Home Prices Are Soaring So Fast, They Are Negating The Benefits Of Low Mortgage Rates

A recent report in the Wall Street Journal that cited data from the National Association of Realtors and Fannie Mae caught our eye by highlighting an unfortunate reality of low interest rates: while they initially help even the playing field and make homes more affordable for more Americans, after a while, price appreciation will ultimately make housing less accessible for middle- and working-class Americans.

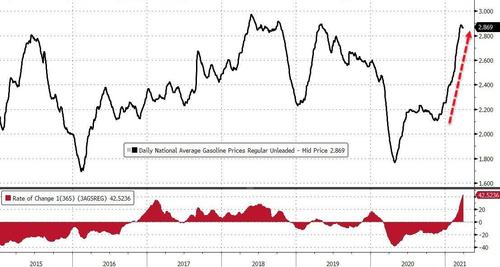

Using data combined with anecdotes from home buyers, WSJ illustrated how the rapid pace of price appreciation over the last year is affecting the outlook for the housing market, as high prices negate the impact of mortgage rates that are still near record lows.

Nationwide, the median existing-home sales price rose 16.2% in the first quarter to $319,200, a record high in data going back to 1989, NAR said.

Prices are rising so rapidly that they are outweighing the benefit of rock-bottom borrowing rates. In the first quarter, the typical monthly mortgage payment rose to $1,067, from $995 a year earlier, NAR said, even as mortgage rates declined.

Of course, the frenzied state of the American real estate market is nothing new.

The other day, we reported that home sales prices in the country’s hottest markets had risen by their widest level since 2006, according to the Case-Shiller Home Price Index, a closely watched measure of home prices in the US which offers a breakdown by region, as well as nationally. According to Case-Shiller, US home prices in 20 major cities are up a shocking 11.10% year-over-year.

But outside the major metro markets, demand was even stronger, translating into the biggest YoY increase in median sales since 2006.

As for that data we noted earlier, the NAR found that 182 of the 183 regions it tracks are reporting higher median sales prices than the year prior. But even more notably, 89% of those areas are seeing prices up more than 10%.

Thus far, the housing boom has been so widespread in part due to low mortgage rates, which have made mortgages more affordable, and more obtainable, for middle-class Americans. But economists believe that the inflection point where buyers of more modest means are priced out of the market is near. In other words, it’s one thing when ritzy markets like NYC and San Francisco see home prices boom. But when it starts happening in Boise, the outlook for price appreciation is much more limited, because the pool of potential interested buyers is much more limited.

Speaking of Boise…

In the Boise, Idaho, metro area, where median home prices surged 32.8%, Julie Cook struggled to find a house within her budget. She and her mother moved to Boise from Florida in January. Ms. Cook had looked at house listings before she moved and planned to buy a house in Boise for under $300,000. But by the time she arrived, there was little that amount could buy.

Ms. Cook ended up purchasing a townhouse for $330,000 in March. “It’s really not my dream or anything,” she said. “But I felt like I needed to, for mine and my mom’s sake, find a place that we could afford.”

Already, first-time home buyers are struggling with soaring prices, as those with limited budgets increasingly lose out to cash buyers, and economists at Fannie Mae are taking this into account.

Economists have said the pace of price increases is likely to slow later in the year and next as more people are priced out of the market, especially if mortgage rates tick higher. Mortgage-finance company Fannie Mae is forecasting median existing-home prices to rise 11.5% in 2021, then slow to a 4% increase in 2022.

“With low inventory already impacting the market, added skyrocketing costs have left many families facing the reality of being priced out entirely,” Mr. Yun said.

And while commodity prices soar amid a construction boom, it’s worth noting that easy government money (and artificially low interest rates thanks to the Federal Reserve) aren’t the only factors driving home prices higher.

Record-low inventory is also a factor. Data show Americans are staying in homes longer, and that the number of homes on the market has tumbled as the pandemic has made many who already own comfortable homes less inclined to sell (whether that’s due to the fear of letting strangers in their home in the middle of a pandemic, or the unwillingness to navigate the market as a buyer).

Across the country, and especially outside the big cities, brokers are warning that they have never seen demand so high. But for any investors looking for a potential opportunity to flip, just remember: while remote work is probably here to stay, the pace of this torrid market might not be as durable.

And if anything brings that home, it is this chart, as we noted earlier, showing home-buying sentiment has collapsed to its weakest since 1983…

Get back to work Mr.Powell!

Tyler Durden

Fri, 05/14/2021 – 14:59

via ZeroHedge News https://ift.tt/3hmglhU Tyler Durden