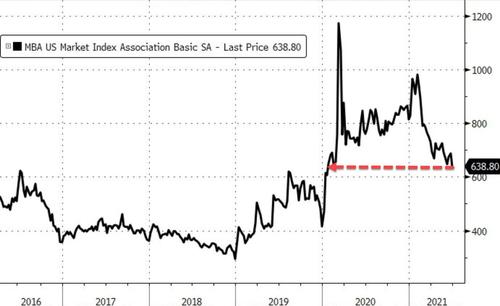

Mortgage Apps Crash To Pre-COVID Lows As Homebuyer Confidence Collapses

Who could have seen this coming?

Despite near record high confidence among homebuilders and realtors (whose salaries depend on it), it would appear that it is collapsing homebuyer confidence that really matters after all…

Source: Bloomberg

Howe do we know? Well aside from home sales tumbling, we are now seeing mortgage applications slumping to pre-COVID lows…

Source: Bloomberg

Overall mortgage applications dropped 6.9% WoW – the biggest drop in almost 5 months

This reflected an 8.2% decrease in applications for refinancing existing loans and a 4.8% drop in applications to purchase a home.

“Purchase applications for conventional loans declined last week to the lowest level since last May,” Mike Fratantoni, MBA’s Senior Vice President and Chief Economist, said in a statement.

“The average loan size for total purchase applications increased, indicating that first-time homebuyers, who typically get smaller loans, are likely getting squeezed out of the market due to the lack of entry-level homes for sale.”

With both new and existing home sales having fallen sharply this year (due, according to NAR, to a shortage of houses on the market) and mortgage rates rising (anticipating a Fed taper), perhaps – once again – the rational exuberance of home-builders and home-brokers should be more measured.

Tyler Durden

Wed, 06/30/2021 – 09:05

via ZeroHedge News https://ift.tt/3hjBw2j Tyler Durden