Washington Worries Spark Dollar Buying-Panic; Bitcoin & Bullion Dive

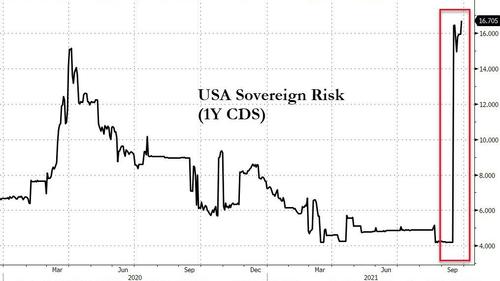

The ongoing debacle in Washington is not helping anything into quarter-end, as debt ceiling doubts have sent USA sovereign risk to cycle highs once again… that’s near the highest level since the 2015 Debt Ceiling chaos.

Source: Bloomberg

And Pelosi’s pontifications have done nothing to take the ‘kink’ in the Bills curve…

Source: Bloomberg

Will the Democrats get everything they deserve this week?

A choppy day in equity-land saw overnight gains (again), chaos around the US open (again)… some dip-buying and then another weak close (as Manchin warned no spending deal for at least 2-3 weeks). Small Caps were the day’s biggest loser with Nasdaq slumping red (as up over 1% overnight) in the late-day weakness

The S&P 500 is on track to post its first monthly decline since January. While rising bond yields, Fed tapering, the delta variant and inflation help explain that, all of those will slow profit growth after rising earnings estimates and big beats helped fuel 2021’s stock rally until now with an always-optimistic eye for the ‘recovery’ and ‘return to normal’ that now seems ever further away.

Treasury yields roller-coastered today but overall it was a ‘pause’ in the panic-selling.

Source: Bloomberg

10Y Yields tested down to 1.50% intraday and found support before pushing back to close unch…

Source: Bloomberg

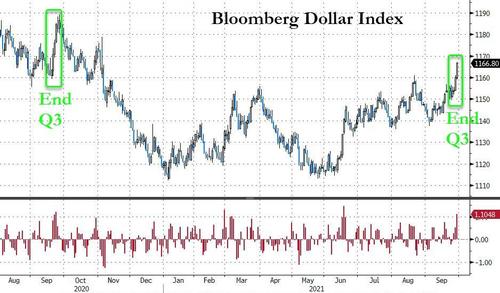

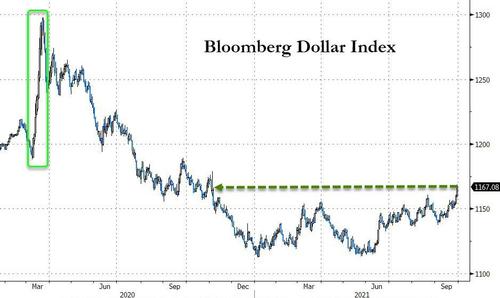

The USDollar screamed higher for the second straight day – the biggest 2-day jump since June and 3rd biggest 2-day jump in a year… We note that into the end of Q3 2020, we also saw a notable surge in demand for dollars…

Source: Bloomberg

…to its highest since the election (early Nov 2020)…

Source: Bloomberg

Note that the real bulk of the USD buying has occurred from the EU open to the EU close for the last few days…

Source: Bloomberg

EURUSD plunged to a 1.15 handle for the first time since July 2020…

Source: Bloomberg

And as the dollar soared, gold was monkeyhammered…

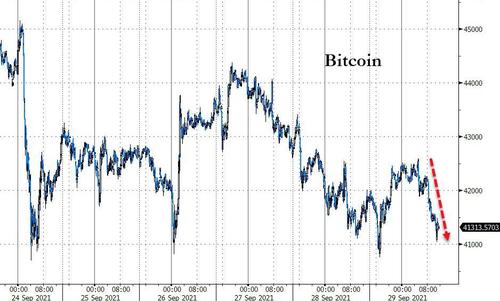

And crypto took a beating too…

Source: Bloomberg

Nattie plunged today too – its biggest one-day drop since Dec 2020 – on forecasts for warmer weather conditions…

European natural gas closes at a fresh all-time high after rising >10% today (both for UK NBP and Dutch TTF benchmarks). At the close, European gas was at the equivalent of ~$29 per mBtu…

…or close to $170 per barrel of oil equivalent. Yes, you read that correctly.

Source: Bloomberg

WTI closed lower today – after a failed attempt to rally back to $76 to close with a $74 handle…

Source: Bloomberg

In fact, comparing US NatGas to US Crude, Henry Hub is at the extreme rich end of the recent range relative to WTI…

Source: Bloomberg

Finally, tick, tock…

Source: Bloomberg

Tyler Durden

Wed, 09/29/2021 – 16:01

via ZeroHedge News https://ift.tt/2Wo0Cqq Tyler Durden