Saving For A Home-Downpayment Now Takes Even Longer… Thank The Fed

America’s working-poor, or put another way – whatever is left of the middle class – continue to get screwed by the Federal Reserve and their easy-money policies that have inflated both home prices and rents to unaffordable levels.

For the average person, saving 10% of monthly income towards a 20% down payment on a median-priced US home has jumped one year, from seven before the virus pandemic to now eight, according to Bloomberg, citing new data from Tomo, a real estate startup.

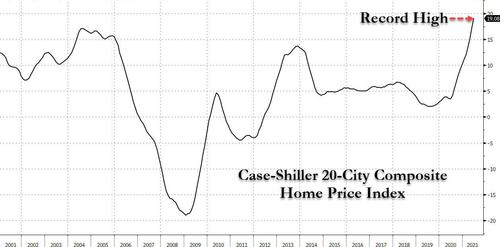

The Fed buying $40 billion per month in MBS has kept mortgage rates pinned at ultra-low levels; and combined with extremely tight housing inventory, this was the perfect trigger to spark bidding wars that pushed home values across the country to record high levels.

Renters who had hopes of living the American dream by owning a home have become shocked by the surge in home prices over the last year…

Skylar Olsen, the principal economist at Tomo, said the people who save for a down payment “are the people who can. Folks who have a lot of rent burdens tend to save nothing, and there’s always a fairly sizable share of the population who have a pretty substantial rent burden.”

Tomo data showed the highest years-to-save on a per metro basis. The highest was Los Angeles at 19.2, San Francisco at 17.9, and San Jose at 18.2. In Seattle and New York, it takes about 12.3 years and 11.9 years, respectively, for the average person to save for a down payment.

Even then, waiting more than a decade indicates prices will continue to go higher unless the Fed reverses course on easy monetary policy.

Recent data from the National Association of Realtors shows first-time buyers’ share of existing- home purchases declined to 29% last month.

At some point, people will figure out The Fed is the root cause of the housing mania, and most importantly, why they can no longer afford a home and are stuck in ‘renter nation’ where they can hardly build any savings.

As Ron Paul recently noted, this is the biggest lie of all – while The Fed was taking extraordinary efforts to ‘stimulate’ the economy, the unelected officials in the Marriner Eccles Building enabled the impoverishment of ordinary Americans, enrichment of the elites, and facilitated unprecedented government debt and deficits.

Tyler Durden

Wed, 09/29/2021 – 21:00

via ZeroHedge News https://ift.tt/3ijMo1B Tyler Durden