European Gas, Power Hyperinflation Getting More Surreal By The Day

The hyperinflation in European gas and electricity prices is getting more surreal by the day.

Two days after we said that European natural gas and power prices hit escape velocity after Russia unexpectedly cut supplies, prices jumped to records, signaling the supply shortage will only get worse just as the cold winter season starts on Friday.

Dutch natural gas for next month, the European benchmark, rose as much as 13.4% to 98.23 euros per megawatt-hour. The U.K. contract also surged 17.4% to a new high of 252.53 pence a term. Both contracts have more-than-doubled in price over the past month. German power for next year jumped as much as 12% to 132 euros per megawatt-hour, while the French equivalent gained 10.3% to 135.50 euros per megawatt-hour. Both reached record highs on Thursday. Converted to oil price equivalents, these are price rapidly approaching $200/barrel.

As we have discussed in recent weeks, European stockpiles of everything from gas to coal and water for electricity production are in short supply and there are few signs the situation will improve anytime soon as demand continues to roar back from a pandemic-driven lull, Bloomberg writes today.

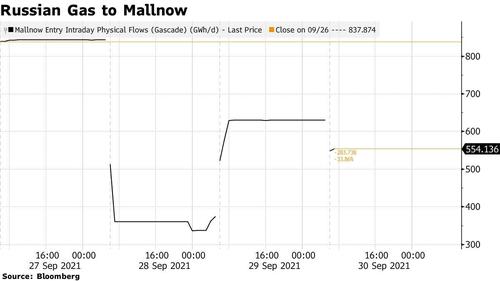

Not helping the already critical situation, Russian gas flows to Germany’s Mallnow terminal dropped again, paring yesterday’s partial recovery. Supplies via the major transit route are about a third less than at the beginning of the week. And as Bloomberg notes, “European utilities seeking to buy more coal from Russia will also be disappointed as any exports are likely to be limited”, at least until Nord Stream 2 is officially open.

And while central bankers spent much of yesterday to convince the public how transitory the hyperinflation in commodities is, consumers have to pay astronomical energy bills right now, and they are hardly excited at the prospect of bills that could be five or more times higher. Worse, prices are about to get even higher as constraints have caught the market off guard, just as countries are about to start drawing down on the gas in storage. European stocks are at the lowest in more than a decade for this time of year

“We didn’t predict these prices coming,” Alex Grant, senior vice president at Equinor ASA, said at a conference in London on Wednesday. “In the prices there is a risk premium for what might happen going forward and the risk is still very much dependent on gas supply.”

Meanwhile, French Prime Minister Jean Castex is scheduled to announce measures the government intends to put in place to mitigate the increase in energy prices this evening

Elsewhere, overnight another three small U.K. energy providers went out of business on Wednesday, bringing the tally to 10 just in the past two months. Some 1.7 million homes have now been forced to switch providers.

With the energy crisis leading to widespread shortages of gasoline across the UK, on Thursday an estimated 27% of service stations in the U.K. still have no fuel and 21% have only one grade in stock, according to a survey by the Petrol Retailers Association. 52% of sites report having both gasoline and diesel in stock, PRA says in a statement.

“PRA members are reporting that whilst they are continuing to take further deliveries of fuel, this is running out quicker than usual due to unprecedented demand,” Executive Director Gordon Balmer says adding that “we would urge drivers to maintain their buying habits and only fuel up as and when needed to ensure there is plenty of fuel to go around.”

Yeah, good luck that.

Tyler Durden

Thu, 09/30/2021 – 10:25

via ZeroHedge News https://ift.tt/3a72qYl Tyler Durden