As Markets Brace For Beijing Easing, Chinese State Media Unveils 25bps RRR Cut Before Year-End

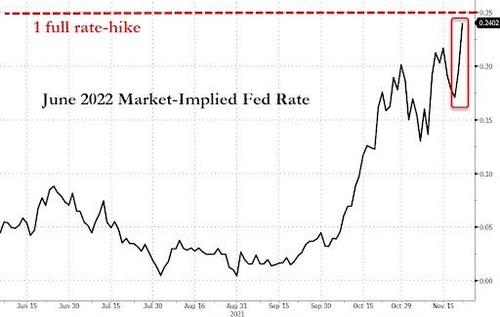

While some in the market are still obsessing over i) when the Fed will end its taper and ii) when it will commence liftoff, or start the rate hiking process which according to the latest market-implied odds, will begin in June instead of July (spoiler alert – it won’t)…

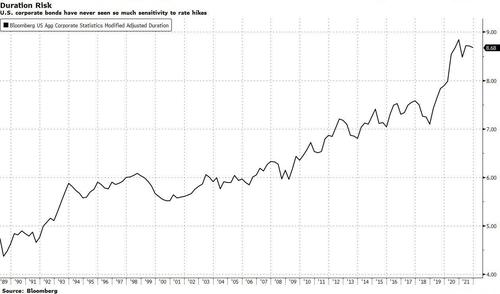

… the real question traders should be asking is how long after the Fed’s attempt to tighten financial policy crashes and burns, because with record duration in the corporate bond market – the same bond market that the Fed already bailed out in March 2020 and so it will never let it crash again – it will take just a few rate hikes for everything to collapse.

So in a preview of things to come to the US, over the weekend, China’s central bank signaled possible easing measures to aid the economy’s recovery after a sharp downturn in recent months fueled by a property slump.

In its latest quarterly monetary policy report published Friday, the People’s Bank of China removed from its policy outlook a few key phrases cited in previous reports, including sticking with “normal monetary policy.” Additionally, as Goldman’s Maggie Wei wrote in her PBOC monpol post-mortem, the bank noticed three changes in the Q3 report compared with Q2:

- PBOC added monetary policy should be based on domestic economic situation – “monetary policy would give prominence to domestic economic situation”;

- PBOC stated monetary policy should “give greater priority to serving the real economy and to enhance the stability of broad credit growth”;

- instead of “to guide lending rates lower” as mentioned in the Q2 report, Q3 report stated PBOC would work on “lowering financing cost for SMEs”.

The report also dropped previous phrases to “control the valve on money supply” and vowing not to “flood the economy with stimulus,” signaling more credit support in coming months. These statements and changes, according to banks such as Goldman, Citi and Nomura, suggests a shift in stance toward incrementally more supportive policies, “but mainly through increasing targeted supports to green development and SMEs while policy interest rates would remain unchanged.”

Meanwhile, the statement on “giving prominence to domestic economic situation” is an addition compared with the Q2 report, but not a new phrase itself as it was mentioned by PBOC officials recently. This statement is likely a response to market concerns on the divergence of monetary policy between China and major DMs (in particular the US) in the future and, according to Goldman, “leaves the door open for more monetary policy easing despite normalization of monetary policy (tapering and future rate hikes) in the US.“

Nomura’s Ting Lu echoed Goldman’s take, writing that he “expects Beijing to soon significantly step up its monetary easing and fiscal stimulus to counteract the increasing downward pressure.”

The PBOC’s more dovish outlook follows growing concerns about the economy flagged by several officials recently. After warning that China faces “downward pressure” at the start of the month, Premier Li Keqiang told a seminar on Friday that China still faces “many challenges” in keeping the economy stable, although this year’s goals will likely be achieved. He also emphasized policymakers would continue using reforms to increase productivity, streamlining administrative burdens for corporates and pushing for major project construction to maintain labor market stability and ensure economic growth within a reasonable range.

Even more ominously, Liu Shijin, who sits on the central bank’s monetary policy committee, echoed a recent downbeat assessment by Citigroup, saying in an online forum Sunday that the economy could enter a period of “quasi-stagflation,” which needs close attention if it happens.

“The concern for growth slowdown is clearly rising among technocrats at different government agencies,” said Macquarie Group Ltd.’s Larry Hu. “But the key is whether the top leaders share such a view.” The Politburo meeting in December and Communist Party’s Central Economic Work Conference due in the same month, will provide more clues, he said.

China finds itself in an unfamiliar place with growth by some estimates set to drop below 5% next year, testing authorities’ resolve to cut the economy’s reliance on the highly-leveraged property sector. In the quarterly report, the PBOC said the economic recovery faces restrictions from “temporary, structural and cyclical factors,” and it’s become more difficult to maintain a stable economy.

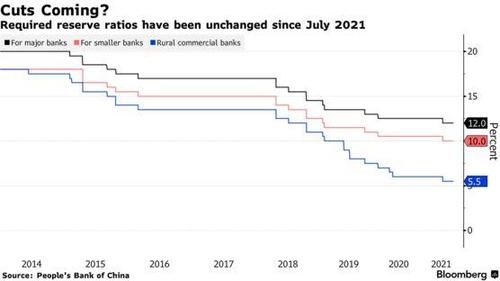

Meanwhile, also overnight, China stood pat on its version of Libor, or the benchmark lending rate known as the loan prime rate (LPR), for the 19th straight month at its November fixing, in line with market expectations. But, as the state-controlled Global Times writes today, confirming the rate cut speculation, “some analysts said that China will likely make another Reserve Requirement Ratio (RRR) cut before the end of this year to cope with an economic slowdown, though the benchmark lending rate is unlikely to change this year.”

The Global Times quoted Xi Junyang, a professor at the Shanghai University of Finance and Economics, who said that the central bank will likely cut the RRR, the amount of cash that banks and financial institutions must hold as reserves, by 25 basis points before the end of this year.

“The RRR cut is necessary as the government needs to cope with the economic slowdown fueled by a mixture of factors, including the COVID-19 resurgence and real estate controls. Besides, China’s capital supply growth is at a relatively low level, providing space for cutting the RRR,” he told the Global Times on Monday.

An RRR cut, while unlocking over $100BN in liquidity, however would not be followed by a cut in the benchmark lending rate this year, the Global Times reported.

“The unchanged LPR in November shows that the PBC agrees with the current interest rate level in the credit market, as financial data show that these figures are within a reasonable range. Besides, banks are not motivated to lower the credit rate, while keeping the LPR unchanged will help stabilize market expectations for the property market,” Zhou Maohua, a macroeconomics analyst under the financial market division of Everbright Bank, told the Global Times on Monday.

One reason for China’s continue caution: soaring wholesale inflation and painful consumer price inflation. Wu Chaoming, chief analyst of Chasing Securities, told the Global Times that “since inflation is still at a relatively high level, the timing of interest rate cuts will likely be delayed, and structural adjustment will remain the mainstream mode for the time being.”

Of course, even “only” an RRR cut would be very much welcome and the local market was delighted by the prospect, sending China’s CSI 300 Index higher as much as 0.5% Monday morning on expectations of potential loosening, while the 10-year government bond futures contracts gained as much as 0.3%. As for more cuts? Well, with the Chinese economy continuing to shrink, it is only a matter of time before Beijing – like the Fed – has no choice but to start from easing square one all over again.

Tyler Durden

Mon, 11/22/2021 – 15:33

via ZeroHedge News https://ift.tt/3kZQKvY Tyler Durden