Here Is The Heatmap From Today’s Red Hot CPI Report

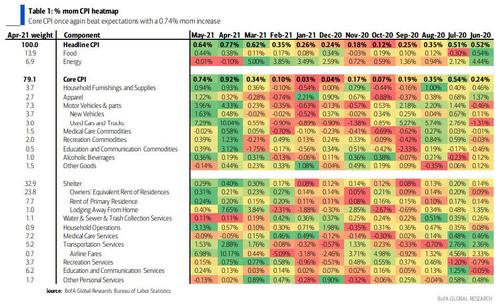

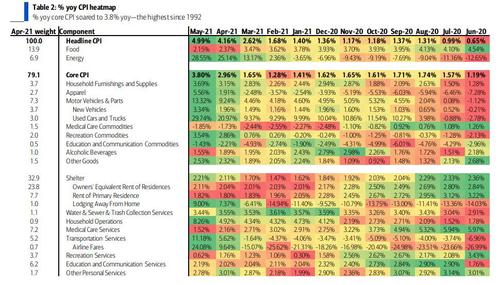

After the “eye-popping” April CPI report, expectations were for another big increase in consumer prices in May and boy, did the data not disappoint with core CPI surging another 0.7% (0.74% unrounded), which boosted the % yoy rate to 3.8% (3.80% unrounded) from 3.0% previously. This was the highest % yoy rate since 1992.

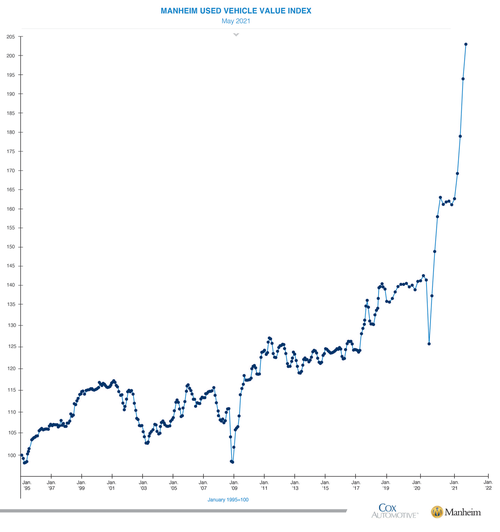

One big similarity with April was continued outsized strength in used cars inflation, which rose another 7.3% mom in May. Used car prices are now up 16.6% year-to-date (ytd) and according to the Mannheim Used Car Index which is up 26% YTD and 48% Y/Y, it’s set to keep rising.

Also, for the first time CPI new car prices added to the strength, surging 1.6% mom.

And now new car prices surging too:

The index for new vehicles rose 1.6 percent in May, its largest 1-month increase since October 2009.

— zerohedge (@zerohedge) June 10, 2021

Together, new and used cars contributed 37bp to core CPI, accounting for half of this month’s increase. As Lin notes, the auto sector remains disrupted by the global chip shortage and it will be difficult to predict how much more upside there will be this year as the situation will take time to resolve, making the year-end core inflation forecast a moving target.

Additionally, there were signs of broader commodity pressures with household furnishings & supplies gaining 0.9% mom, apparel jumping 1.2% mom, and recreation commodities, education/communication commodities, and alcohol all rising 0.4% mom. In services, transportation services remained hot rising 1.5% mom. This gain was bolstered by a 7.0% spike in airline fares and car/truck rental soaring 12.1% mom.

In summary, the reopening theme continued to be a big driver this month. That said, lodging away from home cooled to a modest 0.4% mom increase. Airline fares remain 12% relative to pre-pandemic levels and lodging down 4.6%, so there is further room to run this summer as travel demand heats up.

One major difference in May vs April was a robust pickup in Owner Equivalent Rent (OER) to a 0.31% mom print, after averaging 0.23% mom over the prior 3 months. This – as we warned last month – puts rent pressures back in the territory of the pre-pandemic trend. As BofA cautions, while “one month is a not a trend, but this is certainly a positive signal for stronger persistent inflation should it continue to operate there.” Incidentally, BofA’s base case is that once transitory pressures ease next year that core inflation will settle above the Fed’s 2% target, and stronger rents will play a key role in achieving this.

Meanwhile, household operations also exploded 3.1% mom in May, although this may be more of a one-off. Meanwhile, healthcare remained soft at -0.1% mom.

A visual summary of the data looks like this, first on a M/M basis, where the base effect has no impact as it is sequential.

… and then the YoY CPI print which is less relevant due to the collapse last year.

Bottom line, the inflation doves will say that once again there are reasons to dismiss much of the strength in this CPI report. That said, given the jump in OER, this report reflected greater progress versus April in terms of stronger underlying inflation. In other words, as even BofA warns, “we cannot dismiss all of the strength to transitory stories” and adds that “it will remain important to monitor whether transitory inflation passes through into stronger persistent inflation.”

And unfortunately, while nominal wage growth – a critical component to keeping inflation sticky – continues to rise, when indexed for inflation, real average hourly earnings are the lowest they have been this century!

Tyler Durden

Thu, 06/10/2021 – 11:30

via ZeroHedge News https://ift.tt/3vaj80V Tyler Durden