When Expedient “Saves” Become Permanent, Ruin Is Assured

Authored by Charles Hugh Smith via OfTwoMinds blog,

The Fed’s “choice” is as illusory as the “wealth” the Fed has created with its perfection of moral hazard.

The belief that the Federal Reserve possesses god-like powers and wisdom would be comical if it wasn’t so deeply tragic, for the Fed doesn’t even have a plan, much less wisdom. All the Fed has is an incoherent jumble of expedient, panic-driven “saves” it cobbled together in the 2008-2009 Global Financial Meltdown that it had made inevitable.

The irony is the only thing that will still be rich when the whole rotten, corrupt, fragile financial system of illusory stability collapses in a heap of runaway instability. The irony is that the Fed’s leaky grab-bag of expedient “saves” was not designed to ensure systemic stability, though that was the PR cover story.

The Fed’s leaky grab-bag of expedient “saves” had only one purpose: save the fat-cats, skimmers, scammers, fraudsters and embezzlers who had gotten rich off the Fed’s cloaked transfer of wealth: the purpose of all the 2008-2009 extremes was not to impose the discipline required to truly stabilize the financial system; the purpose was to elevate moral hazard— the separation of risk from the consequences of risk–to unprecedented heights, backstopping every skimmer, scammer, fraudster and embezzler from well-deserved losses as the entire pyramid of fraud collapsed under its own enormous weight of risky bets gone bad.

To save its cronies from the catastrophic losses that should have been taken by those making the bets, the Fed instituted one expedient “save” after another: backstopped global banks with $16 trillion, dropped interest rates to zero, eliminated truthful reporting by ending mark-to-market pricing of risk, flooded the financial system with free money for financiers, all designed to signal that the Fed will never let its cronies suffer the consequences of their risky bets, i.e. the perfection of moral hazard.

The Fed’s perfection of moral hazard has now spread to the entire market and populace: it’s not just the skimmers, scammers, fraudsters and embezzlers who are supremely confident the Fed will never allow them to experience the consequences (i.e. crushing losses) of super-risky bets going bad; the entire American populace now shares that supreme confidence that one can put all of one’s life savings on any roulette number (GME or AMC option, Doge cryptocurrency, etc.) and the Fed will guarantee every roulette number is a winner–a big winner.

As a result of the Fed’s perfection of moral hazard, systemic risk has exploded to unprecedented levels. As risk cannot be extinguished, it can only be transferred, the Fed has transferred geometrically expanding risk to the system itself.

The Fed’s fig-leaf for this vast transfer of wealth to the top layer of gambler sociopaths is the wealth effect: if the Fed triples the value of stocks, then all that new wealth will encourage people to borrow and spend feeely, keeping the economy from the cleansing of a recessionary contraction of risky credit.

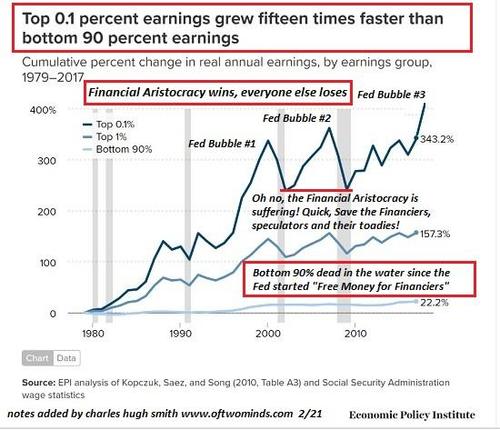

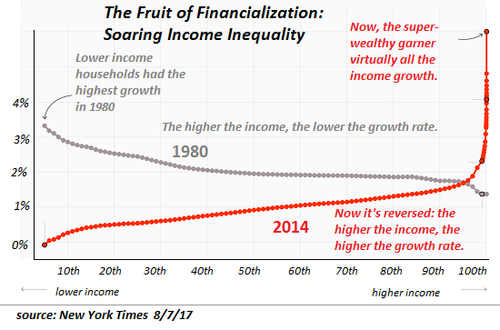

The wealth effect was just another fraud, as the concentration of wealth in America is so extreme that the tripling of equities only benefited the already-wealthy. All the Fed accomplished with its grab-bag of expedient “saves” was new and destabilizing extremes of wealth-income inequality: the earnings of the top 0.1% exploded higher 15-fold while the earnings of the bottom 90% stagnated; virtually all the gains from the Fed’s expedient grab-bag of consequence-free winnings accrued to the top 0.1% (see charts below).

Having engineered the greatest transfer of wealth and risk in human history via its expedient “saves” of those who shouldn’t have been saved, the Fed is now trapped: if it stops inflating the stock market, and allows consequence to re-connect with risk, then the losses will be catastrophic for everyone who blindly believed that the Fed’s powers to suppress risk and guarantee every roulette number is a big winner was god-like.

But if they keep inflating the stock market and signaling “no one will ever lose a penny buying stocks” (i.e. the perfection of moral hazard), then the entire system’s stability is increasingly at risk. (Not to mention the potential for rip-your-face-off inflation to become embedded in expectations.)

By making expedient “saves” permanent policy, the Fed has ensured the destabilization of the entire financial system. If you promise no amount of risk will ever deliver any consequence other than “every roulette number will be a big winner,” then risk rapidly approaches near-infinite heights. If the Fed attempts to backstop and bail out every institution and punter who believed in the Fed’s power to extinguish risk, that expedient “save” will collapse the system.

Here’s the Fed’s choice: continue making expedient “saves” permanent policy, the system collapses. Withdraw the guarantee that risk will never have any consequences, and the system collapses. The Fed’s “choice” is as illusory as the “wealth” the Fed has created with its perfection of moral hazard–a perfection that could only end in the collapse of the entire fraudulent fantasy of risk-free gains forever.

I’ve written a number of books on the trap of expedient “fixes” we have entered; free sample chapters can be found on My Books:

Inequality and the Collapse of Privilege

Resistance, Revolution, Liberation

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Tyler Durden

Tue, 06/29/2021 – 16:45

via ZeroHedge News https://ift.tt/2UfrhnN Tyler Durden