Expectations Matter Most When It Comes To Inflation

By Laura Cooper, Bloomberg reporter and Markets Live commentator

Inflation expectations matter when it comes to central-bank policy, with scope for markets to ramp up hedging bets as price uncertainty extends – and more potential shock-and-awe CPI prints add conviction to the debate.

While investor fears of runaway price pressures may yet prove overblown, as evidence of inflationary impulses builds, demand for hedges against the widening tail risk of sustained pressures can extend.

The Federal Reserve is steadfast in its resolve to focus on employment but a de-anchoring of inflation expectations can prompt a rates guidance about-turn. Fed members have stated as much, monitoring transitory pressures that could prove persistent.

An anchoring of inflation expectations equates to forward-looking gauges that are relatively insensitive to incoming data, according to former Fed Chair Ben Bernanke. Expectations may be harder to contain against rising commodity prices, producer supply constraints, and labor shortage anecdotes that risk durable supply-side wage pressures.

The Fed may further struggle to anchor expectations given the ambiguity around its average-targeting mandate. An inflation overshoot is welcome as it allows the economy to run hot, yet the implicit period of inflation variability – and uncertainty – can have investors seeking greater compensation for tail risks.

The Fed’s preferred gauge, expected inflation over the 5-year period that begins five years from today, is already upending the downtrend since 2013. While both a steeper nominal and flatter TIPS curve look needed to spur it sustainably beyond 2.4%, momentum matters – all else equal, if markets expect inflation to rise by 1ppts, actual price pressures tend to follow in-step.

The new Index of Common Inflation Expectations is taking greater prominence on the Fed’s dashboard. While it came in around 2% in 1Q-2021, should it “drift up persistently,” policy may be adjusted, according to Fed members Richard Clarida and Lael Brainard. Of the 21 variables in the index, expectations derived from 5-year and 10-year TIPS have the greatest weight.

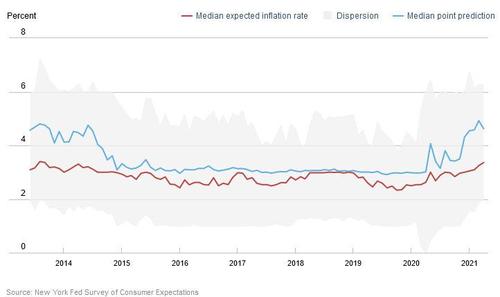

Other market-based measures are likely to stoke further upside: signs of wage pressures before the labor market recovery is effectively complete, for example. Other metrics are already elevated with the latest Survey of Consumer Expectations revealingthe highest one-year forward print since 2013.

A simple model of 10-year breakeven rates run off of nominal yields and macro drivers such as credit spreads suggests elevated bets already. Yet given heightened uncertainty, captured in the Minneapolis Fed’s market-implied probability of 3%+ inflation in coming years rising above 30%, rates can climb as pricing near-term risks extends further out

Of course, it’s hard to have conviction that we are witnessing a regime shift after a prolonged period of tepid price pressures. Secular disinflationary forces likely remain, core PCE drivers point to subdued longer-term trends and ultimately, an overshoot of inflation bets, most evident in the unusually inverted 5y-10y breakeven spread, can be pared back

Yet with more months of inflation conviction ahead – and core prints above 3% – expectation risks are skewed higher. That could be what is needed to prompt that policy pivot – after all, there is a risk in expecting the future to replicate the past after all.

Tyler Durden

Thu, 05/13/2021 – 17:40

via ZeroHedge News https://ift.tt/3uYiBQx Tyler Durden