One Bank Finds That There Is Actually Too Little Corporate Debt

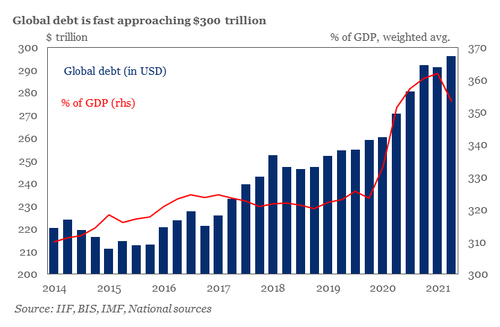

By now it is common knowledge (or we hope it is) that there is just way too much debt in the world, with the IIF calculating earlier this month that global debt hit a record $296 billion in Q2, up $36 trillion since covid, representing almost 360% of global GDP.

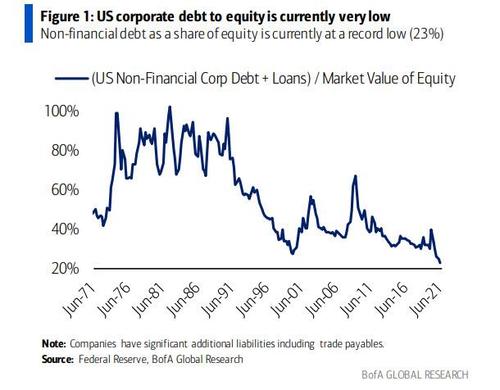

Yet in an unexpected twist, this morning BofA’s credit strategists made the “surprising” discovery that corporate debt has never been lower… at least when compared to the amount of corporate equity.

As Bank of America strategist Hans Mikkelsen writes, “financial debt (bonds and loans) of US Non-financial corporations fell to a record low 23% of the market value of equity in in 2Q-2021 from 25% the prior quarter (Figure 1).

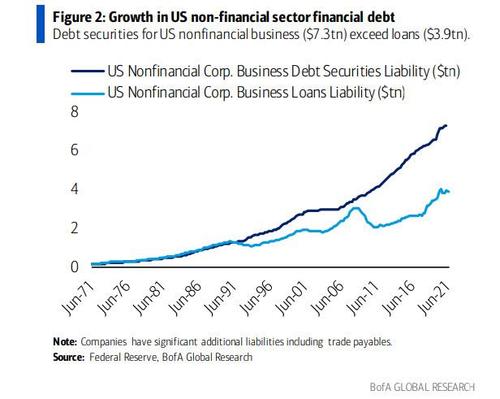

Amusingly, and in what we assume is an attempt at institutional trolling, Mikkelsen then says that while some have argued over the years there is too much corporate debt (Figure 2), “that suggests instead there is either too much corporate equity or too little corporate debt, or both.”

While it’s unclear if the chief BofA credit strategist was being facetious or joking, luckily he answered his own rhetorical question by noting that “assets have struggled historically following low values for this leverage ratio (4Q-1972, 1Q-2000, 2Q-2007).”

Why? Because what this completely meaningless ratio reveals is that while we may have a corporate debt bubble (and we do), it’s far smaller than the equity bubble, hence why the denominator (market value of equity) is massive enough to make the total debt amount small. And, no surprise, the ratio hits record lows when there are equity bubbles like in 2000 and 2007, which is also why assets “struggle” after… because what happens after the equity bubble peaks is far less pleasant. The only question is how much further will central banks keep inflating the current bubble which also happens to be the biggest of all time.

Tyler Durden

Wed, 09/29/2021 – 13:21

via ZeroHedge News https://ift.tt/3upwmrZ Tyler Durden