity analysts’ channel checks confirm stable infrastructure and property activity and resilient auto and appliance production in April. However, it is important to emphasize that China’s role in the commodity market has changed somewhat from previous years in three ways.

First, we have seen manufacturing outperforming infrastructure and property investment in China, which is also consistent with the fact that prices of flat steel (mostly used in manufacturing) outperform those of long steel (mostly used in construction). And the key source of manufacturing strength is strong external demand, which in turn was driven by economic re-opening after mass vaccination and significant monetary and fiscal support overseas. Therefore, as our commodity strategists have argued, the incremental demand for commodities currently comes from ex-China.

Second, changes in China supply outlook play an important role. Tightened steel capacity swap rules and the anti-corruption campaign in the coal industry of Inner Mongolia have added supply pressure during a time when demand is strong. China’s commitment to “Carbon Neutral 2060”, which our equity analysts expect to generate profound impacts on upstream industries, further signals to the market that China’s supply of high-emission products such as steel, aluminum and cement is unlikely to respond to higher prices.

Third, geopolitical tensions introduce risk premium and complicate the picture. The most recent example is the announcement by the National Development and Reform Commission (NDRC) to suspend indefinitely all activities under the China-Australia Strategic Economic Dialogue. Although little details were provided and our ANZ economics team believes tariffs or restrictions on iron ore are very unlikely given China’s heavy reliance on Australian supply, the news may have contributed to the latest market moves given the inbound questions that we received on the headline.

Bottom line: China demand appears robust in level terms, but we do not think the latest commodity price increases indicate China’s commodity demand is accelerating.

Q: What near-term responses can we expect from Chinese policymakers?

Chinese policymakers have taken notice of the sharply rising upstream price inflation. For example, at the Financial Stability and Development Committee meeting chaired by Vice Premier Liu He on April 8, policymakers stated the need to “keep prices stable” and to “closely monitor commodity prices”. On April 9, Premier Li Keqiang hosted a meeting with economists and entrepreneurs where Premier Li called for “strengthening the management of raw materials markets” and “alleviating the cost pressure on businesses”.

The challenge from a policy perspective is that at the same point Beijing desires lower commodity prices, they are also focused on achieving their de-carbonization targets by restraining metals supply in sectors with significant spare capacity, relative low value, and high carbon footprint (e.g., aluminum and steel in particular). Policy induced constraints on both current and forward supply act as tightening effects on underlying balances and support price. Moreover, in an environment of both strong domestic and external demand as is currently the case, such supply cuts provide even greater price effect. Until there is a material deceleration in demand conditions to moderate current tightness across the majority of industrial commodities, the ability to sustainably restrain price dynamics is limited.

In regard to actual policy tools to alleviate the pain on downstream manufacturers, so far there have been a few channels of attempted influence by Chinese policymakers. The first is to reduce other types of costs faced by businesses. We think recent announcements on cutting taxes and fees fall into this category. Second, policymakers can encourage imports and discourage exports to help meet domestic demand. For example, the Ministry of Finance has removed the export tax rebate on 146 steel products effective May 1. Third, the government can deploy strategic reserves of commodities. And lastly, regulators have urged commodities futures exchanges to curb speculative activities.

Bottom line: Although some measures are available to policymakers to temporarily alleviate pressures, the fundamental supply and demand tightness is more difficult to address.

Q: What is the impact of higher upstream prices on China growth and inflation?

Rising prices are the mechanism through which the market finds a new equilibrium by destroying demand and/or incentivizing supply. The degree to which each of the two margins of adjustment happens depends on supply and demand elasticities. So far there has been little evidence of end-demand destruction at current price levels in the available China macro and micro data. However, one trend which has emerged from late Q1 onward is a phase of downstream metal destocking. This has been best demonstrated by the negative metals apparent demand growth rates in April after strong year-over-year growth in Q1. We believe this reflects essentially a temporary buyer strike, where downstream consumers destock inventory until they have to return to market given end-demand requirements. This trend could temporarily soften metal physical markets, although raw material stock levels suggest this should abate into Q3.

The potential for supply-side responses are limited by Beijing’s de-carbonization policy emphasis. In the short run, whilst there exists some spare capacity flex in the system, a combination of weak processing margins (e.g., copper, zinc) or policy constraints at a provincial level (e.g., aluminum smelting in Inner Mongolia and steel mills in Tangshan) offer headwinds to any output acceleration. At the margin we do expect some improvement in secondary based metals production from scrap, though the volumes will be limited in aggregate. The risk of net supply capacity additions from here is low particularly in the aluminum and steel (blast furnace) sectors. A hard cap on aluminum capacity will be hit this year after which only swaps will be allowed. For steel, a recent tightening in blast furnace capacity swap rules (1.5:1 old for new swap ratio) limits any expansion potential beyond shifts to electric arc furnace (EAF).

While higher inputs costs are impacting gross margins in some industries including auto, historical experience suggests that downstream profits at the aggregate level do not suffer greatly when upstream prices increase, likely due to the relatively small raw material share of total costs and producers’ ability to improve efficiency and/or pass some of the higher costs onto end-consumers. That said, the COVID shock is like no other, and we may see significant demand destruction if prices move higher for longer, particularly when supply has become much less responsive to price signals than before because of longer-term trends such as de-carbonization.

In previous research, we have found that PPI inflation only affects non-food goods in CPI and the pass-through is far from complete. Given the softening food price inflation on pork cycle and the muted service inflation on both economic slack and government policies aimed at reducing housing and medical costs faced by consumers, we think CPI inflation is likely to remain subdued even as PPI inflation reaches a multi-year-high.

Bottom line: The impact of higher commodity prices and upstream producer prices on Chinese growth and CPI inflation looks limited thus far.

Q: Will the upstream price inflation cause the PBOC to tighten monetary policy?

In the Q4 PBOC Monetary Policy Report, the central bank characterized the high PPI inflation and low CPI inflation as driven by “temporary factors”. The Q1 PBOC survey of urban depositors showed inflation expectations remained subdued among consumers. In April, Monetary Policy Committee (MPC) member Wang Yiming discussed the rebound in oil and metals prices and highlighted the need to “avoid strengthening inflation expectations.” Overall, the central bank appears to be paying closer attention to upstream price pressures and inflation expectations over the past few months.

On the other hand, interbank liquidity has been kept ample and 7-day repo rate has stayed below the policy rate of 2.2%, suggesting little signs of policy tightening on the back of sharply rising upstream prices. The lack of response from the central bank makes economic sense because the root cause of the latest commodity price rally is not China demand. As discussed earlier, stronger ex-China demand and supply concerns have played a bigger role in driving the market higher. If this diagnosis is indeed correct, then tightening monetary policy in China would not be an effective solution. If anything, the demand destruction impact of higher input costs may argue for accommodative monetary policy to offset the overall burdens on businesses as long as inflation expectations remain anchored.

Bottom line: We do not expect the PBOC to tighten monetary policy on higher upstream prices.

Tyler Durden

Tue, 05/11/2021 – 21:45

via ZeroHedge News https://ift.tt/3vWFpQA Tyler Durden