Proof-Of-Stake Coins Surge After Musk Trashes Power-Hungry Bitcoin

Authored by Scott Chipolina via Decrypt.co,

In brief

-

With Proof of Stake (POS), cryptocurrency miners can earn more crypto if they hold more coins.

-

Proof of Stake (POS) was created as an alternative to Proof of Work (POW), which is the consensus algorithm that Bitcoin uses.

-

Several coins that use alternative consensus algorithms to Bitcoin have increased in value.

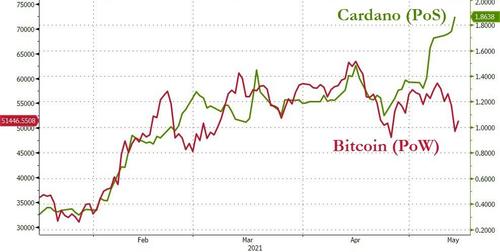

Several proof-of-stake cryptocurrencies have increased in price since Elon Musk backtracked on Bitcoin two days ago.

In a tweet earlier this week, Musk announced that Tesla had suspended vehicle purchases made in Bitcoin. “We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel,” he said.

Since that tweet, the Tesla CEO doubled down, saying that it is “high time for a carbon tax,” and that while he strongly believes in crypto, “it can’t drive a massive increase in fossil fuel use.”

His U-turn on Bitcoin caused its price to drop from approximately $57,000 to as low as $48,000. But other cryptocurrencies, which use alternatives to Bitcoin’s energy-intensive proof-of-work algorithm, have benefited from Musk’s announcement.

Proof-of-stake cryptocurrencies

Proof-of-stake (PoS) cryptocurrencies are fundamentally different from proof-of-work (PoW) cryptocurrencies.

PoW systems use huge amounts of energy to secure the network. Miners use powerful computers in a race to solve complicated mathematical puzzles; the winner receives newly-minted crypto.

By contrast, in a PoS system, miners validate transactions based on the amount of coins they hold. The more coins a miner hold, the more likely they are to win the right to validate transactions.

Because PoS networks do not suck up the immense amount of energy consumed by PoW networks like the Bitcoin network, they are environmentally friendlier.

In the wake of Musk’s announcement, at least six cryptocurrencies have increased in price.

Proof-of-stake price surges

The largest PoS cryptocurrency by market cap is Cardano (ADA), which has increased by over 13% during the last 24 hours to a price of $1.89.

Another PoS cryptocurrency that has increased since Musk’s announcement is Polygon (MATIC), which has a market cap of $7.6 billion. In the last 24 hours, Polygon has increased by almost 16% to a price of $1.25.

Anything but Bitcoin

Other cryptocurrencies that use alternatives to proof of work algorithms also surged.

One such example is Stellar (XLM), which has a market cap of $16 billion and uses a small number of trusted nodes to validate transactions. In the last day, XLM has increased by 16% to a price of $0.7.

Hedera Hashgraph (HBAR) has outpaced almost every other coin on this list, increasing by 35% in the last day to a price of $0.35. HBAR has a market cap of just under $3 billion. It uses its own hashgraph consensus algorithm.

While all of these Bitcoin alternatives have increased since Musk’s announcement, none have surged as much as Klaytn (KLAY), which has grown by just under 40% growth in the last 24 hours, reaching a price of $3.03. KLAY has a market cap of $7.4 billion. Its blockchain uses a proof of contribution consensus mechanism, which uses a small number of trusted validators.

Despite all of these coins being in the green, Musk appears to be fully focused on Dogecoin, a proof-of-work cryptocurrency.

Tyler Durden

Fri, 05/14/2021 – 12:45

via ZeroHedge News https://ift.tt/2Ra1Va1 Tyler Durden