Did Today’s Shockingly Bad Home Sales Data Just Derail The Fed’s Tapering Plans

In previewing Wednesday’s FOMC meeting, DB’s Jim Reid pointed out that the bank’s economists are generally expecting the Fed to provide an update on the progress of taper discussions that will help refine the likely timeline for an announcement in the coming months. Their view is that there’ll be a clearer signal from the Fed’s leadership that the timeline is coming into view at the Jackson Hole economic symposium in August or at the September meeting, before an official announcement at the November meeting, though the incoming data will dictate the exact sequence. Basically the meeting can be simplified to working out which the committee sees as the biggest risk – the recent rise in inflation vs the recent rise in the delta variant.

Further to that, speculation is rife that that key debate to top the FOMC agenda on Wednesday is whether to taper the Fed’s purchases of mortgage-backed securities faster than its buying of Treasury debt. As Bloomberg wrote on Sunday, “policy hawks at the Federal Reserve are setting their sights on scaling back the U.S. central bank’s massive intervention in the mortgage market as home prices soar. But the Fed leadership doesn’t sound convinced by arguments in favor of a hasty exit strategy.”

Maybe not.

As today’s surprisingly weak new home sales data for the month of June showed, the housing market – record home prices notwithstanding…

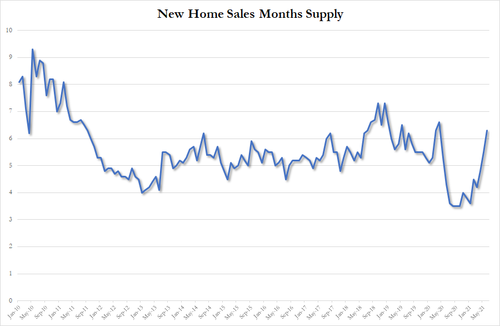

.. suddenly finds itself in an unexpectedly weak spot as home sales tumbled by a whopping 6.6% M/M to a level not seen since April 2020…

… and not due to supply – as noted, there was a generous 6.3 months of housing supply, back to where it was just before the pandemic struck…

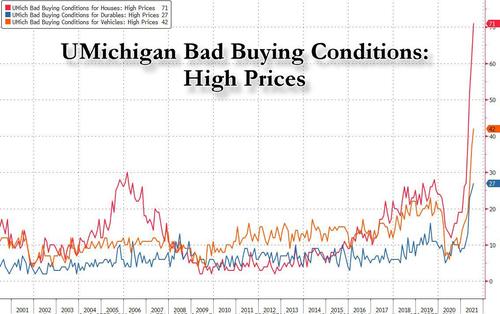

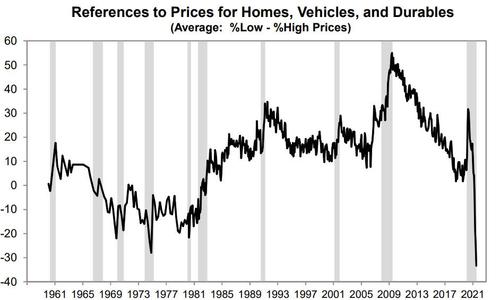

… but demand, the same lack of demand we highlighted recently which according to sentiment surveys has manifested itself in a buyer’s strike with US consumers reportedly balking at any future purchases of everything from Houses to Durable goods and cars due to soaring prices.

As UMichigan economist Richard Curtin elaborates, “Inflation has put added pressure on living standards, especially on lower and middle income households, and caused postponement of large discretionary purchases, especially among upper income households” adding that “consumers’ complaints about rising prices on homes, vehicles, and household durables has reached an all-time record.”

Which again brings us to today’s shockingly poor new home price sales report, which has not only pushed builder stocks lower, but according to Bloomberg’s Felize Maranz is also “adding to the case that the housing market may have peaked, potentially furthering expectations for slowing inflation across the board.”

And while sales of new homes dropped in June to the lowest since April 2020, indicating weaker demand amid high prices and tight supply, this follows last week’s mixed report on housing starts and permits, which also signaled that a hot market may be cooling.

So in light of the sharp slowdown in the housing market will this be enough to, pardon the pun, taper the Fed’s tapering language, and more specifically, will it end any debate that the Fed will focus on cutting its MBS purchases before it shifts to Treasurys?

“The agenda for this next meeting is probably to start hashing out some of the logistics,” said Aneta Markowska, chief financial economist at Jefferies LLC in New York. “On timing, it’s still too early to make decisions, but I think the focus is going to be on those operational details.”

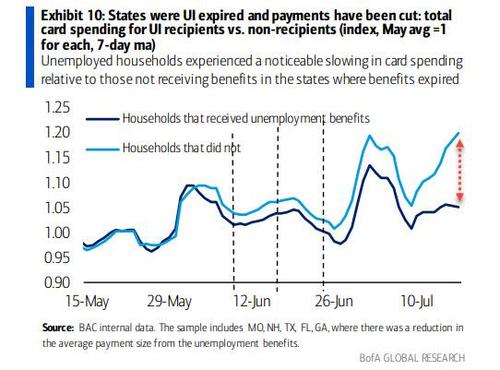

The slowdown comes at a time when Bloomberg warns of an “unprecedented spike” in US evictions as the foreclosure moratorium comes to an end, and also as households which no longer are receiving unemployment benefits saw their spending drop sharply…

… all of which has culminated with Goldman slashing its GDP forecast for next year (more in a subsequent post).

In other words, not only has US economic growth peaked but it may be on the verge of contracting in the coming months.

So what will the Fed do: will it taper just as fears about the US economy resurface, sparking the market shock which Bank of America, Morgan Stanley and even Goldman have been warning about in recent weeks, or will it announce that it is no longer “talking about talking about tapering” at least until there is some clarity on the Biden infrastructure stimulus which is emerging as the most important variable whether the US economy enjoys a healthy tailwind into the end of the year?

The answer will be revealed in just over 48 hours…

Tyler Durden

Mon, 07/26/2021 – 11:14

via ZeroHedge News https://ift.tt/3eTPLKU Tyler Durden