Key Events This Holiday-Shortened Week: A Wednesday Data Dump For The Ages

This week will be heavily compressed given Thanksgiving on Thursday. The highlight though will be the just announced White House decision to nominate Powell for a second term as Fed Chair with Lael Brainard set to become Fed vice chair (suggesting Rich Clarida is out). Overnight it’s been announced that Biden will give a speech to the American people tomorrow on the economy and prices. Biden will likely discuss hiw decision here and perhaps plans to release oil from the strategic reserve.

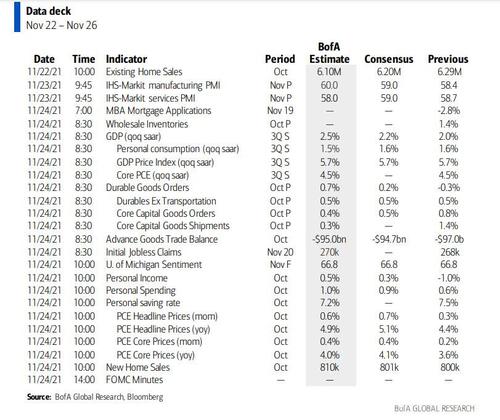

Following that, DB’s Jim Reid notes that Wednesday is especially busy as a pre-holiday US data dump descends upon us. We’ll see the minutes of the November 3rd FOMC meeting and earlier that day the core PCE deflator (the Fed’s preferred inflation metric), Durable Goods, the UoM sentiment index (including latest inflation expectations), new home sales and jobless claims amongst a few other releases.

In addition to the abovementioned Fed chair decision, there are also a number of other positions to fill at the Fed in the coming months, with Vice Chair Clarida’s term as an FOMC governor expiring in January, Randal Quarles set to leave the Board by the end of this year, and another vacant post still unfilled. So a significant opportunity for the Biden administration to reshape the top positions at the Fed.

More internationally, covid will be focus, especially in Europe as Austria enters lockdown today after the shock announcement on Friday. Germany is probably the swing factor here for sentiment in Europe so case numbers will be watched closely. Staying with Germany, there’s anticipation that a coalition agreement could be reached in Germany between the SPD, Greens and the FDP, almost two months after their federal election. Otherwise, the flash PMIs for November will be in focus, with the ECB following the Fed and releasing the minutes from their recent meeting on Thursday.

That said, the Fed chair decision is unlikely to have a material impact on the broad policy trajectory. Inflation in 2022 is likely to remain at levels that make most Fed officials uncomfortable, whilst the regional Fed presidents rotating as voters lean more hawkish next year, so there’ll be constraints to how policy could shift in a dovish direction, even if an incoming chair wanted to move things that way.

Another unconfirmed but much anticipated announcement this week could come from Germany, where there’s hope that the centre-left SPD, the Greens and the liberal FDP will finally reach a coalition agreement. The general secretaries of all three parties have recently said that they hope next week will be when a deal is reached, and a deal would pave the way for the SPD’s Olaf Scholz to become chancellor at the head of a 3-party coalition. Nevertheless, there are still some hurdles to clear before then, since an agreement would mark the start of internal party approval processes. The FDP and the SPD are set to hold a party convention, whilst the Greens have announced that their members will vote on the agreement.

On the virus, there is no doubt things are getting worse in Europe but it’s worth putting some of the vaccine numbers in some context. Austria (64% of total population) has a double vaccination rate that is somewhat lower than the likes of Spain (79%), Italy (74%), France (69%), the UK (69%) and Germany (68%). The UK for all its pandemic fighting faults is probably as well placed as any due to it being more advanced on the booster campaign due to an earlier vaccine start date and also due to higher natural infections. It was also a conscious decision back in the summer in the UK to flatten the peak to take load off the winter wave. Europe is a bit behind on boosters versus the UK but perhaps these will accelerate as more people get 6 months from their second jab, albeit a bit too late to stop some kind of winter wave.

There may also be notable divergence within Europe. Countries like Italy and Spain (and to a slightly lesser extent France) that were hit hard in the initial waves have a high vaccination rate so it seems less likely they will suffer the dramatic escalation that Austria has seen. Germany is in the balance as they have had lower infection rates which unfortunately may have encouraged slightly lower vaccination rates. The irony here is that there is some correlation between early success/lower infections and lower subsequent vaccination rates. The opposite is also true – i.e. early bad outcomes but high vaccination rates. The US is another contradiction as it’s vaccination rate of 58% is very low in the developed world but it has had high levels of natural infections and has a higher intolerance for lockdowns. So tough to model all the above.

Elsewhere, in light of the rising caseloads, the November flash PMIs should provide some context for how the global economy has performed into the month. We’ve already seen a deceleration in the composite PMIs for the Euro Area since the summer, so it’ll be interesting to see if that’s maintained. If anything the US data has reaccelerated in Q4 with the Atlanta Fed GDPNow series at 8.2% for the quarter after what will likely be a revised 2.2% print on Wednesday for Q3. Time will tell if Covid temporarily dampens this again. Elsewhere datawise, we’ll also get the Ifo’s latest business climate indicator for Germany on Wednesday, which has experienced a similar deceleration to other European data since the summer. The rest of the week ahead appears as usual in the day-by-day calendar at the end.

Courtesy of DB here is a day-by-day calendar of events

Monday November 22

- Data: US October Chicago Fed national activity index, existing home sales, Euro Area advance November consumer confidence, Australia flash November manufacturing, services and composite PMIs (22:00UK time)

- Central Banks: ECB’s Holzmann, Kazaks and Kazimir speak

Tuesday November 23

- Data: Flash November manufacturing, services and composite PMIs from France, Germany, Euro Area, UK and US, US November Richmond Fed manufacturing index

- Central Banks: BoE’s Haskel speaks

- Other: President Biden to speak on economy and prices

Wednesday November 24

- Data: Japan flash November manufacturing, services and composite PMIs, Germany November Ifo business climate indicator, US weekly initial jobless claims, preliminary October wholesale inventories, durable goods orders, core capital goods orders, October personal income, personal spending, new home sales, final November University of Michigan consumer sentiment index, second estimate Q3 GDP

- Central Banks: FOMC release meeting minutes, BoE’s Tenreyro speaks

Thursday November 25

- Central Banks: Bank of Korea monetary policy decision, ECB release meeting minutes, ECB President Lagarde, ECB’s Villeroy, and Elderson, BoE Governor Bailey and BoE’s Haskel speak

- Other: US markets closed for Thanksgiving holiday

Friday November 26

- Data: France November consumer confidence, Euro Area October M3 money supply, Italy November consumer confidence index

- Central Banks: ECB President Lagarde, ECB’s Schnabel, Panetta and Lane, and BoE’s Pill speak

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the second Q3 GDP release, the October durable goods report, and the October core PCE report, all on Wednesday morning. The minutes from the November FOMC meeting will be released on Wednesday. There are no speaking engagements from Fed officials this week due to the Thanksgiving holiday.

Monday, November 22

- 10:00 AM Existing home sales, October (GS -2.0%, consensus -1.8%, last +7.0%); We estimate that existing home sales declined by 2.0% in October after increasing by 7.0% in September. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

Tuesday, November 23

- 09:45 AM Markit Flash US manufacturing PMI, November preliminary (consensus 59.1, last 58.4); Markit Flash US services PMI, November preliminary (consensus 59.0, last 58.7)

- 10:00 AM Richmond Fed manufacturing index, November (consensus 11, last 10)

Wednesday, November 24

- 08:30 AM Initial jobless claims, week ended November 20 (GS 245k, consensus 261k, last 268k); Continuing jobless claims, week ended November 13 (consensus 2,052k, last 2,080k); We estimate initial jobless claims declined to 245k in the week ended November 20.

- 08:30 AM Advance goods trade balance, October (GS -$98.5bn, consensus -$95.0bn, last -$96.3bn); We estimate that the goods trade deficit increased by $3.6bn to $98.5bn in October compared to the final September report, reflecting an increase in imports.

- 08:30 AM Wholesale inventories, November preliminary (consensus +1.1%., last -0.2%): Retail inventories, November (consensus +0.2%, last +1.4%)

- 08:30 AM GDP, Q3 second (GS +2.5%, consensus +2.2%, last +2.0%): Personal consumption, Q3 second (GS +2.0%, consensus +1.6%, last +1.6%): We estimate a five-tenths upward revision to Q3 GDP growth to +2.5% (qoq ar). Our forecast reflects the upward revisions to inventory data since the advance Q3 reading, as well as firmer-than-expected services consumption details in Friday’s Census QSS survey.

- 8:30 AM Durable goods orders, October preliminary (GS -0.5%, consensus +0.2%, last -0.3%): Durable goods orders ex-transportation, October preliminary (GS +0.7%, consensus +0.5%, last +0.5%); Core capital goods orders, October preliminary (GS +1.0%, consensus +0.5%, last +0.6%); Core capital goods shipments, October preliminary (GS +0.7%, consensus +0.5%, last +1.4%); We estimate durable goods declined 0.5% in the preliminary October report, reflecting a pullback in commercial aircraft and defense orders. However, we estimate firm gains in core capital goods orders (+1.0%) and core capital goods shipments (+0.7%), reflecting strong goods demand and higher prices.

- 08:30 AM Personal income, October (GS flat, consensus +0.2%, last +0.2%); Personal spending, October (GS +1.1%, consensus +1.0%, last +0.6%); PCE price index, October (GS +0.59%, consensus +0.7%, last +0.32%): Core PCE price index, October (GS +0.37%, consensus +0.4%, last +0.21%) PCE price index (yoy), October (GS +4.95%, consensus +5.1%, last +4.38%); Core PCE price index (yoy), October (GS +4.02%, consensus +4.1%, last +3.64%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.37% month-over-month in October, corresponding to a 4.02% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.59% in October, corresponding to a 4.95% increase from a year earlier. We expect that personal income was flat and personal spending increased by 0.2% In October.

- 10:00 AM University of Michigan consumer sentiment, November Final (GS 67.1, consensus 66.8, last 66.8); We expect the University of Michigan consumer sentiment index increased by 0.3pt to 67.1 in the final November reading.

- 10:00 AM New home sales, October (GS flat, consensus flat, last +14.0%); We estimate that new home sales were flat in October, reflecting an increase in housing permits offset by expected mean reversion following last month’s sharp increase in sales.

- 02:00 PM Minutes from the November 2-3 FOMC meeting; The FOMC announced the start of tapering at its November meeting today at a $15bn per month pace. The FOMC statement noted that the Committee is “prepared to adjust the pace of purchases if warranted,” but language like this that expresses flexibility is routine, and we think the hurdle to accelerating the pace is high.

Thursday, November 25

- Thanksgiving holiday. NYSE closed. SIFMA recommends bond markets also close.

Friday, November 26

- NYSE will close early at 1:00 PM. SIFMA recommends an early 2:00 PM close to bond markets.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 11/22/2021 – 09:32

via ZeroHedge News https://ift.tt/3HI33Hg Tyler Durden