The Currency Story Has Undergone A Silent, Subtle Curve Shift

By Ven Ram, Bloomberg reporter and macro commentator

Front-end yields held hostage by central banks around the world have engendered a silent shift in currency pricing: exchange movements are being increasingly influenced by changes in the intermediate and longer segments of the yield curve.

Currencies that were typically more responsive to relative changes in yields at, say, the two-year part of the curve are now responding more and more to shifts at the five- and 10-year segments, with the dollar being a case in point.

The chart above shows how closely the Dollar Index has tracked five-year real yield spreads between the U.S. and Germany (hat tip to J. Paul Knight, assistant portfolio manager of U.S. large-cap equity at the Employees Retirement System of Texas for his observation). Indeed, the correlation between the spreads and the dollar in the past year is running at 0.57, reflecting its influence on the currency. Taken together with 10-year differentials , the two points of the curve delineate the trajectory of the dollar by more than four-fifths.

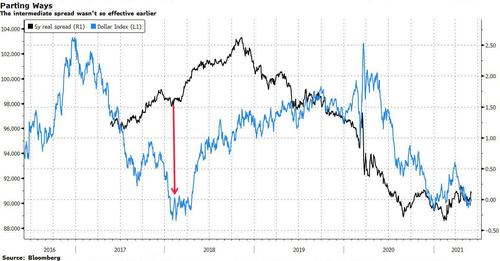

To be sure, it wasn’t always like this. Take a look at this chart above that encompasses a longer time frame, which shows the Dollar Index ignoring the movement in spreads. That was a time clearly before the pandemic when the U.S. economy was still in the midst of its longest post-war expansion, with central banks not anywhere near controlling the yield curve, de facto or de jure.

Tyler Durden

Mon, 06/07/2021 – 19:40

via ZeroHedge News https://ift.tt/350DnDD Tyler Durden