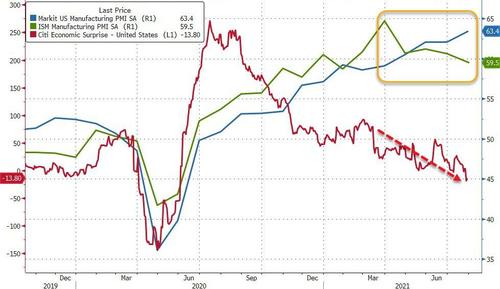

Take Your Pick: US Manufacturing Economy Hits Record High & 2021 Lows

Despite the plunge in ‘hard’ economic data, Markit’s final July Manufacturing PMI rose once again, this time to a record high (63.4 vs 63.1 flash and 62.1 in June) but ISM’s Manufacturing survey disappointed, dropping from 60.6 to 59.5 (missing expectations of a small rise to 60.9).

Source: Bloomberg

Quite a run for Markit’s survey?!

As Tom Fiore notes on the ISM:

“Business Survey Committee panelists reported that their companies and suppliers continue to struggle to meet increasing demand levels. As we enter the third quarter, all segments of the manufacturing economy are impacted by near record-long raw-material lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products. Worker absenteeism, short-term shutdowns due to parts shortages and difficulties in filling open positions continue to be issues limiting manufacturing-growth potential.“

“Comments indicate slight improvements in labor and supplier deliveries offset by continued problems in the transportation sector. High backlog levels, too low customers’ inventories and near record raw-materials lead times continue to be reported. Labor challenges across the entire value chain and transportation inefficiencies are the major obstacles to increasing growth”

Prices Paid fell back modestly from its highest since 1979 and Employment inched higher…

Source: Bloomberg

Chris Williamson, Chief Business Economist at IHS Markit said:

“July saw manufacturers and their suppliers once again struggle to meet booming demand, leading to a further record jump in both raw material and finished goods prices.

“Despite reporting another surge in production, supported by rising payroll numbers, output continued to lag well behind order book growth to one of the greatest extents in the survey’s 14-year history, leading to a near-record build-up of uncompleted orders.

“Capacity is being constrained by yet another unprecedented lengthening of supply chains, with delivery delays reported far more widely in the past two months than at any time prior in the survey’s history. Manufacturers and their customers are consequently striving to maintain adequate inventory levels, often reporting the building of safety stocks where supply permits, to help keep production lines running and satisfy surging sales.

“The result is perhaps the strongest sellers’ market that we’ve seen since the survey began in 2007, with suppliers hiking prices for inputs into factories at the steepest rate yet recorded and manufacturers able to raise their selling prices to an unprecedented extent, as both suppliers and producers often encounter little price resistance from customers.”

So once again PMIs suffer the indignation of imbibing supply chain disruptions as a positive indicator of demand, sending the model higher and higher as the situation gets worse and worse.

All in all, there is something for everyone here – Manufacturing is at 2021 lows, and record highs… pries are at record highs or rolling over… employment is picking up but supply chains are a disaster…

Tyler Durden

Mon, 08/02/2021 – 10:06

via ZeroHedge News https://ift.tt/3xhof0o Tyler Durden