When Do Policy Makers Become Concerned

Unlike the Fed-mandated party line of “transitory inflation”, which was eagerly espoused by the likes of Morgan Stanley and JPMorgan (discussed earlier), Bank of America has breached with Wall Street convention and discussing yesterday’s scorching CPI, the bank’s chief economist says that “very aggressive monetary and fiscal policy has added rocket fuel to the economic reopening” and cautions that in his view ” this is not purely temporary” adding that repeated “one time” price increases and super dovish policy promises are already raising inflation expectations.

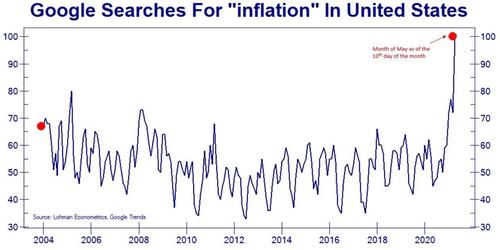

Picking up on what we said earlier this week in “Hyperinflation Fears Are Soaring Across America” where among other things we showed the surge in google search for “inflation” (wait until this become stagflation before things get really fun)…

… Harris notes that this is starting to become apparent in both market based measures and consumer surveys.

The end result according to the strategist, is that workers and firms are beginning to incorporate a “cost of living” component in their wage and price demands. That said, the hope is that shortages ease in the fall as supply catches up to demand. Reduced unemployment benefits, the reopening of schools and childcare facilities and less fear of catching COVID on the job should accelerate the return of workers to the job market. However, Harris concludes, “with more fiscal stimulus coming and the Fed delaying its exit from zero rates, aggregate demand will remain strong and shortages could return quickly.”

So when – if ever – will policy makers become concerned?

With the Fed pledging to wait years before it starts hiking rates, can anything spoil the fun at the Marriner Eccles building even as a tide of stagflation lifts all recessionary boats? According to Harris, fiscal stimulus will continue move forward undeterred despite the recent hot data, while “the disappointing jobs number can be used to justify enacting the full budget proposals.” Meanwhile, for the moment the Fed is staying close to script. “The rise in inflation is purely temporary. Inflation expectations are a lagging indicator. And if and when inflation picks up in earnest we have the tools to deal with it.”

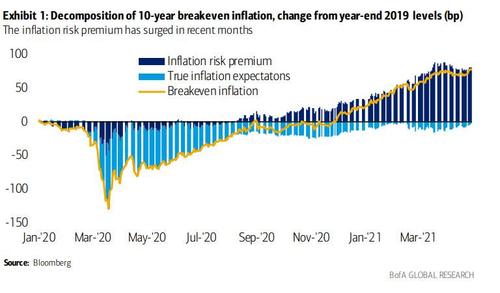

So while we wait, the BofA strategist recommends that investors keep a close eye on the various measures of inflation expectations. So far, the bond market appears to have accepted the Fed’s narrative, and while inflation breakevens have moved up in recent months but had muted response to yesterday’s data release, falling modestly on Thursday. Consumer surveys have also picked up, but have yet to fully reverse the drop late in the last business cycle.

Finally, BofA is keeping a close eye on the Michigan measure of inflation expectations 5 to 10 years ahead. It has risen from a low of 2.2% to 2.7% last month. We get the preliminary May number on Friday, and it may notch up another tenth. However, the real test comes later as surveys begin to reflect the press coverage around yesterday’s number and all of the signs of shortages.

Tyler Durden

Thu, 05/13/2021 – 12:18

via ZeroHedge News https://ift.tt/2Rhsz0r Tyler Durden