Silvergate Soars After Announcing Partnership With Facebook-Backed Cryptocurrency

Having been hammered in recent weeks for no bigger sin than sporting anti-Midas Cathie Wood (and her ARKK) as one of its bigger prominent investors, Silvergate Capital – a small ($2 billion market cap) “provider of infrastructure solutions and services for the growing digital currency industry”, i.e., crypto fintech player – soared over 20% in after hours trading following an 8K announcing that it will become the exclusive issuer of DiemUSD, the stablecoin formerly known as Libra, and which is backed by Facebook.

The Diem Association, a group of Facebook and 25 other companies and nonprofit groups once known as Libra, is moving its main operations to the U.S. and partnering with Silvergate to issue its cryptocurrency backed by U.S. dollars. Silvergate, a prominent but small (its capitalization of just $2BN is smaller than the market cap of most memecoins) player in the cryptocurrency industry, which will issue the coin and manage Diem’s reserve of U.S. dollars, the association said Wednesday in a statement.

According to the partnership press release, Silvergate will issue a U.S. dollar backed stablecoin, known as DiemUSD, the first asset ever issued on the Diem payment system, which will enable the conversion of fiat USD to and from the stablecoin through a process known as “minting” and “burning.” The stablecoins can then be used by virtual asset service providers (“VASPs”) for a variety of use cases, which includes commerce between consumers and merchants, as well as cross-border payments.

In a primer published today, Bank of America writes that Diem aims to occupy the middle ground between unregulated cryptocurrencies and the status quo: “It is a distributed ledger-based system which looks to combine crypto’s resilience and openness with the requirements of global regulators and mainstream finance. It is, we think, a hugely ambitious project, and one which could potentially launch before any of the European central banks’ digital currencies. It aims to address the remittance market, and to introduce more diversity into the payments ecosystem.”

While Diem is still building out a global payments network, with the idea that it could serve its own stablecoin or even central bank digital currencies if world governments decide to issue them, for now it will be Silvergate that serves as gatekeeper to Facebook’s initial foray into digital currencies.

“It’s critical for the U.S. to foster innovation in this space. The U.S. can’t really afford to fall behind here,” said Diem Chief Executive Officer Stuart Levey. Levey said Diem’s payments network will be able to lower the cost of sending money around the world, whether it’s through a Diem-issued coin or the central-bank digital currencies that many countries are considering.

As Bloomberg notes, while more straightforward to achieve, the new plans are a big comedown from the vision unveiled by the Libra Association in 2019. That June, Facebook and 27 partners announced the project to great fanfare with large ambitions. The Libra Association, as the Diem Association was then known, said it planned to launch a global stablecoin backed by a basket of currencies, including the U.S. dollar, euro and others.

However, the blowback from world governments was fierce and even though Facebook executives said they were just one of equal partners in the association, U.S. lawmakers said its involvement gave them concerns about protecting user data or giving the already powerful company a toehold in financial services. Some lawmakers even posited that libra could be a threat to the U.S. dollar as the world’s reserve currency.

Luckily for Facebook, that bogeyman is now China which is rushing ahead with its own digital cryptocurrency whether the US likes it or not, and as such Facebook’s digital currency ambitions have turned from liability to an asset.

Amid the criticism, the Libra Association lost some of the members most equipped to address financial regulators, including Visa Inc., Mastercard Inc., and PayPal Holdings Inc. Eventually, the Libra Association decided to delay the launch of a multi-currency coin in favor of separate cryptocurrencies linked to individual countries’ money. The association also rebranded as Diem, but never received a necessary license from the financial regulator in its headquarters country of Switzerland.

Now, Diem’s ambitions are tightening once again. The association’s members currently include Facebook, crypto-focused companies like Coinbase and others such as ride-hailing company Uber and commerce platform Shopify. Diem said while it expected eventual approval in Switzerland, it’s withdrawing the application for its license and moving most operations to the U.S.

Diem’s U.S. subsidiary plans to register as a money-services business with a division of the U.S. Treasury Department.

And while Diem’s path forward might be easier that Libra’s, Bloomberg frets that the association could struggle to explain how the project differs from myriad dollar-backed stablecoins that already exist, such as USD Coin. We don’t: if anything the recent resurgence in private cryptos has shown just how lax the US will be despite frequently threatening to regulate cryptos out of existence. After all, a wipe out of the crypto currency space whose market cap is now over $2 trillion would be a crushing, deleveraging blow to the financial system where approximately 20% of all Americans now hold some crypto in their digital wallets.

Sensing that the wind has shifted and the big digital currency bogeyman is now China, Facebook has decided to give its stablecoin a second try. In an interview, Levey said the association believes that the way it’s implementing the coin, with built-in consumer protections and anti-crime provisions, will be appealing to regulators and companies that want to use the network.

Many central banks, including those of the U.S., Europe and China, are in the process of researching or building their own digital currencies. If those come to pass, Levey said, Diem can adjust its network to accommodate them.

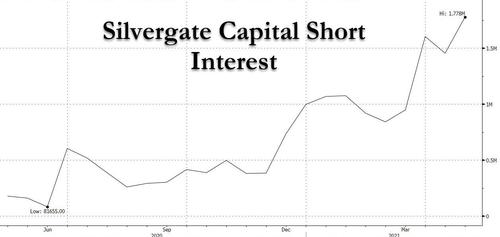

Finally, for those considering dipping their toe into the publicly-traded Silvergate, whose market cap today was a tiny $2 billion, an amount Facebook can easily spend 5x over to purchase the company if and Diem project takes off, a quick observation: as a result of having Cathie Wood among its shareholders, the stock has been shorted into oblivion in recent weeks, as a result its short interest is now the highest on record. How much of move higher would be sufficient for the shorts to panic and send the highly illiquid stock (it trades just 1.2mm shares per day) soaring?

For professional subs curious to learn more about Diem, we have provided a comprehensive primer in the usual place.

Tyler Durden

Wed, 05/12/2021 – 17:38

via ZeroHedge News https://ift.tt/3eMbWmR Tyler Durden