Tesla Suspends Bitcoin Payments Over “Concerns About Environmental Impact”

After announcing plans to accept payment for Tesla’s cars in bitcoin back in February, Tesla CEO Elon Musk has just announced via tweet that the company will suspend bitcoin payments over concerns about the environment.

As perhaps the biggest booster of bitcoin in corporate America, Tesla announced during its Q1 earnings report released last month that it made a $272 million profit selling some of the bitcoin it had purchased on the company’s balance sheet. Earlier this week, Musk joked about the possibility that the firm might accept Doge for payment.

In a note published on Twitter, Musk wrote that while he is still personally a believer in the crypto currency, Tesla has become concerned about the role of fossil fuels in bitcoin mining, a common criticism made by environmentalists against bitcoin. “Cryptocurrency is a great idea on many levels and has a promising future but this cannot come at a great cost to the environmet,” Musk wrote. He added that the company “will not be selling any bitcoin and we intend to use it for transactions as soonas mining transitions to a more sustainable energy.”

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

The note comes after Musk joked earlier this week about the prospect of the company accepting payment in Dogecoin as well.

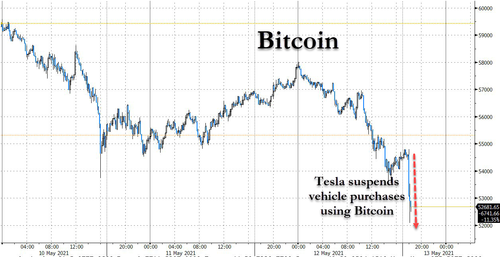

The price of bitcoin kneejerked lower on Musk’s tweet, according to Coin Market Cap, extending its 24-hour decline to 6%.

While the initial reaction in crypto was anything but bullish, analysts quickly noted that this could be good news for ethereum, as Musk noted in his tweet that Tesla will be looking at alternatives in the crypto space that use “<1%" of bitcoin's energy consumption.

As JPM recently pointed out in a note to clients, ESG factors are one reason ethereum’s explosive move higher, which has made it a standout crypto performer in recent weeks, will likely continue. The greater focus by investors on ESG has shifted attention away from the energy intensive bitcoin blockchain to the ethereum blockchain, which in anticipation of Ethereum 2.0 is expected to become a lot more energy efficient by the end of 2022. Ethereum 2.0 involves a shift from an energy intensive Proof-of-Work validation mechanism to a much less intensive Proof-of-Stake validation mechanism. As a result, less computational power and energy consumption would be needed to maintain the ethereum network.

In other words, this is one area where ethereum can out-compete bitcoin in the long run.

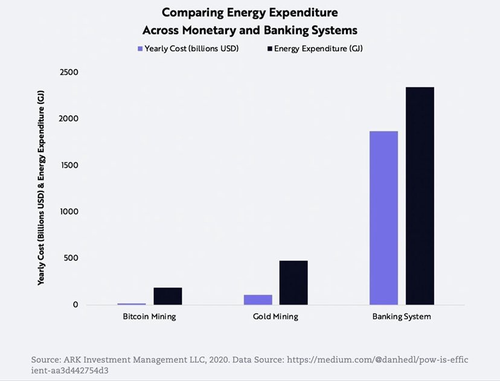

But when it comes to fossil fuel consumption, the traditional banking system has crypto beat.

Tyler Durden

Wed, 05/12/2021 – 18:29

via ZeroHedge News https://ift.tt/3uMDQVk Tyler Durden