Key Events This Very Busy Week: Fed, GDP, Earnings Gallore And Much More

Cutting to the chase, it’s a very busy week, perhaps the most important week for markets this summer. Clearly the Federal Reserve’s decision on Wednesday is likely to be the focal point. As well as that, there are a number of key data releases, including the first look at Q2’s GDP reading for the US (Thursday) and the Euro Area (Friday), whilst earnings reports will include Tesla (today), Alphabet, Apple, Microsoft (all tomorrow), and Facebook (Wednesday). So get ready for a barrage of early week tech earnings after a good start to the US season.

Looking at some of the highlights in more detail let’s start with the Fed. As DB’s Jim Reid writes, at last meeting in June the FOMC undertook a hawkish shift by moving their median dot to show two rate hikes in 2023, compared to none before. Meanwhile inflation data has continued to surprise to the upside since then, with the latest CPI reading at +5.4%, and core CPI at +4.5%, which is the highest for the latter since 1991. At this meeting, DB economists are expecting them to provide an update on the progress of taper discussions that will help refine the likely timeline for an announcement in the coming months. Their view is that there’ll be a clearer signal from the Fed’s leadership that the timeline is coming into view at the Jackson Hole economic symposium in August or at the September meeting, before an official announcement at the November meeting, though the incoming data will dictate the exact sequence. Basically the meeting can be simplified to working out which the committee sees as the biggest risk – the recent rise in inflation vs the recent rise in the delta variant.

Elsewhere it’s quite an eventful week ahead on the data front, and we’ll get the first look at the Q2 GDP figures for a number of key economies. On Thursday we could well see US real GDP exceed its pre-Covid peak for the first time since the crisis began, which would be a much, much quicker return to the pre-crisis peak than after the GFC. We’ll also get the Q2 GDP release for the Euro Area (Friday), but they remain some way behind their pre-crisis level, having contracted in Q4 2020 and Q1 2021 as further restrictions were imposed again. Inflation will also be in focus, with the Euro Area flash CPI reading out this week (Friday) for July. Economists are expecting headline inflation to tick back up to +2.0% this month, which is exactly at the ECB’s new target, before peaking at c.3.0% yoy in the latter months of the year.

Moving on to earnings releases, and the coming week will see the season in full flow, with 177 companies in the S&P 500 reporting and Europe starting to get busy too. Among the highlights are Tesla, LVMH and Lockheed Martin today. Then tomorrow we’ll hear from Apple, Microsoft, Alphabet, Visa, UPS, Starbucks and General Electric. Wednesday sees releases from Facebook, PayPal, Pfizer, Ford, Thermo Fisher Scientific, McDonald’s, Barclays, Qualcomm, Bristol Myers Squibb and Boeing. On Thursday, we’ll then get reports from Amazon, Mastercard, Comcast, L’Oréal, Merck & Co., T-Mobile US, AstraZeneca, Volkswagen, Sanofi, Credit Suisse and Lloyds Banking Group. Finally on Friday, the releases include Procter & Gamble, Exxon Mobil, AbbVie, Chevron, Charter Communications, Linde, Caterpillar, Natwest Group and BNP Paribas.

Finally tomorrow, the IMF will be releasing their latest projections for the global economy in their World Economic Outlook Update. So expect plenty of headlines.

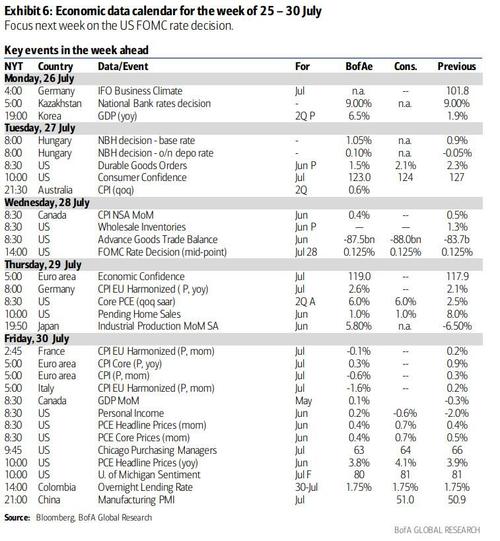

Day-by-day calendar of events, courtesy of Deutsche Bank

Monday July 26

- Data: July flash PMIs from Japan, Germany July Ifo business climate, US June new home sales, July Dallas Fed manufacturing activity

- Central Banks: BoE’s Vlieghe speaks

- Earnings: Tesla, LVMH, Lockheed Martin

Tuesday July 27

- Data: China June industrial profits, Euro Area June M3 money supply, US preliminary June durable goods orders, May FHFA house price index, July Conference Board consumer confidence, Richmond Fed manufacturing index

- Earnings: Apple, Microsoft, Alphabet, Visa, UPS, Starbucks, General Electric

- Other: IMF release World Economic Outlook Update

Wednesday July 28

- Data: Germany August GfK consumer confidence, France July consumer confidence, Italy July consumer confidence, US preliminary June wholesale inventories

- Central Banks: Federal Reserve monetary policy decision

- Earnings: Facebook, PayPal, Pfizer, Ford, Thermo Fisher Scientific, McDonald’s, Barclays, Qualcomm, Bristol Myers Squibb, Boeing

Thursday July 29

- Data: France June PPI, Germany July unemployment change, preliminary July CPI, UK June consumer credit, mortgage approvals, M4 money supply, Euro Area final July consumer confidence, US advance Q2 GDP, core PCE, weekly initial jobless claims, June pending home sales

- Earnings: Amazon, Mastercard, Comcast, L’Oréal, Merck & Co., T-Mobile US, AstraZeneca, Volkswagen, Sanofi, Credit Suisse, Lloyds Banking Group

Friday July 30

- Data: Japan June jobless rate, retail sales, industrial production, preliminary Q2 GDP reading from France, Germany, Italy and Euro Area, preliminary July CPI from France, Italy and Euro Area, June unemployment rate from Italy and Euro Area, US Q2 employment cost index, June personal income and personal spending, July MNI Chicago PMI, final July University of Michigan consumer sentiment index

- Earnings: Procter & Gamble, Exxon Mobil, AbbVie, Chevron, Charter Communications, Linde, Caterpillar, Natwest Group, BNP Paribas

* * *

Finally, looking at just the US, Goldman notes the key economic data releases this week are the durable goods report on Tuesday, the Q2 GDP report on Thursday, and ECI and core PCE inflation on Friday. The July FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM. Governor Brainard is scheduled to speak on Friday following the end of the FOMC blackout period.

Monday, July 26

- 10:00 AM New home sales, June (GS +3.7%, consensus +4.0%, last -5.9%): We estimate that new home sales increased by 3.7% in June, reflecting mean-reversion and a rise in starts but a slowdown in permits and mortgage applications.

- 10:30 AM Dallas Fed manufacturing index, July (consensus 32.3, last 31.1)

Tuesday, July 27

- 8:30 AM Durable goods orders, June preliminary (GS +4.5%, consensus +2.0%, last +2.3%); Durable goods orders ex-transportation, June preliminary (GS +0.5%, consensus +0.8%, last +0.3%); Core capital goods orders, June preliminary (GS +0.5%, consensus +0.8%, last +0.1%); Core capital goods shipments, June preliminary (GS +0.8%, consensus +0.8%, last +1.1%): We estimate durable goods orders rose 4.5% in the preliminary June report, reflecting a large increase in commercial aircraft orders. We estimate +0.5% for core capital goods orders and +0.8% for core capital goods shipments, reflecting rising machinery prices and output but some deceleration in orders activity.

- 09:00 AM FHFA house price index, May (consensus +1.6%, last +1.8%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, May (GS +1.6%, consensus +1.5%, last +1.62%):We estimate the S&P/Case-Shiller 20-city home price index rose by 1.6% in May, following a 1.62% increase in April.

- 10:00 AM Conference Board consumer confidence, July (GS 122.5 consensus 124.0, last 127.3):We estimate that the Conference Board consumer confidence index decreased by 4.8pt to 122.5 in July. Our forecast reflects weaker signals from other consumer confidence measures.

- 10:00 AM Richmond Fed manufacturing index, July (consensus +20, last +22)

Wednesday, July 28

- 08:30 AM Wholesale inventories, June preliminary (consensus +1.1%, last +1.3%); Retail inventories, June (consensus +0.6%, last -0.8%)

- 08:30 AM Advance goods trade balance, June (GS -$90.9bn, consensus -$88.0bn, last -$88.2bn): We estimate that the goods trade deficit increased by $2.7bn to $90.9bn in June compared to the final May report, reflecting inventory restocking and weakening exports.

- 02:00 PM FOMC statement, July 27-28 meeting: As discussed in our FOMC preview, we continue to expect the first hint about tapering in August or September, followed by a formal announcement in December and the start of tapering at the beginning of next year.

Thursday, July 29

- 08:30 AM GDP, Q2 advance (GS +8.25%, consensus +8.5%, last +6.4%); Personal consumption, Q2 advance (GS +10.4%, consensus +10.5%, last +11.4%): We estimate GDP growth improved to +8¼% annualized in the advance reading for Q2, following +6.4% in Q1. Our forecast reflects another large gain in consumption driven by reopening and fiscal stimulus (+10.4% annualized) that embeds a sizeable increase in virus-sensitive services categories in June. We also expect strength in business fixed investment (+10%) led by the intellectual property category (+14%). On the negative side, we expect a pause in residential investment growth (+0.6%) following the sharp increases over the prior three quarters. We also estimate a drag on GDP growth from inventories (-0.6pp qoq ar) and net trade (-0.1pp). The report will also include annual revisions to incorporate 2020 annual source data.

- 08:30 AM Initial jobless claims, week ended July 24(GS 400k, consensus 380k, last 419k); Continuing jobless claims, week ended July 17 (consensus 3,192k, last 3,236k): We estimate initial jobless claims declined to 400k in the week ended July 24.

- 10:00 AM Pending home sales, June (GS +1.0%, consensus +0.5%, +8.0%): We estimate that pending home sales increased 1.0% in June.

Friday, July 30

- 08:30 AM Employment cost index, Q2 (GS +0.8%, consensus +0.9%, prior +0.9%): We estimate that the employment cost index rose 0.8% in Q2 (qoq sa), which would boost the year-on-year rate by three tenths to +2.9%. Despite the high unemployment rate, labor shortages exerted upward pressure on wage growth in the second quarter, and the ECI measure is also running below our composition-adjusted wage tracker (+3.3% in Q2). At the same time, we expect normalization in incentive payments to weigh on the headline ECI series.

- 08:30 AM Personal income, June (GS -0.1%, consensus -0.4%, last -2.0%); Personal spending, June (GS +0.8%, consensus +0.7%, last flat); PCE price index, June (GS +0.51, consensus +0.6%, last +0.45%); Core PCE price index, June (GS +0.45%, consensus +0.6%, last +0.48%); PCE price index (yoy), June (GS +3.93%, consensus +4.0%, last +3.91%); Core PCE price index (yoy), June (GS +3.50%, consensus +3.7%, last +3.39%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.45% month-over-month in June, corresponding to a 3.50% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.51% in June, corresponding to a 3.93% increase from a year earlier. We expect a 0.1% decrease in personal income and a 0.8% increase in personal spending in June.

- 09:45 AM Chicago PMI, July (GS 62.0, consensus 63.3, last 66.1): We estimate that the Chicago PMI pulled back by 4.1pt to 62.0 in July, reflecting continued supply chain disruptions and weak international trade data.

- 10:00 AM University of Michigan consumer sentiment, July final (81.0, consensus 80.8, last 80.8): We expect the University of Michigan consumer sentiment index increased to 81.0 in the final July reading.

- 08:30 PM Fed Governor Brainard (FOMC voter) speaks: Fed Governor Brainard will speak to the Aspen Institute on Rebuilding the Post-Pandemic Economy. Prepared text and Q&A are expected.

Source: Deutsche Bank, BofA, Goldman

Tyler Durden

Mon, 07/26/2021 – 09:55

via ZeroHedge News https://ift.tt/3iP0BmD Tyler Durden