Kemp: China’s Electricity Crisis Caused By Coal Shortage

By John Kemp, Reuters energy reporter and columnist

China is in the grip of a severe shortage of both coal and electricity as the economy has resumed strong growth after the coronavirus recession but coal mine output has failed to keep up, leaving generators short of fuel.

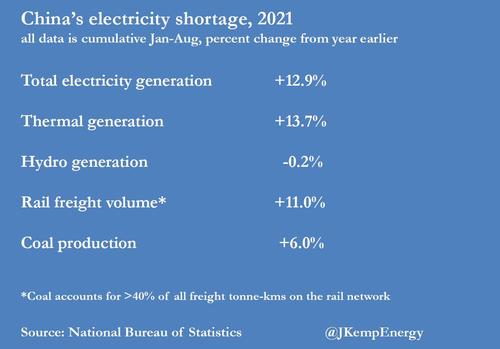

Reflecting a booming economy, China’s electricity generation increased by 616 Terawatt-hours (13%) in the first eight months of 2021 compared with the same period last year.

Consumption growth has been led by the service sector (+22%) and primary industries (+20%), with somewhat slower but still fast increases from manufacturing (+13%) and residential users (+8%).

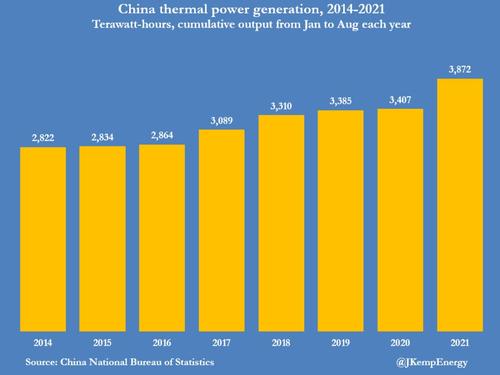

Most of the increase has been supplied by thermal generators, principally coal-fired power stations, which increased output by 465 TWh (14%) in the first eight months, according to the National Bureau of Statistics (NBS).

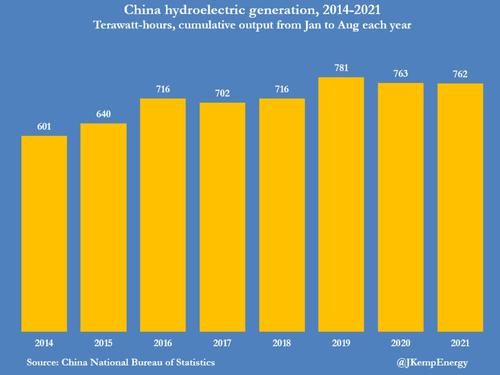

Hydro-electric output has actually fallen slightly this year and is running at the lowest level since 2018, intensifying pressure on thermal generators to make up the shortfall.

Thermal generation units ran for an average of 2,589 hours in the first seven months of the year, up from 2,321 last year, an increase of 12%, according to the China Electricity Council, which represents power producers.

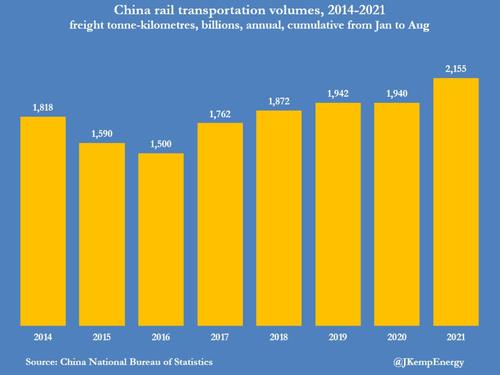

Confirming the increase in thermal generation, freight movements on the national rail network were up 11% in the first eight months of the year.

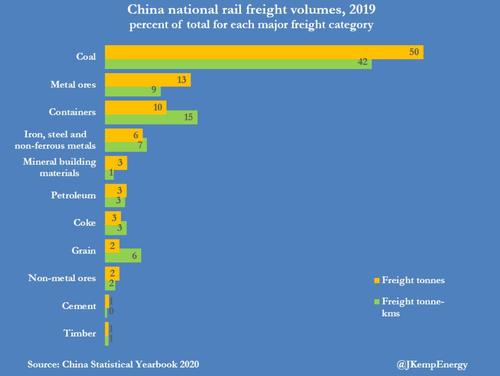

Coal is the most important commodity hauled by rail, accounting for 50% of the tonnage loaded and 42% of the tonne-kilometres. Rapid growth in rail freight so far this year is consistent with heavy demand for coal from power generators and industrial users.

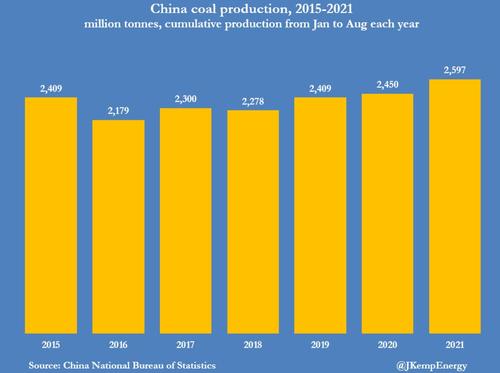

But coal mine production has climbed by just 6% compared with 2020, according to monthly reports from the NBS.

The result has been a severe depletion of coal inventories which has contributed to low stocks at many power plants and upward pressure on coal prices.

Coal prices have more than doubled to almost $210 per tonne, up from just $90 this time last year, based on the most actively traded contract on the Zhengzhou Commodity Exchange.

Responding to the shortage, top regulators at the National Energy Administration and the National Development and Reform Commission have emphasised the need to increase domestic coal and gas production to secure energy supplies this winter.

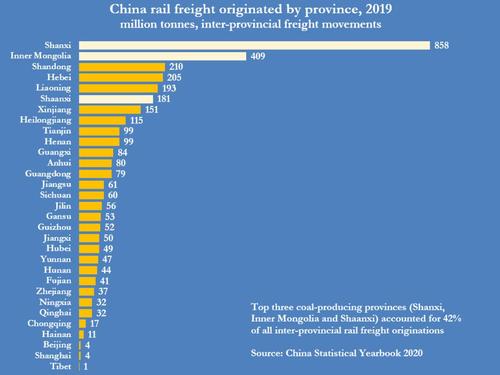

The largest and most efficient coal mines in the provinces and autonomous regions of Shanxi, Inner Mongolia and Shaanxi have been instructed to boost output urgently to help replenish coal stocks.

Provincial governments and power generators in northern provinces and on the east coast are also trying to buy additional supplies from Mongolia, Russia and Indonesia, which is pushing up international prices.

As the crisis has intensified, China’s State Grid, responsible for transmission across most of the country, except for the far south, has pledged to maintain electricity supplies to residential customers and an all out fight to meet basic power needs this winter.

But the fact so many organizations and senior officials have felt the need to emphasize their determination and plans for ensuring winter fuel supplies is an indication of how serious the coal and electricity situation has become.

Tyler Durden

Wed, 09/29/2021 – 20:00

via ZeroHedge News https://ift.tt/3kVex0O Tyler Durden