NFIB Data Says It’s Only An Economic Recovery

Authored by Lance Roberts via RealInvestmentAdvice.com,

The recent NFIB survey suggests we are only in an economic recovery, not an expansion. Such was a point I made with Daniel Lacalle in a recent podcast.

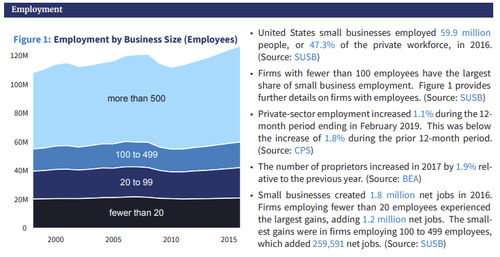

While the mainstream media overlooks the NFIB data, they really shouldn’t. There are currently 30.7 million small businesses in the United States. Small businesses (defined as fewer than 500 employees) account for 99% of all enterprises, employ 60 million people, and account for nearly 70% of employment. The chart below shows the breakdown of firms and jobs from the 2019 Census Bureau Data.

We understand the importance of the data, which is why we regularly report on it. For example:

-

September 2019 – NFIB Survey Trips Economic Alarms:

-

April 2019 – Previous Recession Warnings Now A Reality

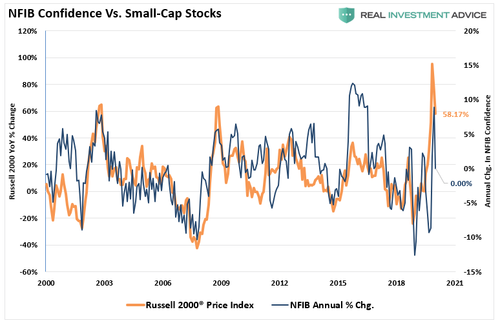

Our most recent report was at the end of January entitled: “NFIB Survey Warns About Small-Cap Stocks” Starting a little over a month later, small-cap stocks began to underperform the major index.

The most recent survey for April 2020 is sending some important messages that differ from what we hear from the mainstream media:

-

The “confidence” of an economic recovery is weak.

-

Higher wages are not a significant concern.

-

Businesses aren’t investing due to a lack of “real demand.”

Let’s dig in.

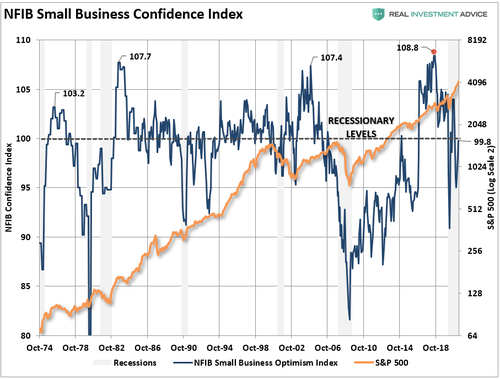

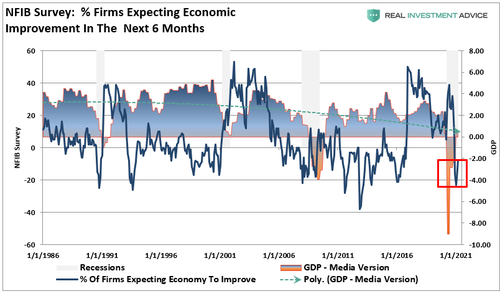

NFIB Shows Confidence Drop

The April survey showed a slight increase in the over “confidence” index to 99.8 vs. 98.2 in March. The reading is substantially lower than the August 2018 reading of 108.8. Notably, despite a year-long economic recovery from the Q2-2020 lows, the level of confidence remains near recessionary levels.

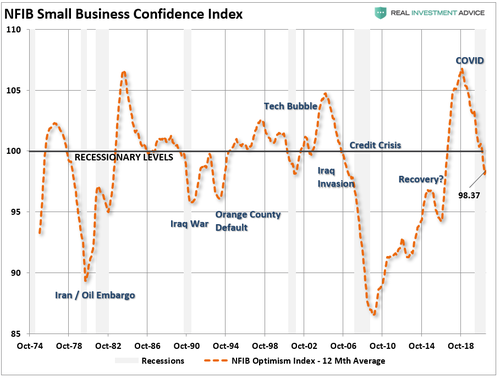

However, given the “noise” of that dataset, we find a more useful gauge of “confidence” in the 12-month moving average. Not surprisingly, given the economy is still struggling with the current recovery, “confidence” remains extremely weak.

The importance of “weak confidence” also affects the “risk” business owners will take concerning capital expenditures, employment, and sales. Importantly, this is a “sentiment” based survey. Such is a crucial concept to understand as “planning” to do something and “doing” it can be very different.

An Economic Boom Will Require Participation

Currently, many analysts expect a massive economic boom in 2021. The basis of those expectations is massive “pent-up” demand as the economy reopens.

I would agree with that expectation had there been no stimulus programs or expanded unemployment benefits. Those inflows allowed individuals to spend during a recession where such would not usually be the case. Those artificial inputs dragged forward future or “pent-up” consumption into the present.

However, the NFIB survey also suggests much the same.

Small businesses are susceptible to economic downturns and don’t have access to public markets for debt or secondary offerings. As such, they tend to focus heavily on operating efficiencies and profitability.

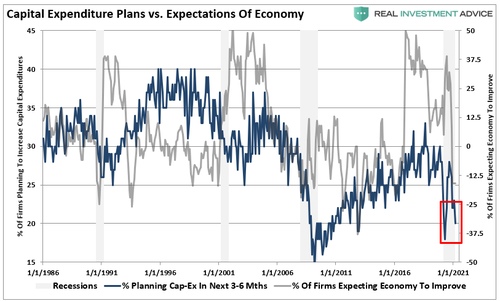

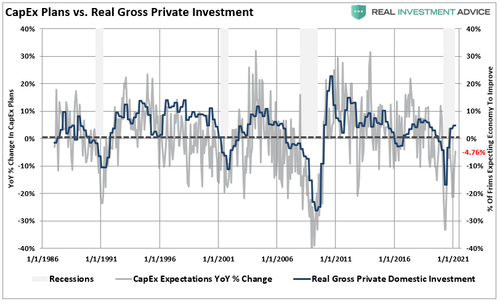

If businesses were expecting a massive surge in “pent up” demand, they would be doing several things to prepare for it. Such includes planning to increase capital expenditures to meet expected demand. Unfortunately, those expectations peaked in 2018 and are dropping back to the March 2020 lows.

There are important implications to the economy since “business investment” is a GDP calculation component. Small business capital expenditure “plans” have a high correlation with real gross private investment. The weakness in “CapEx” expectations suggests overall business investment will remain weak as well.

As stated, “expectations” are very fragile, and reality is often quite different.

Employment To Remain Weak

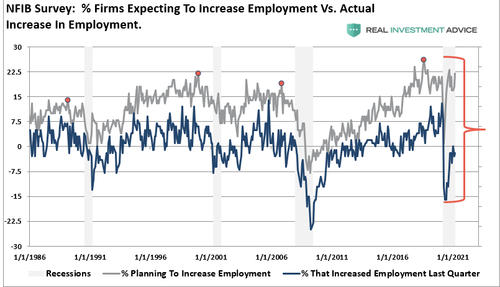

If small businesses think the economy is “actually” improving over the longer term, they would also be increasing employment. Given business owners are always optimistic, over-estimating hiring plans is not surprising. However, reality occurs when actual “demand” meets its operating cash flows.

To increase employment, which is the single most considerable cost to any business, you need two things:

-

Confidence the economy is going to continue to grow in the future, which leads to;

-

The increase in the production of goods or services requiring increased employment to meet growing demand.

Currently, there is little expectation for a strongly recovering economy.

Businesses understand that the stimulus “pulled forward” much of the current demand. As such, they can not commit to the “costs” of “long-term employment” for a “short-term” artificial economic boost.

Yes, injecting stimulus into the economy provides an increase in demand for goods and services. However, when the funds are exhausted, so does the demand. Small business owners understand the limited impact of artificial inputs.

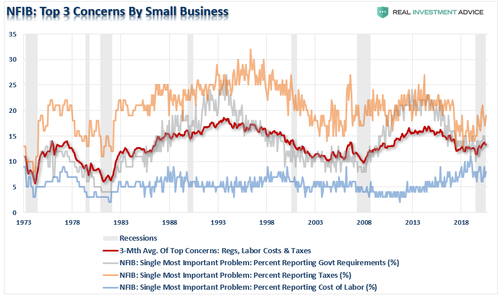

Also, given President Biden is focused on more government regulation and higher taxes (which falls squarely on the creators of employment), increased costs will further deter long-term hiring plans.

Notice that despite all the “angst” over record “job openings,” labor costs are not a significant concern for employers. Given the vast majority of jobs are not “minimum wage,” the cost of labor and wages have not risen markedly. What is a concern is higher taxes which impact business owners far more than employees.

The Big Hit Is Coming

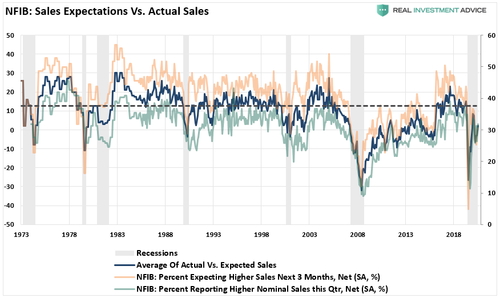

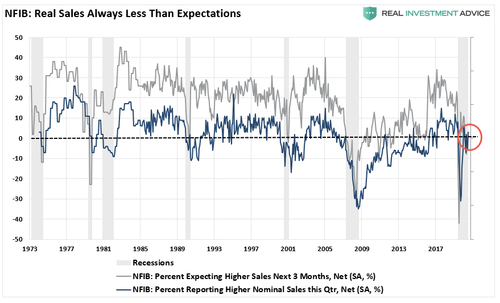

Retail sales make up about 40% of personal consumption expenditures (PCE), which comprises roughly 70% of the GDP calculation. Each month the NFIB tracks both actual sales over the last quarter and expected sales over the next quarter. There is always a significant divergence between expectations and reality.

While stimulus may lead to a short-term boost in consumption, the impact of higher taxes, more regulations, and weak employment growth will suppress consumption longer-term.

Despite economic headlines, the recovery of sales for small businesses has been less than “booming.”

The weakness in actual sales also explains why employers are slow to hire and commit capital for expansions. As noted, employees are among the highest costs associated with any enterprise, and “capital expenditures” must pay for themselves over time. The actual underlying strength of the economy, despite cheap capital, does not foster the confidence to make long-term financial commitments to anything other than automation.

Despite mainstream hopes, business owners must deal with actual sales at levels more commonly associated with ongoing recessions rather than recoveries.

Of course, this remains an argument of ours over the last couple of years. While the media keeps touting the strength of the U.S. consumer, the reality is quite different. If such were indeed the case, there would be no requirement to inject billions of dollars in stimulus to keep individuals afloat.

Such is why this remains an “economic recovery” rather than an “economic expansion.”

A Recovery Versus An Expansion

With this background, it is easier to understand why the recent exuberance in chasing small-cap stocks may be premature. While small-cap companies do historically perform well coming out of recession, the basis was an organic recovery cycle of increasing productivity.

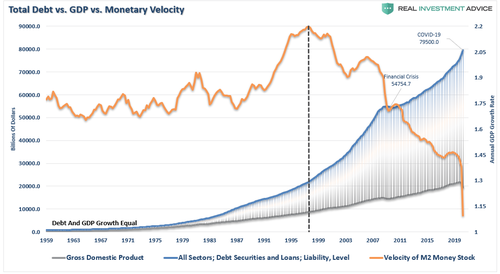

Currently, the run-up remains the assumption that the stimulus-fueled recovery is sustainable. Such is only the case if the stimulus becomes a regular benefit and increases in size annually. However, since deficit-based spending is deflationary, the outcome will fall well short of expectations.

“in 1998, the Federal Reserve “crossed the ‘Rubicon,’ whereby lowering interest rates failed to stimulate economic growth or inflation as the ‘debt burden’ detracted from it. When compared to the total debt of the economy, monetary velocity shows the problem facing the Fed.”

Such is a critical point as it relates to small-cap companies given their high correlation to small-business confidence. The correlation between the small-cap index (Russell 2000) and underlying confidence is very high. Given the annual change in “confidence” is declining, it is not surprising to see that small-cap stocks recently peaked.

Conclusion

Given that debt-driven government spending programs have a dismal history of providing the economic growth promised, disappointment over the next year is almost a guarantee.

While there are indeed “inflationary pressures” short-term as the massive infusions, coupled with supply shortages and delivery bottlenecks, higher prices will erode purchasing power. The decline in purchasing power, combined with higher input costs, and potentially higher taxes, will continue to weigh on confidence near term.

There are risks to assuming a strong economic and employment recovery over the next couple of quarters. The damage from the shutdown on the economy, and most importantly, small business, suggests recovery may remain elusive.

Most importantly, there is a massive difference between “getting back to even” versus “growing the economy.” One creates economic prosperity by expanding production, which creates consumption. The other does not.

Being optimistic about the economy and the markets currently is far more entertaining than doom and gloom. However, it is the honest assessment of the data and the underlying trends, which help protect one’s wealth longer-term.

Tyler Durden

Fri, 05/14/2021 – 09:34

via ZeroHedge News https://ift.tt/2RhzAyt Tyler Durden