Commodities, Cryptos, & Crappy Stocks Crumble As Stagflation Signals Soar This Week

So, the last week has flashed the ‘reddest’ of red flags that Stagflation is upon us: Payrolls disappoint… Retail Sales disappoint… Inflation hotter than expected… Sentiment far worse than expected…

Source: Bloomberg

Ignore all that… everything is fine…

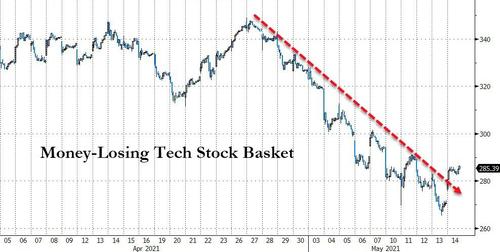

Crappy Stocks (money-losing tech companies) dropped for the 3rd straight week…

Source: Bloomberg

Commodities had their worst week since October…

Source: Bloomberg

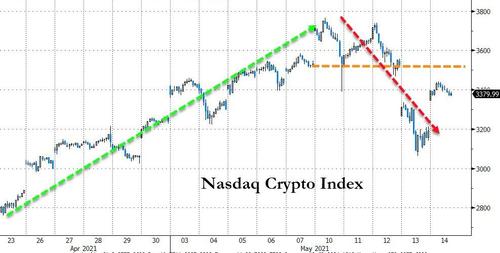

Crypto was lower on the week based on Nasdaq’s index…

Source: Bloomberg

But the Crypto market was very mixed with bitcoin battered (thanks to Musk’s musings) as ether surged (and bounced back from Elon’s hit)…

Source: Bloomberg

Ether closed the week back above $4000 despite the Musknado…

Source: Bloomberg

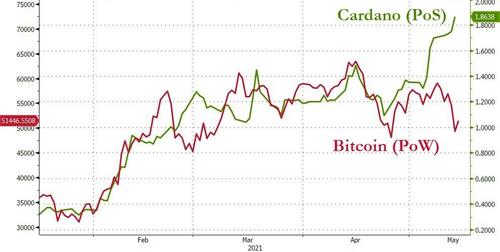

We do not that proof-of-stake currencies trumped proof-of-work currencies…

Source: Bloomberg

The broad equity markets were all lower on the week but not for want of algos efforts to ignite a squeeze on Tuesday and Friday. The Dow was the least worst horse in the glue factory but Small Caps and Big-Tech were the ugliest old nags on the week (despite a big surge Friday)..

This was the worst week for stocks since February.

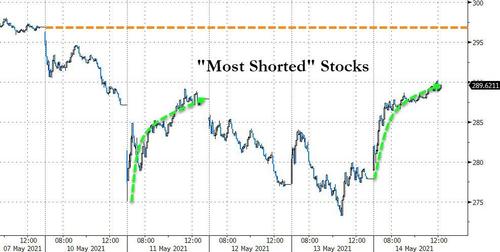

“Most Shorted” Stocks ended the week lower but the two big squeezes are clear…

Source: Bloomberg

Consumer Discretionary stocks were the worst on the week, along with Tech; Consumer Staples and Financials were best, eking out very modest gains…

Source: Bloomberg

TSLA was down for the 4th straight week (as was ARKK). TSLA’s worst week since March 2020 closed it below its 200DMA…

Source: Bloomberg

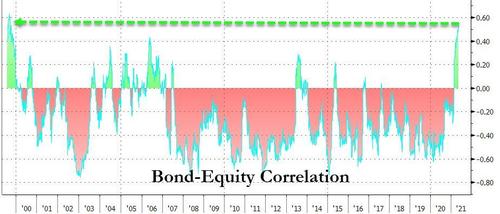

Risk Parity crashed this week (as bonds and stocks fell together) – this was the worst week for RP strategies since March 2020…

Source: Bloomberg

Treasury yields were all higher on the week, mainly due to the reaction to the hotter than expected CPI print on Wednesday. The long-end underperformed with 30Y +7.5bps…

Source: Bloomberg

The 10Y Yield ended the week back above 1.60% but erased most of the CPI spike…

Source: Bloomberg

The dollar ended the week very modestly higher after running the stops above last Friday’s payroll print peak…

Source: Bloomberg

Crude and Gold managed modest gains on the week, Silver saw a small loss and copper was clubbed…

Source: Bloomberg

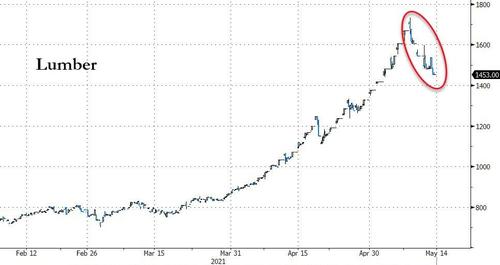

Lumber was hammered…

Source: Bloomberg

And Iron Ore, Steel, Copper, and so on were all hit this week as China cracked down…

Source: Bloomberg

Finally, we note that both stocks and bonds were lower on the week for the worst combined performance since Feb…

Source: Bloomberg

as, after more than a decade mostly in negative territory, the 60-day correlation between U.S. Treasuries and the S&P 500 Index has reached the highest since 1999, according to data compiled by Bloomberg.

Source: Bloomberg

Tyler Durden

Fri, 05/14/2021 – 16:00

via ZeroHedge News https://ift.tt/3w4nuYg Tyler Durden