Q2 GDP Revised Slightly Higher As Core Inflation Rises The Most Since 1983

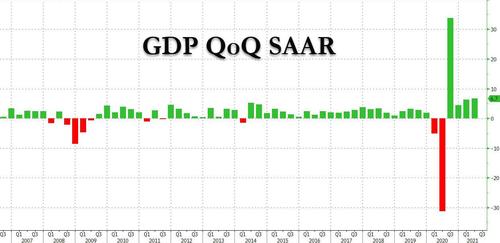

There was little surprise in today’s third and final revision of Q2 GDP data, which came in just barely above consensus expectations, rising from 6.6% (or rather 6.560%) in the second estimate to 6.7% (6.720% to be precise), which was also higher than the 6.6% consensus. The number, while also higher than the 6.3% reported in Q1 will be the best US GDP print for a long, long time, with many expectations a sharp decline in GDP in the current and certainly future quarters if Biden is unable to pass his full $3.5 trillion stimulus which now appears to be the case.

In its snapshot assessment, the BEA reports that “in the second quarter, government assistance payments in the form of loans to businesses and grants to state and local governments increased, while social benefits to households, such as the direct economic impact payments, declined. In the first quarter of 2021, real GDP increased 6.3 percent.”

Looking at the details, the revision to GDP reflected upward revisions to consumer spending, exports, and inventory investment that were partly offset by an upward revision to imports.

- Real disposable personal income (DPI)—personal income adjusted for taxes and inflation—decreased 30.2 percent in the second quarter, an upward revision of 0.8 percentage point from the second estimate.

- The decrease in current-dollar DPI primarily reflected a decrease in government social benefits related to pandemic relief programs, notably direct economic impact payments to households established by the Coronavirus Response and Relief Supplemental

- Appropriations Act and the American Rescue Plan Act. Personal saving as a percent of DPI was 10.5 percent in the second quarter, compared with 20.5 percent in the first quarter

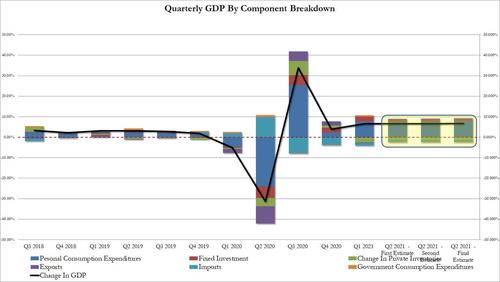

Broken down by component, we see the following changes from the second GDP estimate last month:

- Personal Consumption contributed 7.92% of the bottom-line GDP print, or some 118%. This was entirely as a result of the spending boost from the latest fiscal stimulus earlier this summer.

- Fixed Investment dipped from 0.63% to 0.61% in the final estimate. Nonresidential fixed investment, or spending on equipment, structures and intellectual property rose 9.2% in 2Q after rising 12.9% prior quarter

- A decline in private Inventories subtracted 1.26% from the GDP number, slightly below last month’s estimate of -1.30%

- Net trade was a slightly smaller detractor to growth, with Exports rising from 0.70% to 0.80% while Imports also grew from -0.94% (remember, Imports subtract from GDP) to -0.99%.

- Finally government subtracted another -0.36% from the GDP number, slightly higher than the -0.33% last month.

Visually:

Of course, since these numbers reflect what happened in the ancient second quarter, they are completely irrelevant for an economy that is now rapidly sliding into stagflation.

The latest GDP report also had new disclosure on corporate profits which rose 5.1% in prior quarter, the BEA said. Y/Y corporate profits rose 45.1% in 2Q after rising 17.6% prior quarter, while financial industry profits increased 10.9% Q/q in 2Q after rising 0.3% prior quarter. At the same time, Federal Reserve bank profits surged 36.4% in 2Q after falling 11.1% prior quarter while nonfinancial sector profits rose 13.8% Q/q in 2Q after rising 9.1% prior quarter.

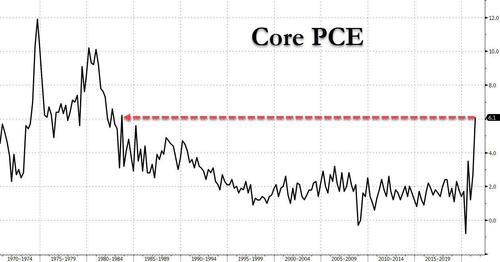

Finally, looking at the inflation components, the price index rose 6.1% in 2Q after rising 4.3% prior quarter while the Core PCE rose 6.1% in 2Q, unchanged from the previous estimate, after rising 2.7% prior quarter. This was the highest core inflation print since 1983 although we know that according to real-time indicators, even higher inflation prints are coming.

Tyler Durden

Thu, 09/30/2021 – 08:52

via ZeroHedge News https://ift.tt/2Yhw62i Tyler Durden