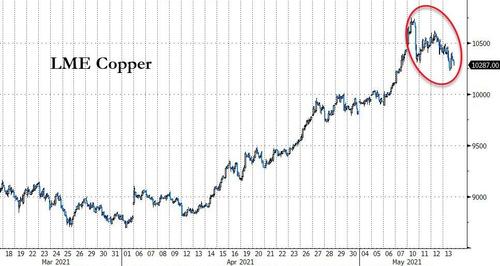

Did China Just Kill The Commodity-Craze?

After weeks of vertical rampage, commodity prices broadly tumbled this week as everything from lumber to iron ore saw their first weekly drop in months.

Source: Bloomberg

While it may be early, the sudden reversal across the commodity space has many wondering if the bubble has popped.

Copper prices were on course for their first weekly decline since the start of April on Friday as rising inflation fears and a dip in demand from China dragged prices down.

“The high copper price appears to have curbed demand,” said broker Marex Spectron.

Source: Bloomberg

Iron ore continued its fall from a record amid efforts by China to clamp down on surging prices, with the metal set for the biggest two-day plunge since 2019.

Source: Bloomberg

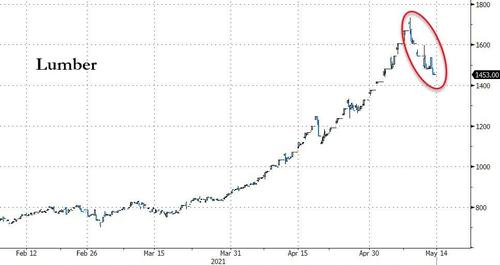

And even lumber’s long run of gains is stalling…

Source: Bloomberg

With Capital Economics warning “we forecast [lumber] prices will fall to $600 per 1,000 sq.ft by end-2021.“

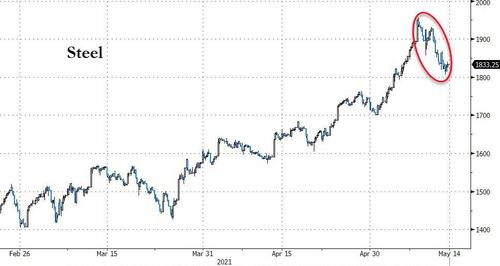

Meanwhile, warnings of a crackdown on misbehaviour in the steel market hammered Chinese steel prices…

Source: Bloomberg

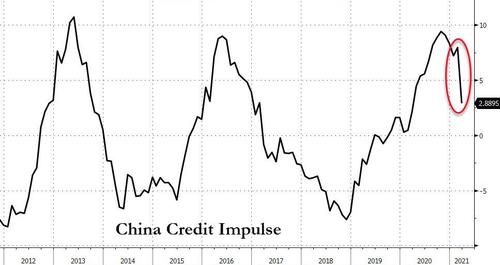

So what’s happening?

We have vehemently explained over the past few years that ‘as goes China’s credit impulse, so goes the world’ and it would appear, once again, that is occurring. Specifically, this week saw data showing new bank loans in China fell more than expected in April and money supply growth slowed to a 21-month low, pointing to slower growth in the world’s biggest metals consumer.

Source: Bloomberg

Tyler Durden

Fri, 05/14/2021 – 14:20

via ZeroHedge News https://ift.tt/3tMUrHg Tyler Durden