John Authers: Watching For “Unrest” Over EM Food Prices And Whether Elon Musk Has “Jumped The Shark”

Among the difficulties of entering uncharted macroeconomic territory, where daily “transitory” changes cause wild volatility in all corners of the market, is documenting key themes as they emerge.

One of the better analyses of the current market environment that we have read has come from Bloomberg Opinion writer John Authers. In a piece published on Friday, Authers lays out two key market themes heading into the end of Q2:

-

The developing problem of inflation, especially as it relates to the cost of food, in emerging markets.

-

How Elon Musk has, alongside of all of his devotees and disciples, placed himself firmly on the wrongside of what could be a serious coming market correction.

Rising Food Prices In Emerging Markets Could Eventually Lead To Civil Unrest

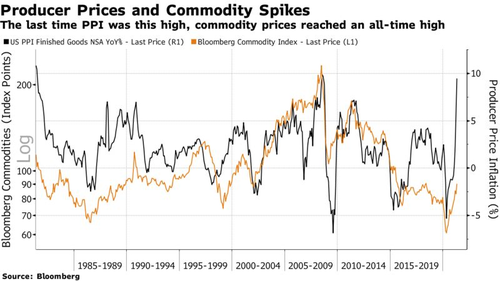

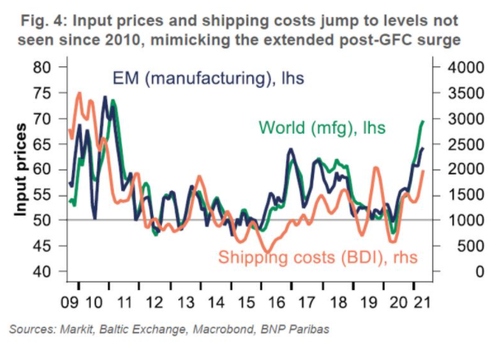

First, Authers points out the obvious: commodity prices have blown through the roof. Producer price inflation came in at “its highest in four decades, bar a brief peak in the summer of 2008,” he notes of this week’s data.

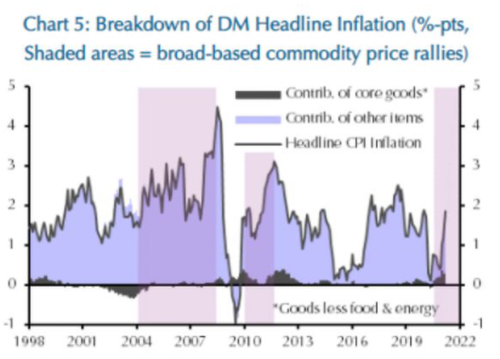

He notes that while the 2008 price spike was driver by oil, there’s no such pressure now. The Bloomberg Commodity Index is up 48.4% over the last 12 months, a stunning rise. Authers also points out that “in developed markets at least, the contribution of core goods — excluding oil and agricultural products — to inflation isn’t very significant”.

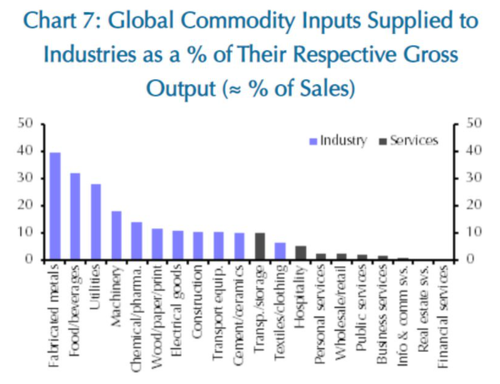

He notes that commodity inflation isn’t a major problem for the products and services that dominate the developed world…

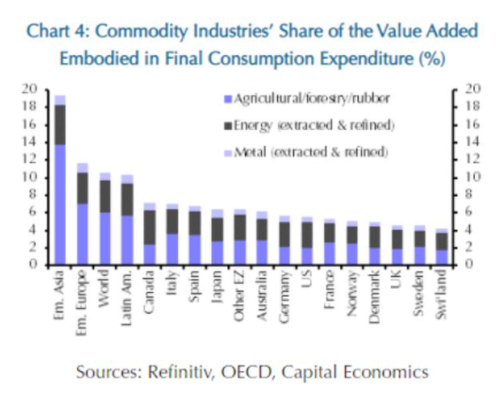

…but that they still play a crucial role in emerging markets. For example, places like Sub-Saharan Africa and Asia are far more affected by commodity prices than places like Europe and North America.

And when these moves happen in emerging markets, they tend to be sustained. The last such move in commodity prices came during the Global Financial Crisis and lasted for “a couple years”, Auther notes.

The rising prices can beget social unrest, he notes, citing that the spark that lit the Arab Spring revolts of 2011 was protests in Tunisia over high food prices.

“Only in a rich nation could one exclude nourishment and staying warm as anything other than ‘core.’ Commodity price inflation can thus be very politically destabilizing, especially in countries without strong and flexible systems of governance,” wrote Jason DeSenna Trennert of Strategas Research Partners.

He continued: “Sadly, riots for food in countries like India, Egypt, and Indonesia became commonplace. With America’s twin deficits approaching 20% of GDP, it is difficult to get bullish about the U.S. dollar, especially against commodities and hard assets. In this way, the dollar is, as Treasury Secretary John Connally once said, “our currency and your problem.”

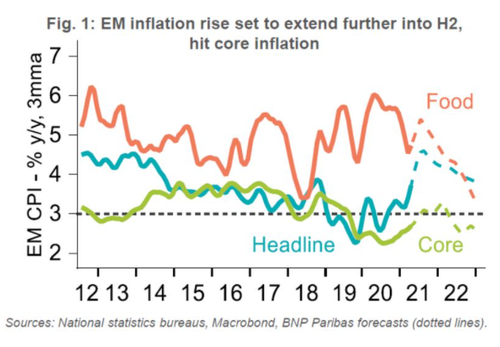

The risk is real, Authers notes. He makes the case that food makes up 29.8% of consumer expenditures in India, as much as 59% in Nigeria, while only accounting for 6.4% in the U.S. As a result, headline inflation in emerging markets will rise, he argues.

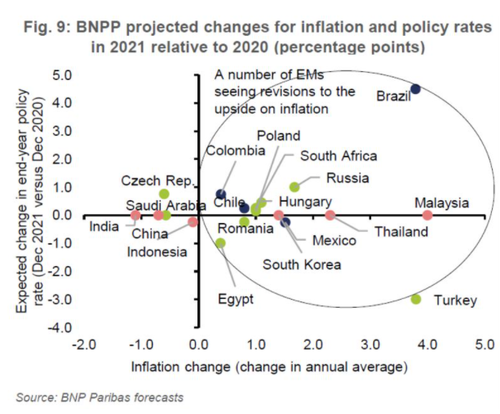

At that point, countries could consider interest rate hikes when their economies “aren’t ready” for them, Authers says.

These rising rates would be largely unexpected, as noted in the BNP chart above. Authers concludes his argument by noting that the combination of expensive food and rising rates are both “unpopular” trends in emerging markets – especially during a pandemic. This, obviously, would raise the risk for unrest.

Elon Musk’s Crypto Advocacy Has Taken A “Dark Turn”

Shifting gears, Auther also approaches the subject of one of the most well known beneficiaries of the market over the last 18 months, Elon Musk. Musk has seen his net worth rise over $100 billion in the last 18 months as the result of Tesla’s astronomical (and mysteriously timed) rise.

Authers introduces how Musk advocating for cryptocurrencies became a mutually reinforcing theme for both Bitcoin and Tesla. “The narrative involving Musk and cryptocurrencies has taken a much darker turn,” Authers writes.

Questioning whether or not Musk’s statements about dogecoin and bitcoin have been jokes or not, Authers points out the very real effect Musk has had on the price of the coins, noting the dip on Sunday and the rise yesterday, after Musk tweeted positively about dogecoin.

But he also notes that Musk’s involvement in coins means he “might be in danger of turning himself into an unserious figure, which isn’t a great narrative for the CEO of one of the world’s largest companies.”

We’d argue Musk already isn’t a serious figure – but that’s what makes a market, we guess.

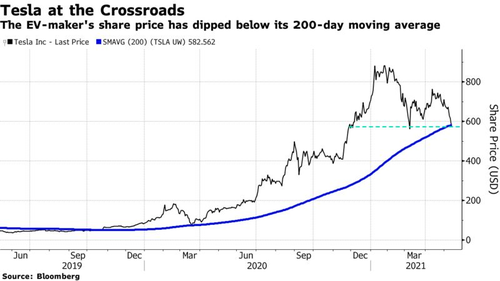

Authers can’t help but align Musk’s comments about coins and the recent drop in Tesla shares, noting that its down 35% from its peak.

“Charts like this don’t look good,” he writes, before going on to conclude that Musk has “jumped the shark”:

After years of triumphantly and cheekily proving the doubters and short sellers wrong, Musk is now on the wrong end of a nasty correction, and vulnerable to a new narrative that he has “jumped the shark” — taken his eye off the ball of his business, and enjoyed a second career as an entertainer. Hubris, or “pride comes before a fall” is one of the oldest human narratives. He doesn’t want to play to it. And as there have been plenty of signs of investment bubbles, particularly in crypto but also in the range of growth and “meme” stocks that support them, a burst bubble looms as another potentially self-fulfilling narrative.

While we think Authers’ timing may be a little late in recognizing Musk for the carnival barker he is, we can’t help but feel as though he finally has his finger on the pulse.

Tyler Durden

Fri, 05/14/2021 – 08:21

via ZeroHedge News https://ift.tt/3tLN6rs Tyler Durden