Tesla Q2 Earnings: China Remains Key, Questions Loom About Bitcoin, Batteries, Bailouts And The FSD Bait And Switch

There’s going to be a long list of topics on the mind of Tesla investors, skeptics, analysts and the financial media alike during Tesla’s upcoming Q2 earnings report. Ahead of the electric automaker’s earnings report today after the bell, here are some of the key issues and concerns Tesla may touch on.

The State Of Tesla’s Union In China

The company’s ongoing love/hate relationship with China is likely going to be in focus, since China’s production and sales play a key role in Tesla meeting its company-wide estimates. It has been tough to distinguish at points whether China has grown tired of Musk, or whether or not the company and the country are growing much closer. Recall, back in early July it was reported that Tesla had even asked the Chinese government to help censor social media posts that were critical of the company. We were first, with the help of well-known short seller Montana Skeptic to ask in April of 2020 whether or not Musk risked becoming a Chinese asset, due to how much of a necessity China was becoming to Tesla’s business operations.

Things were mostly quiet until the beginning of 2021, when in January, Musk called the Chinese government “more responsible” to its citizens than the U.S. government. In March we noted how Musk continued to kiss the ass of the CCP, singing the praises of the country and its government. Then, in April 2021, a spat emerged between Musk and the CCP, supposedly after a protestor at the Shanghai Auto Show in April “went viral” after standing on top of a Tesla vehicle and decrying the car’s brakes. This led to intense shaming by Chinese media, who called Tesla’s handling of the situation a “blunder” and suggested it could “inflict serious damage” on Tesla with the Chinese market.

Since then, we noted that the Chinese government still didn’t seem amused by Musk until May of this year, when Musk made a public about-face on Bitcoin and was then immediately praised by China’s state owned Global Times. In fact, the Global Times then published a piece stating that “work at Tesla’s Shanghai Gigafactory is going smoothly,” just days after it was reported that Tesla was halting its expansion in China, seen as key to its plans to export from its Asia headquarters.

“China is the linchpin to the bull thesis,” Wedbush’s Dan Ives told Reuters this week.

As of July, deliveries in China have picked back up and Musk is back to his old self, praising China, even in response to Chinese state-owned media.

In case anyone was wondering who is pulling the strings: https://t.co/9WAAkwI1PA

— Quoth the Raven (@QTRResearch) July 1, 2021

Tesla’s New Batteries

The batteries proposed by Musk last year “would have higher energy density and would extend ranges of current vehicles and let Tesla offer a $25,000 car in three years, sharpening its technology edge as rivals flood the market with EVs,” Reuters reported Monday morning. Recall, last month Tesla pushed back the debut of these batteries by cancelling plans for the Model S Plaid +. Musk has since said the batteries would “go into volume production next year”.

“It has required an *immense* amount of engineering to take Maxwell’s proof-of-concept to high-quality, volume production & we’re still not quite done,” Musk recently commented about its dry battery electrode manufacturing process.

The Cybertruck and Full Self Driving/Summon Walk-Backs

Investors will likely also be looking for color on the Cybertruck and Full Self Driving/Summon, Tesla “sales pitches” that Musk has recently walked back his promises on. The walk back of history began with a mega-huge whopper about 2 weeks ago when, at the beginning of July, Musk admitted that Full-Self Driving – a non-existent feature customers have been paying for for a half-decade – was a “hard problem”, casually dropping into conversation the idea that the company may not be anywhere close to meeting Musk’s promises about FSD.

In another walk-back and reset of expectations last week, Elon Musk also Tweeted that there was “always some chance” that the Cybertruck – a product introduced almost two years ago in November 2019 to ridiculous fanfare – could “flop”.

Shortly after Musk’s Cybertruck comments came Musk’s “realigning” of expectations about Tesla’s Summon feature, which Musk has been boasting about whilst collecting order money, for years. “Current Summon is sometimes useful, but mostly just a fun trick,” Musk nonchalantly wrote on Twitter earlier this month.

The Ongoing Trial Alleging Musk Unilaterally Bailed Out Solar City When It Wasn’t In Shareholders’ Best Interests

We also can’t forget that Musk spent several days this month testifying in Wilmington, DE about Tesla’s bailout buyout of Solar City. Hanging in the balance of the trial is the question of whether or not Tesla was damaged as a result of the merger and, if so, if Elon Musk was the responsible party.

As the Wall Street Journal noted earlier this month:

“If Vice Chancellor Joseph Slights III, the presiding judge, finds Mr. Musk didn’t control the deal, the case is likely over for the plaintiffs, Mr. Hamermesh said. Case law in Delaware generally defers to the business judgment of independent and properly motivated directors. On the other hand, if the evidence points to control, the court would assess whether the deal process and price were fair and, if not, whether Mr. Musk should be ordered to pay money back to Tesla, Mr. Hamermesh said.”

Tesla has argued that the company’s shareholders “overwhelmingly voted” to approve the bailout, according to FT. Ann Lipton, law professor at Tulane University in New Orleans told FT: “The case has the potential to provide more guidance not only to courts, but also to deal planners, as to the factors courts are likely to take into account when determining whether someone is a controller.”

Delaware Court of Chancery vice-chancellor Joseph Slights wrote in 2018 that “it is reasonably conceivable that Musk, as a controlling stockholder, controlled the Tesla board in connection with the acquisition” and that “there were practically no steps taken to separate Musk from the board’s consideration of the acquisition”.

Analyst Expectations

For the current quarter, analysts have an average estimate of $0.98 per share in earnings on $11.4 billion in revenue.

With so many question marks up in the air, even some Tesla bulls weren’t super optimistic about Q2 numbers. Tesla uber-bull and talking head Ross Gerber is already trying to divert attention to Q3, telling Reuters: “I just don’t see any huge catalyst, like, oh, they’re gonna blow out their numbers this quarter. We are much more bullish for Q3 than Q2.”

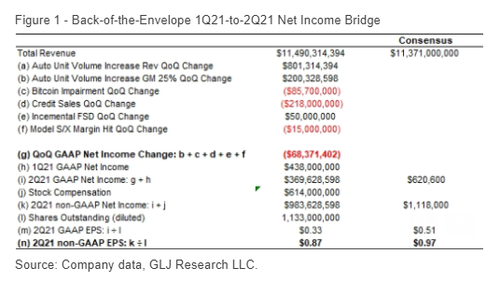

Meanwhile, GLJ Research’s Gordon Johnson took to CNBC early Monday morning to offer his analysis of the upcoming report.

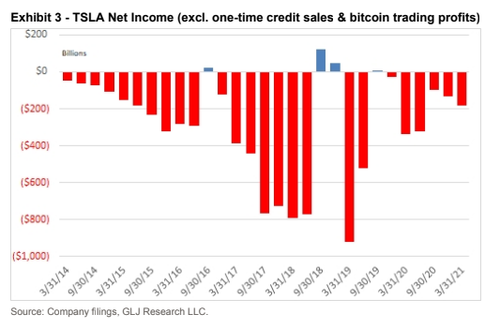

Among Johnson’s points were that Tesla is ceding “significant market share” in key markets globally and that “there’s risk to the consensus estimate” due to a loss of a big credit customer. “We think there’s a potential miss in the offing,” Johnson said. He backed that up in a note released Monday, stating: “We believe there is a strong probability TSLA will disappoint on earnings either in 2Q21 (which our modeling suggests) or 3Q21,” with much of his case resting in Stellantis’s purchases of credits from Tesla drying up.

On the topic of Bitcoin affecting Tesla’s earnings, Johnson said: “They’re going to take about an $85 million charge on Bitcoin” for the second quarter. “Bitcoin is actually going to be a headwind for them,” he continued.

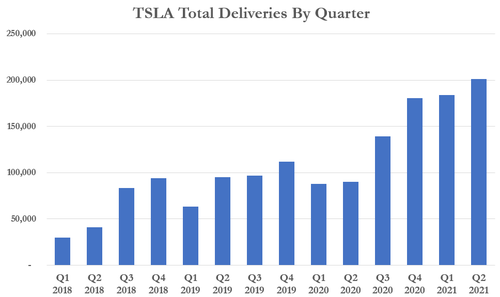

When talking about deliveries, Johnson commented: “If you look at their valuation [100x earnings], I think [Tesla’s deliveries] are a disappointment.”

“When the market comes to realities, drastic things can happen,” Johnson concluded.

Johnson also released a report on Monday morning with his own estimates. Johnson said he expects the automaker “to report 2Q21 rev/GAAP EPS of $11.5bn/$0.37 vs. Cons’ $11.4bn/$0.51 – i.e., a top line beat, yet bottom line miss.”

As a reminder, the company produced 204,081 cars and delivered 199,360 Model 3/Y vehicles, the company said, in Q2. It produced just 2,340 Model S and Model X vehicles and delivered just 1,890 of them.

In total, the company’s delivery of 201,250 vehicles for the quarter missed estimates, CNBC noted. Analysts had been expecting the automaker to deliver 207,000 cars during the quarter. Estimates for the quarter ranged from 195,000 to 231,000.

Tyler Durden

Mon, 07/26/2021 – 10:35

via ZeroHedge News https://ift.tt/3BJK6kz Tyler Durden