“Everyone Is In The Crosshairs”: China Sees “Panic Selling” Amid Unprecedented Crackdown

Say goodbye to socialism with Chinese characteristics and say hello to communist crackdowns with Chinese dictatorial characteristics.

After China implemented a highly publicized crackdown on tutoring and techedu companies, wiping out tens of billions in value as Beijing confirmed it ordered the “for profit” publicly traded sector to, well, no longer be “for profit” while banning them from raising capital or going public – a move which has been viewed as the government’s most extreme step yet to rein in private businesses that regulators blame for exacerbating inequality, increasing financial risk and in the case of some tech titans challenging Beijing’s authority – Beijing has extended its unprecedented crackdown to various other sectors to extend to housing, tech and even food companies.

So after plunging on Friday when the news of the crackdown first hit, on Monday shares of Chinese education stocks listed in the US plunged some more: among the casualties, TAL Education Group tumbled -36%, New Oriental Education & Technology Group was down -32%; Gaotu Techedu – the stock popularized by Archegos whose total return swaps pushed it as high as $149 in January wiping out all the shorts, slumped another -36% and dropped as low as $1,70 this morning while China Online Education Group -11%.

Other major tech and education-linked names were also hit: Alibaba, a Chinese tech conglomerate listed in the U.S. which among other things, invests in education companies, fell -4.9%; Didi Global continued its plunge, down 13% and dropping as low as $7, or half its IPO price of $14; JD.com -6.3%; Baidu -7%; Pinduoduo -13%; NetEase -7.2%; Nio -6.7%; Xpeng -6.4%; Li Auto -4.2% and so on. Today’s rout means that the Nasdaq Golden Dragon China Index, which slumped last week posting its longest losing streak since 2019 over the risks posed by a potentially widening regulatory crackdown in the nation’s technology industry, is set for even more pain.

However, the crash wouldn’t be confined just to the education sector.

With losses in Chinese tech and education stocks now exceeding $1 trillion since February, the questions reverberating across trading desks from Shanghai to New York are where regulators might strike next and whether markets are properly discounting regulatory risk. Property-management and food-delivery companies were among the biggest losers on Monday after Beijing signaled tighter rules for both sectors, while also lashing out at music streaming giant Tencent Music.

Tencent Music ADRs plunged in US premarket trading after Chinese regulators ordered the company to give up exclusive music streaming rights and pay half a million yuan in fines. ADRs of the recently IPOed company dropped 19% to $8.70, while Parent company Tencent Holdings sank 7.7% in Hong Kong, with investors Prosus and Naspers drop as much as 8.9% and 6.9%, respectively. This enforcement action made Tencent the latest Chinese internet giant to be brought to heel by regulators.

It wouldn’t be the last. As China expanded on whirlwind crackdowns, Chinese food delivery giant Meituan’s shares also plunged as much as 15%, the most on record, after China issues new rules for food platforms. On Monday the government posted notices that online food platforms must respect the rights of delivery staff and ensure that those workers earn at least the local minimum income, according to guidelines released by seven agencies including the powerful State Administration for Market Regulation. And with Meituan the largest food-delivery service in the country, it naturally would be hit the hardest.

As Bloomberg adds, the Tencent-backed company is already grappling with an investigation into alleged monopolistic behavior. The food industry regulations, which echo previous warnings, came days after China unveiled a broad set of reforms for private and online education companies, seeking to decrease workloads for students and overhaul a sector it says has been “hijacked by capital.”

Beijing’s myriad clampdowns have shocked even some of the most seasoned China watchers, prompting a rethink of how far Xi Jinping’s Communist Party is willing to go as it tightens its grip on the world’s second-largest economy.

While some investors say the selloff has created buying opportunities, ongoing clampdowns on everything from internet platform operators to commodities producers and China’s gargantuan real estate industry suggest plenty of room for more surprises, especially for international investors as Xi’s government shows less concern than its predecessors did about spooking foreign capital.

As Goldman’s sales desk summed it up this morning, “Even when you think China risk is priced…it can get worse.”

“Everybody’s in the cross-hairs,” said Fraser Howie, an independent analyst and co-author of books on Chinese finance qutoed by Bloomberg. “This is a very difficult environment to navigate, when over the weekend your business can basically be written down to zero by state edict, how on Earth are you to plan for that?”

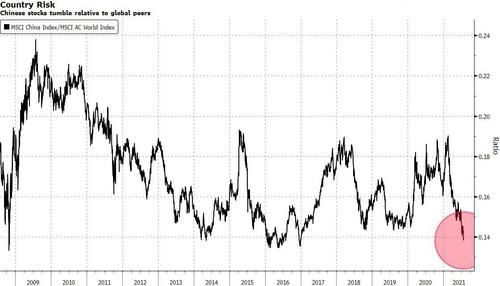

Judging by the market’s reaction, there is no way to plan for anything happening in China except reacting in panicked fashion: the Shanghai Composite dropped as much as 3.5% before paring to 2.6%; CSI 300 slumps 3.3%; all 10 industry groups in the MSCI China Index posted declines as the gauge sank 4.4%, the most in 14 months. The selloff was all the more striking given MSCI’s All-Country World Index jumped on Friday to within a hair’s breadth of its all-time high. The China gauge has dropped more than 25% from this year’s peak and is now trading at about 1.4 times book value, the biggest valuation discount on record relative to global peers.

Also on Monday, the tech-heavy ChiNext Index fell as much as 5.1%, the most since March, while the Hang Seng Tech Index dropped as much as 7.1%, set for the worst day on record.

As Bloomberg puts it, regulatory risk is nothing new in China, but rarely have global investors had to cope with such a widespread onslaught of rules that threaten to curb growth and in some cases decimate entire business models. Beijing’s surprise scuttlingof Jack Ma’s initial public offering of fintech giant Ant Group Co. in November looks increasingly like the high-water mark for an era of relatively loose regulation for the country’s private sector.

Among the investment firms selling on Monday was BNP Paribas Asset Management, which oversees about $559 billion worldwide and was already underweight China heading into the rout. “Investors are looking to figure out if there are more sectors that can face this,” said Zhikai Chen, the firm’s head of Asian Equities. “We are reducing some exposure.”

Chen said it’s too early to judge whether the Chinese government’s attitude toward the private sector has permanently shifted, noting that authorities have in some ways made it easier for companies and investors to access capital markets in recent years.

But, as Bloomberg interjects, that was also true for the education industry a darling sector of Wall Street, until regulators began signaling a potential clampdown earlier this year.

The rules were ultimately stricter than even some of the most bearish predictions, banning companies that teach school curriculums from making profits, raising capital or going public. They have effectively obliterated the model underpinning a $100 billion industry.

The techedu clampdown mirrors Beijing’s broader campaign against the growing power of Chinese internet companies, including Didi Global Inc. to Alibaba Group Holding Ltd. But it also stems from a deeper backlash against an industry that has been criticized for putting too much pressure on children, burdening parents with expensive fees, and exacerbating inequality.

“I don’t think this is so much about foreign investors, I think it is more about trying to restore equality for K-12 education,” said Joshua Crabb, a senior portfolio manager at Robeco in Hong Kong. Still, it’s a reminder for global investors of the importance of tracking the Chinese government’s shifting priorities.

Tyler Durden

Mon, 07/26/2021 – 09:12

via ZeroHedge News https://ift.tt/370lMwv Tyler Durden