Global Home Prices Are Rising At The Fastest Pace On Record

Those looking for signs of a new housing bubble need look no further than today’s existing home sales report which showed that median prices of existing homes in the US soared 24% to a record $363,300.

And while banks have been quick to reprise their roles as the “Ben Bernankes” of this neverending business cycle, trying to counter growing speculation that the US housing market is once again in a giant bubble, with both Goldman…

… and Bank of America telling readers not to believe their lying eyes…

… the reality is that not only is it a bubble in the US, but it is also the biggest housing bubble in the entire world!

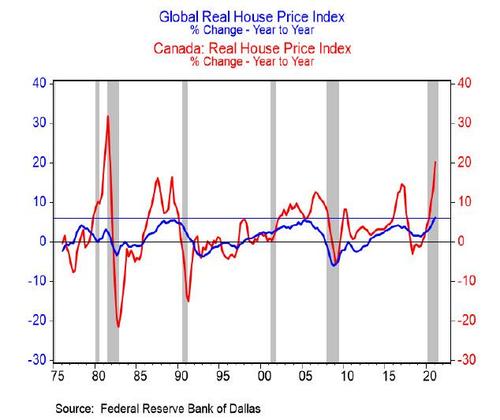

As BMO’s Doug Porter writes, global real home prices are rising at their fastest pace in 45 years of records. According to data compiled by the Dallas Fed, prices after inflation are now up more than 6% y/y, surpassing the prior peaks in 2005 and 1989.

The results are weighted by GDP in the 24 countries covered, so naturally the U.S. leads the results. But the index covers the entire G7, as well as nations as diverse as Korea, Israel, South Africa, New Zealand and Slovenia.

Among these nations, who is the frothiest of them all? Why, none other than Canada, where real prices are now up by more than 20% y/y (topping even New Zealand by this metric), although today’s NAR existing home sale price update likely means that the US is once again in pole position when it comes to the biggest asset bubble ever.

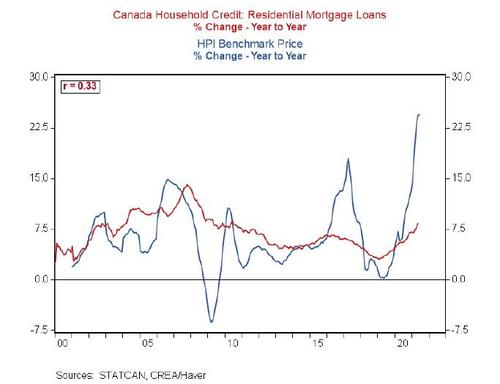

And speaking of Canada, it may have lost the first place in the world’s biggest housing bubble, that doesn’t mean it can’t regain it and as Porter adds “it’s no surprise that residential mortgage growth is gathering steam, now running at 8.3% y/y in May, the most since 2010.” The fastest rate in the past three decades is 14% in 2007, but with the 3-month annualized rate now running at just under 12%, this milestone could be tested if house prices continue to rip higher and sales remain strong.

Tyler Durden

Thu, 07/22/2021 – 18:20

via ZeroHedge News https://ift.tt/3ycFLnT Tyler Durden