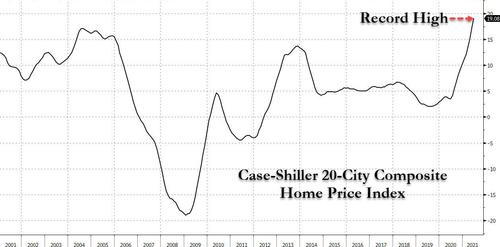

US Home Prices Rise At Fastest Pace On Record

According to the Case-Shiller indices, home prices in America’s 20 largest cities have exploded at 19.08% YoY in June up from 17.14% in May, beating expectations of 18.6%, and the highest pace on record even surpassing the housing bubble days of 2005-2006.

Wihle there was a modest trace of a slowdown in this insane bubble, as the 20-city SA index rose 1.77% m/m in June after rising 1.81% the prior month, the double digit gains will continue well into 20% Y/Y territory. Phoenix, San Diego, Seattle reported highest year-over-year gains among 20 cities surveyed.

All cities that make up the composite saw home prices appreciate at double digits, just a little higher than The Fed’s 2% “goal”.

But, on a national scale, it gets even crazier – or worse for anyone wanting to buy a house: Case-Shiller’s National Home Price Index rose 18.61% YoY in June, up from 16.78% and the fastest pace of home price inflation on record (back to 1988)

The National home price index rose 1.83% m/m in June after rising 1.81% the prior month.

“June’s 18.6% price gain for the National Composite is the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data,” Craig J. Lazzara, global head of index investment strategy at S&P Dow Jones Indices, said in statement. “This month, Boston joined Charlotte, Cleveland, Dallas, Denver, and Seattle in recording their all-time highest 12-month gains.”

The question for Jay Powell is – explain how this is “transitory”?

“The forces that have propelled home price growth to new highs over the past year remain in place and are offering little evidence of abating,” Matthew Speakman, and economist at Zillow Group Inc., said in a statement.

“The number of available homes for sale remains historically small, particularly given the elevated demand for housing.”

Tyler Durden

Tue, 08/31/2021 – 09:13

via ZeroHedge News https://ift.tt/3t1Pg7h Tyler Durden