Bitcoin Slides As Tether Execs Reportedly Face Criminal Probe Over Bank Fraud

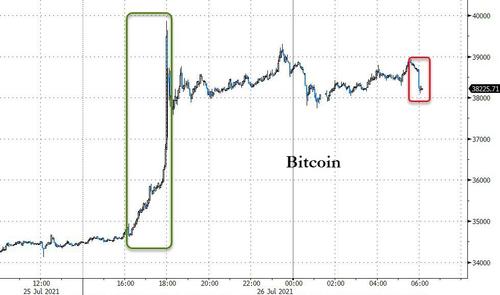

Tether FUD (Fear-Uncertainty-Doubt) is back, just in time to take the shine off Bitcoin’s weekend surge higher.

Bloomberg reports that a US probe into Tether is homing in on whether executives behind the digital token committed bank fraud.

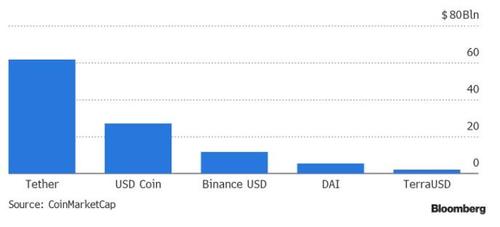

As a reminder, Tether is the third largest digital currency by market cap, at around $63B USD (and by far the largest stablecoin). Note also that we keep calling Tether “a digital currency” and not a crypto currency. This is because there is no Tether blockchain and USDT’s are not mined, they’re “minted”. Ostensibly, Tether receives USD from depositors and then “mints” a corresponding amount of USDT and puts that into their depositors’ account.

And there in lies the concerns – just what the firm does with those deposits.

But this latest probe is over the actions of the firm during its startup early days as federal prosecutors are scrutinizing whether Tether concealed from banks that transactions were linked to crypto, said three people with direct knowledge of the matter who asked not to be named because the probe is confidential.

The latest news comes shortly after Treasury Secretary Janet Yellen said last week that watchdogs must “act quickly” in considering new rules for stablecoins, and the timing of this leak – right after Bitcoin’s latest leg higher – seems entirely too convenient.

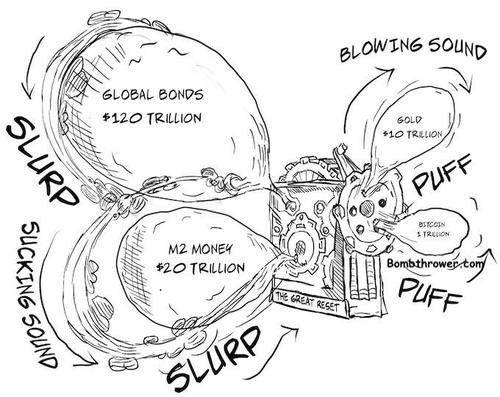

So, as we asked (and answered) over the weekend, what effect would Tether being a complete fraud have on cryptos?

If / when Tether implodes and goes to zero, we may face yet another body blow that over time, cryptos will surmount and recover from. How much and how long depends on where we are in the cycle.

We deal mainly with crypto stocks which generally track the market, but for our readers who hold cryptos directly, we’ll review the defensive posturing so that we never get mangled in a liquidity crisis:

Don’t trade on margin (neither cryptos nor stocks)

Never leave your coins on an exchange.

Aside from speculative YOLO funds, avoid complex DeFi strategies that collaterize or rehypothecate your assets

Don’t hold any value in Tether. If you have to trade into USDT to get out of some exotic or thinly traded alt coin pair, immediately get out of it and move to some other asset.

If you have to make use of a stablecoin, use USDC or DAI.

I would specifically avoid Bitfinex and, Binance for different reasons, noting that Binance is also having regulatory issues in multiple jurisdictions

When using exchanges, use a known exchange in your own country. This is how I prefer it so (God forbid) should the exchange implode you are at least on home turf for any legal proceedings.

What many crypto skeptics fail to appreciate is that increasingly more funds flowing into the crypto economy are intentionally on a one-way trip. They are going there with the intention of never being converted back into fiat. I see all of these weak points we just enumerated as indicative of the fiat world we are cashing out of of, not the crypto world we’re moving into.

Never forget our core thesis.

When I really think about the effect a Tether implosion would have on cryptos, I suspect it will mostly depend on whether cryptos overall are already in a bullish or bearish cycle at the time it happens.

That is the nature of crypto, and markets in general. You can tell you’re in a bear/sideways correction when good news doesn’t do anything for the asset, and you can tell that you’re in a bull move when bad news is shrugged off.

Either way, the societal shift into crypto continues apace.

“Tether routinely has open dialogue with law enforcement agencies, including the DOJ, as part of our commitment to cooperation and transparency,” the company said in a statement.

Trade accordingly on the Tether news.

Tyler Durden

Mon, 07/26/2021 – 09:20

via ZeroHedge News https://ift.tt/3iN5Ova Tyler Durden