BlackRock – The Fed’s Wall Street Croupier

Central banks have not merely inflated the bejesus out of assets prices. They have also caused the very foundations of financial markets to metastasize, yielding an endless array of new products that have no real economic function except to facilitate new forms of pure wagering.

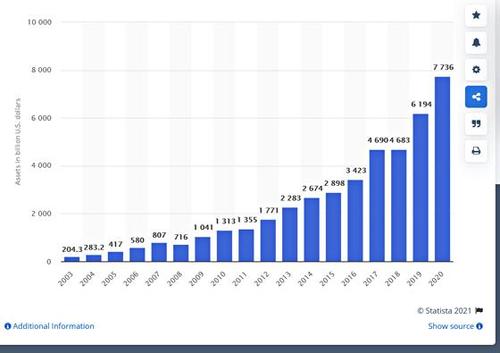

Foremost among these are exchange traded funds (ETFs). If you are inclined to give the latter the benefit of the doubt, you might well ask why the world was so benighted as recently as 2003 that only $204 billion of these swell financial instruments existed – a figure which is just 2.6% of the $7.74 trillion currently outstanding.

That is to say, if ETFs were the spawn of free markets and actually facilitated honest price discovery in primary and secondary capital markets, they would have been invented and institutionalized long ago; and upwards of 80% of outstandings would most certainly not have materialized just during the past eight years.

Total Assets Of Outstanding ETFs, 2003-2020

Of course, what has also materialized during the span of time encompassed by the above chart is essentially free money from the central banks. Massive eruptions of it. Since 2003, their combined footings have risen from less than $4 trillion to more than $35 trillion, thereby water-logging the markets with excess liquidity and turning them into fecund incubators of new wagering devices.

After all, if a real investment professional wanted exposure to the energy sector, for instance, he would undoubtedly investigate the relative merits and potential risks and rewards of all the significant players, including Exxon Mobil, Chevron Corp., Schlumberger, ConcoPhillips. Pioneer Natural Resources, Marathon, Williams Companies, Phillips 66, Kinder Morgan, Valero Energy, Occidental, Devon Energy, Hess, Halliburton, Baker Hughes, Diamondback Energy, APA Corp, ONEOK Inc., etc.

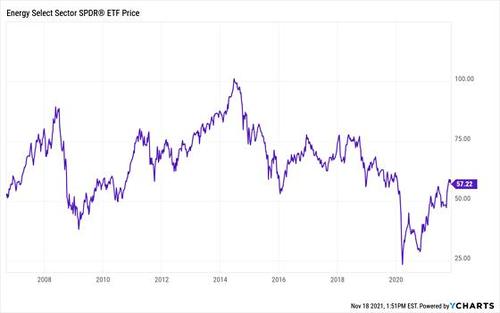

But the last thing he would do is buy all of them, weighted by market cap or some other third-party scheme. Yet that’s what you get when you buy XLE, which is the Energy Select SPDR for the sector: It includes 40 energy companies ranging from the above referenced giant integrated producers like Exxon Mobil to refiners like Valero, to oilfield services companies like Halliburton, to small E&P companies like Newfield Exploration. The iShares equivalent is called IXC and it is even more diversified with 96 companies spread among an even greater diversity of sizes, specializations and geographies.

Needless to say, no long-term investor would possibly believe that such a dog’s breakfast can be rationally analyzed or diligenced. After all, the whole point of competitive markets is to sort out the winners, losers and also-rans at the sector, industry and sub-industry level. So buying the entire industry amounts to embracing self-canceling financial noise and undoing all the hard work of Mr. Market at the operating performance level.

That’s why exchange traded funds, at bottom, are a product of the financial casinos, not the free market. They offer traders and speculators the chance to “bet on black” for just hours, days or weeks at a time based on little more than headlines and momentum. Not surprisingly, the XLE has now completed a round trip to nowhere during the last 15 years as the oil bubble erupted, collapsed, re-erupted, collapsed and is now rising again – even as this ETF’s price is exactly equal to its September 2006 level.

The argument that ETFs are a boon to homegamers who don’t have the time or skill to do the homework at the company level just doesn’t wash. In a world of honest money, they would put their savings in the bank to earn a solid rate of interest or would entrust their allocations to the equity markets to a professional with the skills and track record to pick winning stocks.

By contrast, the very idea of “democratizing” the process of equity investment is a scam that has arisen from the financial casino. It’s a Wall Street invitation to naive homegamers to throw their money at a kaleidoscopic wall of ETFs from which asset gathers scalp a flow of fees off the top.

Indeed, this fact alone tells you all you need to know: There are now more ETFs than actual single-company names traded on the stock markets!

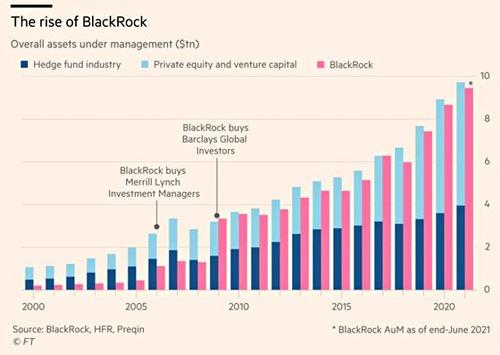

This is all by way of introducing the monster-of-the-ETF-midway, Blackrock (BLK). As of September it was by far the world’s largest asset manager with $9.6 trillion of AUM (assets under management). Accordingly, its asset base is larger than the GDP of every country in the world except the US and China.

In this particular case we have some personal history – having been a founding partner at the Blackstone Group when Blackrock was formed in 1988 as a subsidiary. The next year we all crisscrossed the country trying to raise its first mutual fund based on a comparatively new class of fixed income securities called mortgage-backed bonds.

As we recall, it was a hard sell and that original fund was only about $100 million. So Blackrock’s AUM has grown by a phenomenal 96,000X in the interim!

Needless to say, its founder and current CEO, Larry Fink, is one of the great financial buccaneers of modern times. In addition to building the leading fund manager in what became the multi-trillion mortgage backed securities market, he also made several major acquisitions along the way, including two transformative deals around the time of the great financial crisis.

These included its merger with Merrill Lynch’s asset management business in 2006, which greatly expanded its equities and institutional bond management operations and resulted in a combined AUM of $1 trillion; and then the purchase in 2009 of Barclay’s $1 trillion asset management business, including its iShares unit, the leading provider of the explosively growing exchange traded funds( ETFs).

The latter especially caused Blackrock’s AUM to take off like a rocket, rising from $1 trillion in 2008 to the aforementioned $9.6 trillion at present. Indeed, the pink bars in the chart below are a wonder to behold: They indicate that Blackrock’s footings are equal to the AUM of the entire private equity and venture capital industries (blue bars) combined!

Yet it wasn’t entrepreneurial genius or large-scale mergers alone which have accounted for Blackrock’s phenomenal growth. More than anything else it is the poster boy for the massive financial asset inflation of the last two decades, and especially the explosive growth of ETFs and other passive funds where it is the dominant player.

As the central banks poured upwards of $30 trillion of fiat credit and liquidity into financial markets after the mid-1990s, asset gathers like BLK had a field day scooping up both fixed income and equity investments. Indeed, the upward march of the chart’s pink bars representing Blackrock’s AUM is virtually unprecedented in business history.

Robin Wigglesworth on Twitter: Next week BlackRock will probably report that its assets under management have jumped to $10 trillion. That’s equal to the entire hedge fund, venture capital and private equity

Needless to say, the upward march of the pink bars above did wonders for Blackrock’s financials, as well as the net worth of Larry Fink. Thus, in the LTM period ending in December 1999, BLK’s net income posted at a modest $59.4 million, which at a 18.5X PE multiple gave rise to a market cap of $1.1 billion. Back in the day, that was considered not bad for a 1988 startup.

Fast forward to the September 2021 LTM period, however, and the numbers have taken on considerable girth. BlackRock’s LTM net income posted at $5.8 billion or 98X the 1999 figure, while the company’s PE multiple has expanded to 24X – thereby raising its market cap to $141 billion or by 128X the 1999 figure.

Here’s the thing. Blackrock is huge in size, but extremely diminutive in value-added. On average it scraps about 30 basis points of management fees from its massive AUM – the overwhelming share of which is composed of ETFs and other passive and quasi-indexed funds. These thin margins are more than made up in volume, of course, but they are nevertheless thin because Blackrock essentially functions as a glorified croupier in today’s Wall Street casino. It spreads the cards and chips, and scoops up a tiny slice of the wagers.

It goes without saying, of course, that honest capital and money markets would never employ a $9.6 trillion croupier. There wouldn’t be any demand for its services.

Likewise, Wall Street’s current croupier wouldn’t have anything close to a $140 billion market cap, either. The financial sheeples who feed it fees would be collecting interest at their bank or modest returns from their equity fund managers, instead.

The croupier holds poker cards in his hands at a table in a casino.

To be sure, we don’t hold it against people like Larry Fink who have become billionaires in a world of rotten money. The central bankers who made this madness possible are the ones who should bear the everlasting rebuke.

But like in the case of the left-wing billionaires of Silicon Valley, we do object mightily to the political abuse that these ill-gotten billions have enabled.

In this case, Blackrock has been an active cheerleader for the utterly misbegotten policy of ESG (environmental, social, governance); and has been in the forefront of the Biden White House’s attempts to prod Big Business to enact climate-control measures and adopt other lefty shibboleths such as board diversity as part of their business models.

Back on the campaign trail, Joe Biden made no secret of his support for more government intervention in the economy – the one thing he learned during his 49 years on the public teat. So now his Securities and Exchange Commission is no longer intent on merely the Nanny State job of protecting small investors from financial fraud. The SEC now wants to attack the global climate change hoax by imposing ESG standards on all public companies and mandate disclosure of their carbon footprint.

As the indefatigable Charlie Gasparino of the New York Post recently noted,

What’s different here is how big of a role people associated with Larry Fink’s BlackRock have taken in formulating national ESG policy, and how much the company stands to profit from it with barely a peep from that aforementioned gotcha crowd.

His firm runs money for individuals, businesses and governments across the globe, also managing the Fed’s massive portfolio of debt off and on since the 2008 financial crisis.

Fink is a billionaire, and his success enabled him to become a key player in the Democratic Party. And he hasn’t been bashful in deploying BlackRock’s clout to advance Democratic economic causes in ways that happen to support its bottom line.

Last year, he famously wrote an open letter threatening to push for the removal of board members of companies BlackRock invests in if they refuse to toe the progressive line on climate change.

More recently he has vowed to make ESG a centerpiece of BlackRock’s investing model. As Eleanor Terrett of Fox Business has reported, BlackRock now offers more than 150 mutual funds and exchange-traded funds (investment pools that trade like stocks) that adhere to ESG standards – more than any other firm on Wall Street.

As it turns out, the Biden administration is stocked with former BlackRock people who are doing the same on a national regulatory level.

Take Brian Deese, the current head of the National Economic Council. He was Fink’s global head of sustainable investing. Or take Deputy Treasury Secretary Wally Adeyemo. He was Fink’s former chief of staff and is one of the top advisers to Treasury Secretary Janet Yellen, who is a key player in the national ESG push.

There you have it. The Fed has wrecked the foundations of free market prosperity by turning the money and capital markets into raging gambling venues. The latter, in turn, have conferred trillions of ill-gotten gains on the small share of households which own most of the financial assets, and especially on industry insiders and founders who were in the right place at the right time.

Now the Wall Street croupier who rode the Fed’s serial bubbles to unimagined heights wants to finish the job by hobbling what’s left of main street prosperity with the disastrous remedies of the Climate Howlers and other woke nonsense now at large in the Imperial City.

That is to say, there is a lot more that is rotten about today’s central banking than the money itself. The latter is now fueling a class of bubble-billionaires who apparently feel they can powder the pig by embracing left-wing progressivism at the very time that the future of economic liberty and capitalist prosperity hangs in the balance.

So, yes, scorn the bubble-billionaires for their political apostasy, but the everlasting damnation must go to the central bankers who fostered today’s financial and political madness in the first place.

* * *

PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO & ACTION

Reprinted with permission from David Stockman’s Contra Corner.

Tyler Durden

Mon, 11/22/2021 – 17:00

via ZeroHedge News https://ift.tt/3nFp8Ot Tyler Durden