America’s Housing Future Remains Murky At Best – Part 1

Authored by Bruce Wilds via Advancing Time blog,

The housing market in America is not one but many markets that generally share a few common threads. In America, the government, coupled with a slew of builder and Realtor associations control the housing narrative. Housing prices in Canada have been on fire for years now we are seeing this type of buying frenzy spreading to America. This has allowed some buyers to ignore the reality that soaring lumber prices over the past 12 months have caused the price of an average new single-family home to rise by $35,872, according to the National Association of Home Builders.

The two questions that loom large are, who is buying these houses and where are they coming up with the cash to make such offers? Part of this is driven by the government continuing to cloak itself in the guise of being a good and kind friend to first-time buyers and helping them buy homes. This has helped move many a buyer into a home they can’t afford, cannot take care of, or simply don’t need. The long-term ramifications of such policies have destroyed many lives by putting people under tremendous financial pressure and taken its toll on neighborhoods across America.

Buyers And Sellers Should Beware

This buying frenzy has brought a lot of money into housing with the promise of weaseling out a profit. This means the housing sector is in some ways begun to mimic the auto sector with a “Buy here, Pay here” group opening on every corner. It has also created a massive industry where houses are bought to “flip,” This generally means buyers put a few dollars into glossing over flaws and place the house back on the market at a much higher price looking for a gullible buyer that doesn’t understand the poor product beneath the glitter.

One trend that has grown rapidly is the “Cash for Keys” market where houses are sold to people with little money down. These deals are often structured more like a lease with an option to buy with a contract that includes a great deal of small print tilted completely in the seller’s favor. The means they sell you a house that is overpriced, milk everything they can out of the buyer, and wait to take it back so they can start the scheme all over again. Common sense dictates that to maximize profits they must really be hammering any foolish buyer willing to go down this path.

Just yesterday a woman and her son that had lived in an apartment at my complex for eight years moved back in after several months in one of these houses. She described the four months in the house as a “horrible ordeal.” This includes things like, unexpectedly large utility bills as well as receiving estimates for needed repairs that shook her to her core. Maintenance costs can be substantial and something the average person leasing never has to deal with because they are usually included in the rent.

The argument that the “housing game” is a racket and moves on the promise of “big money” is highlighted by several facts. For those accepting this argument, in some ways, this can be linked to the World Economic Forum’s 2030 agenda that states in 2030 you will own nothing and be happy. In the piece below, Krystal Ball of the Rising explains why the housing market is booming for those in the upper-middle class. She opines what it means for costs of homes in the future. Seven minutes into this YouTube video (https://www.youtube.com/watch?v=EBb9zf_zWvU) starts a rant, ending with, “however this ends up ordinary people are going to get screwed.”

Many of the messages being promoted as common knowledge do not pass serious scrutiny. As I wrote this post I tried to do a bit of additional research to supplement what I know as a contractor and apartment owner. What I found was more like a pack of lies and half-truths spun to fit an agenda. Those of us in the trenches and with our boots on the ground often see things from a different perspective than what is being presented by the media.

An interesting piece by Emma Diehl (https://www.homelight.com/blog/how-many-homes-does-a-realtor-sell-a-yea…) of the Homelight.com blog points out that in the U.S., there are over 2 million active real estate licensees and 1.3 million Realtors®, or real estate licensees who’ve taken an extra step to become certified members of the National Association of Realtors (NAR). This means, some agents may sell a single house per year for their friend, while others such as Ben Caballero, have built empires to facilitate thousands of sales annually using sophisticated tech systems.

In 2013, CareerBliss announced that being a real estate agent is the single most satisfying job a person could have. This led many people into this line of work. The fact is, most realtors are hard-pressed to make a decent living. This is something we are seldom told and supports the idea much of what we are told about the housing sector is hype and pure bunk. This is supported by the numbers put out by Statista which reported there were 683 thousand houses sold in the United States in 2019. This is the largest figure since 2008 but when divided by the number of real estate licensees does not mean multiple sales for each.

While the market has responded to the housing needs of higher-income households, trends suggest a growing inability or desire to supply housing that is affordable for middle and working-class people. It appears developers have little interest in, or they simply can’t afford to add anything but luxury units. It should be noted that at the same time many houses in America sit empty or underutilized and we are hearing about a lack of new listings. I attribute this to sellers holding units off the market because they think prices will rise, they owe more for the house than they can get, or they fear the selling process will be complicated.

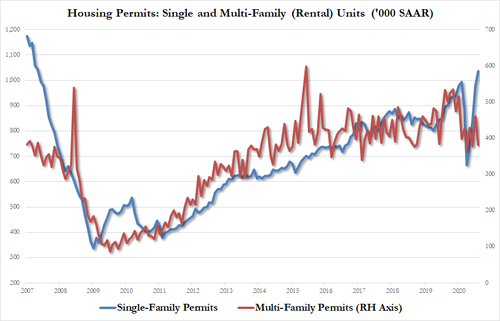

Many economists may use housing starts as an indicator of the health of the economy but such numbers are only a small part of a much larger picture. This number reflects many things other than just the number of new houses under construction or started in a given period. The data is generally divided into three categories: single-family houses, townhouses or small condos, and apartment buildings with five or more units. Still more important than just the number of units being built and the type is who is buying these units and why.

Affordability Is A Growing Issue

While people talk about the cost of buying a home more attention should be directed towards the ability of the buyer to maintain the home after they purchase it. Another factor looming large in this sector of the economy centers on affordability. When it comes to affordability, much depends on which part of the country you live but in many coastal and popular areas prices remain high. Even with current rates by the time you add in rising real estate taxes and other costs new homes are expensive.

Not only are new home prices are on the rise but so are real estate taxes and other fees. There is nothing inexpensive about a new home. Sadly, even the construction is often suspect, while code enforcement has increased, many of the items used in new construction no longer outlive the mortgage a buyer takes on. Whether replacing a door after just a few years or windows, it seems everything is expensive and nothing matches the original design. My house is over a hundred years old and still has the same doors and windows. How many homes built thirty years ago support this claim, enough said.

While the number of permits and building starts give some indication on the direction of housing, this is a complicated and this fickle market that is subject to attitudes and economic factors which can change on a dime. Adding to the recent discussion are claims of people buying homes away from big cities in an effort to escape growing violence and the effects of covid-19, this is interlaced with stories about surging gun sales.

New Construction Is Still Below 2008 Levels

The chart to the right shows that new construction is still below 2008 levels. Much of the new construction has been in apartments and not single-family dwellings. In much of the country, housing units are being built using cheap money flowing from the Fed and Wall Street under the idea that if it is built “they will come.”

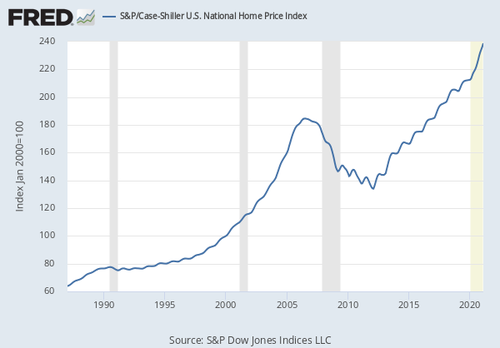

Home-ownership, a large part of the America dream, has been in decline. It could be argued that demographics are not greatly supportive of higher prices, it is also difficult to ignore the fact that when people “double-up” fewer homes are needed. This adds credence to the argument that if prices rise it most likely will be as a result of inflation. Today, huge discrepancies exist in the cost of housing in the various markets across America and while price variations are not uncommon they should be seen as a red flag and reason for caution.

While many people claim the formation of new households and pent-up demand drives this construction I beg to differ. I contend it is a combination of too much money looking for a safe place to hide. Unnoticed by many Americans is how money from Wall Street has entered this arena and is pushing out the average American. One thing is certain that when inflation raises its ugly head and interest rates increase, housing construction will suffer. The intention of this post is to dispel and explore some of the myths and trends surrounding the future of housing while causing people to think about this subject. Hopefully, it has added some clarity to the discussion.

Tyler Durden

Sun, 05/16/2021 – 20:00

via ZeroHedge News https://ift.tt/3uUyMhF Tyler Durden