Iron Ore Prices Bounce As Chinese Steel Output Hits Record Pace

After weeks of a vertical rampage, commodity prices hit a sudden air pocket late last week as everything from lumber to iron ore stumbled for their first weekly drop in months amid efforts by China to clamp down on surging prices. But on Monday, commodities resumed their upward trek, with iron ore futures bouncing above $200 per ton on increasing steel production in China and robust global demand as there are limited signs of the industry cooling despite Beijing’s attempt to subdue output and prices.

Bloomberg reports Chinese steel output in April increased to 97.8 tons, hitting monthly and daily run-rate records. The surge in production has increased year-to-date output to 375 million tons, or about a 16% jump compared to the same period last year. This comes as demand for Chinese steel continues to soar, resulting in lower iron ore stockpiles at ports for the third week in a row and inversely pushing prices higher.

“As China’s steel production still continues to expand, its steel margins remain elevated and seaborne iron ore supply remains constrained, we think that the iron ore price can stay around the current level through 2Q, but is likely to remain highly volatile,” Morgan Stanley said in a commodity note.

Iron ore futures have had a wild ride over the several sessions. Tumbling 11% over the previous two trading days and now up 2% to $205 per ton on Monday.

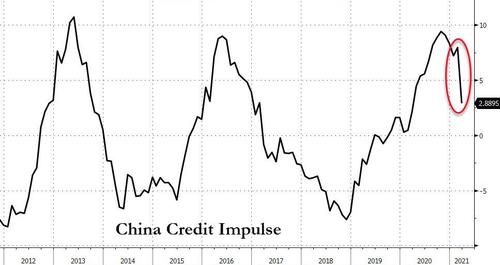

Beijing’s official narrative is that it says it’s committed to climate change by placing new output restrictions on steel mills. What’s concerning is China’s credit impulse is rolling over and may suggest that steel demand will subside sometime in the second half. Last week, data showing new bank loans in China fell more than expected in April, and money supply growth slowed to a 21-month low, pointing to slower growth in the world’s biggest metals consumer.

Keep an eye on China’s credit impulse as it may suggest weakness in commodities are ahead. But on a broader view, Deutsche Bank credit strategist Jim Reid believes commodities will outperform equities in the years ahead.

Tyler Durden

Mon, 05/17/2021 – 08:26

via ZeroHedge News https://ift.tt/2RY2kMP Tyler Durden