Stagflation Scare Sparks Carnage In Crypto, Stocks, & Bonds

Taken together a much weaker-than-expected payroll and much higher-than-expected CPI report suggests more than a whiff of stagflation…

Source: Bloomberg

Stagflation? Inconceivable?

Stocks are down for a third straight session, which hasn’t happened since March. Small Caps were the biggest loser on the day followed by Nasdaq after the plunge oin CPI and immediate bounceback failed (with stocks ending at the lows of the day)…

Today was the biggest loss for S&P since Feb and Dow’s worst day (-700) since January.

Small Caps are down 6% since Friday’s close but the rest of the market is a shitshow too…

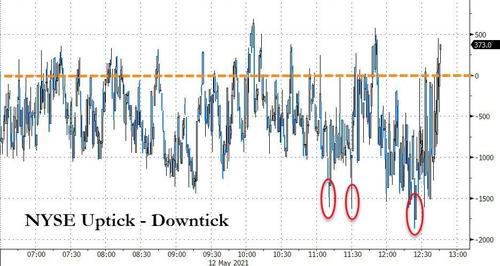

Heading into the 1430ET ‘margin call’ time, a major sell-program hit markets (and another around 1525ET). Note that there was barely any aggressive BTFD programs…

Source: Bloomberg

And today’s Nasdaq-led plunge leaves the tech-heavy index up less than 1% YTD…

Source: Bloomberg

Small Caps and Nasdaq closed below their 100DMAs…

Tech and Consumer Discretionary are the big laggards this week with Staples and Healthcare down least…

Source: Bloomberg

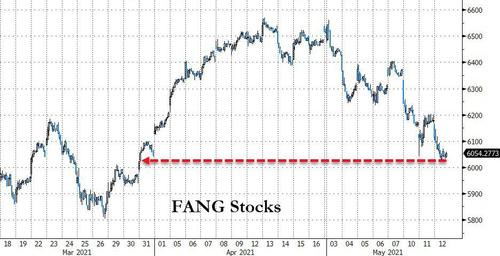

FANG Stocks erased all of yesterday’s bounce (-8% from highs), falling back to their lowest close since March

Source: Bloomberg

AAPL and AMZN closed below their 200DMA…

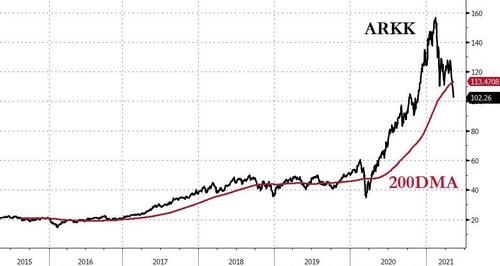

Cathie Wood was clubbed like a baby seal again today…

Source: Bloomberg

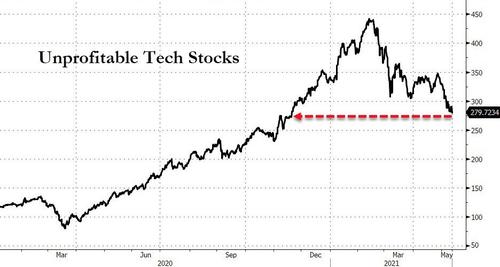

Unprofitable Tech stocks tumbled to their lowest in 6 months (down 37% from highs)

Source: Bloomberg

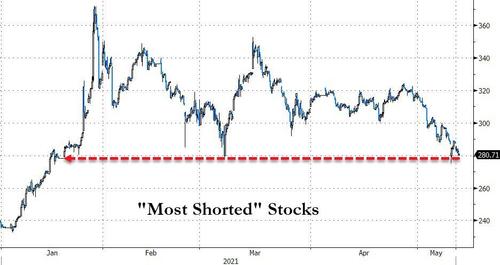

“Most Shorted” Stocks tumbled to their lowest

Source: Bloomberg

Recent IPOs extended their losses today, now down over 28% from highs…

Source: Bloomberg

Growth/Value is at a critical level…

Source: Bloomberg

VIX surged above 27 today – its highest since early March…

And as Larry McDonald’s Bear Traps Report notes, our 21 Lehman Risk Indicators are flashing. The spread between the 2nd and 8th month volatility futures contracts is the highest since March.

Source: Bloomberg

As this spread rises (money managers paying-up for near-term volatility), it is a major warning sign for the market. Once it blows positive, it speaks to a capitulation buying opportunity (with the exception of March 2020).

Treasuries were dumped along with stocks today…

Source: Bloomberg

10Y Yields topped at last week’s spike highs before rotating modestly lower

Source: Bloomberg

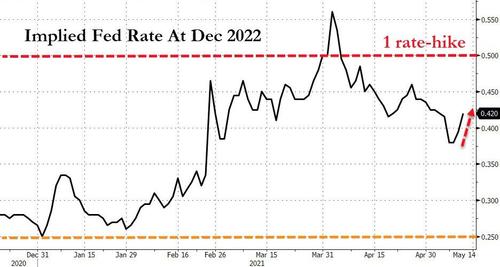

The odds of a rate hike before Dec 2022 are rising…

Source: Bloomberg

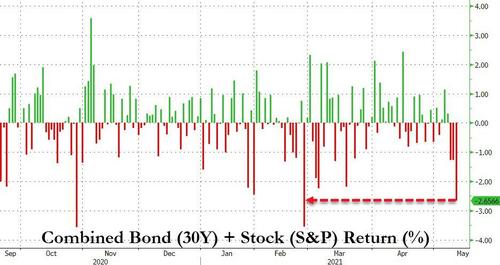

The combined drop in bonds and stocks was the biggest daily loss since February…

Source: Bloomberg

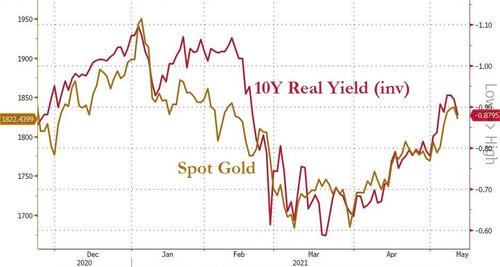

Real yields and gold remain tightly coupled…

Source: Bloomberg

Gold was hit too, back to pre-payrolls levels….

Oil ended higher, but well off its highs with WTI back below $66…

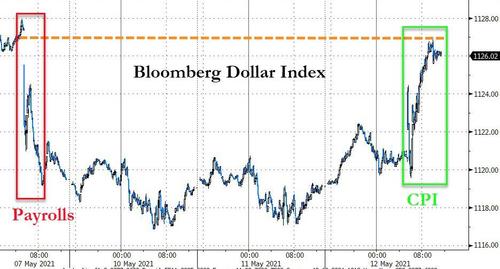

The dollar spiked today – amid the smell of widespread liquidation in everything – erasing the payrolls plunge losses…

Source: Bloomberg

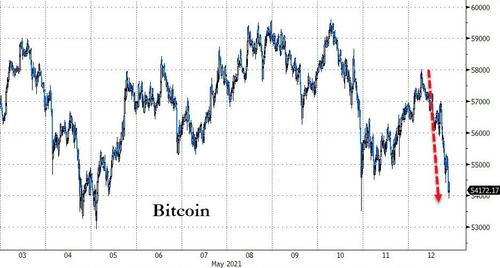

Bitcoin rallied overnight but was dumped along with everything else today after CPI…

Source: Bloomberg

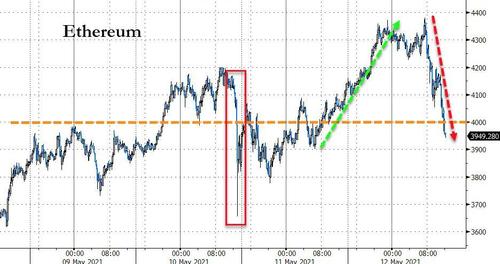

Ether ended back below $4000 after surging to a new record high just shy of $4400…

Source: Bloomberg

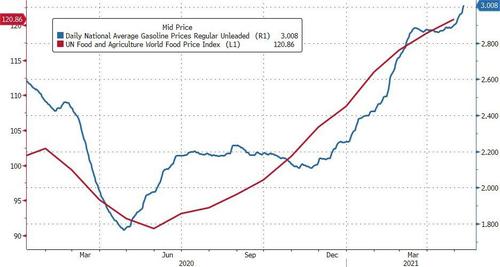

Finally, there’s no inflation if we just ignore the things we need to live (food) and work (gas – which just topped $3 for the first time since 2014)…

Source: Bloomberg

Diamond hands has been replaced by petrol cans pic.twitter.com/0HH2EWXCMZ

— EvInvest (@EvInvest) May 12, 2021

Tyler Durden

Wed, 05/12/2021 – 16:00

via ZeroHedge News https://ift.tt/3fczrUP Tyler Durden