China Is Chipping Away At America’s Influence In The Middle East

By Simon Watkins of Oilprice.com,

-

Its recent withdrawal from Afghanistan was only the latest in a string of moves from the U.S. that served to reduce its influence in the Middle East

-

As the U.S. has been withdrawing from the region, both Russia and China have been capitalizing on the power vacuum

-

In Beijing last week the Gulf Cooperation Council attempted to set up a Free Trade Agreement with China, a move that highlights China’s growing influence in the region

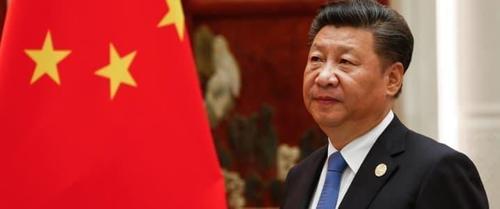

Last week saw a series of meetings in Beijing between senior officials from the Chinese government and foreign ministers from Saudi Arabia, Kuwait, Oman, Bahrain, and the secretary-general of the Gulf Cooperation Council (GCC). At these meetings, the principal topics of conversation were to finally seal a China-GCC Free Trade Agreement and “deeper strategic cooperation in a region where U.S. dominance is showing signs of retreat,” according to local news reports.

As OilPrice.com has been highlighting for some time now, the U.S.’s influence across the Middle East has been in particular decline since the presidency of Donald Trump, in line with his comments to “get out of endless wars” and that the U.S. should no longer resolve “old conflicts in distant lands.” The repercussions of this broad policy idea found the greatest resonance in those countries already aligned to the U.S.’s primary global rivals for power – China and Russia. These included most notably Iran, Iraq, other states in the Shia crescent of power, and Syria, a shift that is analyzed in-depth in my new book on the global oil markets. Following the U.S.’s unilateral withdrawal from the Joint Comprehensive Plan of Action in May 2018, and the subsequent broad- and deep-ranging alliance between Iran and China as delineated in its 25-year comprehensive strategic agreement, it was Iran’s historical enemy, Saudi Arabia, that felt particularly vulnerable to a seemingly newly-reenergized Tehran, and looked to the U.S. for reassurances.

The problem at that point was that a series of events in the preceding years had undermined the core relationship between Saudi Arabia and the U.S. that had been formulated and formalized at a meeting on 14 February 1945 between the then-U.S. President Franklin D. Roosevelt and the Saudi King at the time, Abdulaziz. This agreement was that the U.S. would receive all of the oil supplies it needed for as long as Saudi Arabia had oil in place, in return for which the U.S. would guarantee the security both of the ruling House of Saud and, by extension, of Saudi Arabia. However, facing the prospect of having its own oil industry – the only substantial revenue generator it has – marginalized by the then-nascent U.S. shale oil sector, Saudi Arabia launched the 2014-2016 Oil Price War to try to destroy the U.S. shale threat, or at least severely disable it. When that effort failed to have the desired effect – succeeding only in destroying Saudi Arabia’s own finances and those of its oil-producing neighbors as well – the U.S. changed the 1945 agreement in one key way. The new understanding was: the U.S. will safeguard the security both of Saudi Arabia and of the ruling House of Saud for as long as Saudi Arabia guarantees that the U.S. will receive all of the oil supplies it needs for as long as Saudi Arabia has oil in place and that Saudi Arabia does not attempt to interfere with the growth and prosperity of the U.S. shale oil sector. Shortly after that (in May 2017), the U.S. assured the Saudis that it would protect them against any Iranian attacks, provided that Riyadh also bought a huge quantity of weapons from Washington – US$110 billion immediately and US$350 billion over the next 10 years. However, the Saudis then found out that none of these weapons were able to prevent Iran from launching successful attacks against its key oil facilities in September 2019, or several subsequent attacks.

At around the same time as the U.S.’s assurances of its security were proving of limited worth to Saudi Arabia, Riyadh was also trying to raise money to plug the huge holes in its finances that had been caused by the 2014-2016 Oil Price War by doing an initial public offering (IPO) for its oil and gas giant, Saudi Aramco. The additional problem in this respect for Saudi Arabia was that whenever oil prices rose to or above the level where it could make a profit (US$84 per barrel of Brent was its budget breakeven price for a couple of years after the end of the 2014-2016 Oil Price War), the U.S. told it and its OPEC brothers to pump more because it was damaging the U.S.’s economic prospects. Specifically, before the latest disconnect between oil and gas prices, the longstanding rule of thumb was that for every one cent that the U.S.’s average price of gasoline increased, more than US$1 billion per year in discretionary additional consumer spending was lost. The U.S. – and every other Western country – refused to allow Aramco to undertake any part of its listing on their respective benchmark stock exchanges for a wide range of reasons, thus limiting Saudi’s ability to begin to repair its own finances, but China was ready, willing, and able to provide a solution for the Aramco IPO problem.

China’s willingness to do this – and more importantly from the personal perspective of Crown Prince Mohammed bin Salman (MbS) to allow him to save face over the IPO – was another major milestone in the shift of Saudi towards China. The solution was that China would simply buy the entire stake – at that time 5 percent was the stated amount to be offered – in a straight private placement. This would have the twin huge benefits for MbS of firstly, raising the money that Saudi Arabia needed immediately, and secondly, not requiring any public disclosure of the offer price per share. This latter factor would allow MbS to assure the senior Saudis, who by that time were skeptical of his abilities to lead the country when the time came, that he had managed to hit the US$2 trillion valuation for the whole of Aramco that he had publically set as a benchmark for IPO success.

Although the offer was eventually declined, the fact that China had offered itself as a backstop bid for MbS’s most important public project to that point was not forgotten, and nor were the corollary desires of China to forge closer links with Saudi Arabia going forward. Shortly after the offer was made, China was referred to by Saudi Arabia’s then-vice minister of economy and planning, Mohammed al-Tuwaijri, as: “By far one of the top markets” to diversify the funding basis of Saudi Arabia and that: “We will also access other technical markets in terms of unique funding opportunities, private placements, panda bonds and others.” These comments came at around the same time as the visit of high-ranking politicians and financiers from China in August 2017 to Saudi Arabia, which featured a meeting between King Salman and Chinese Vice Premier, Zhang Gaoli, in Jeddah and, during the visit, Saudi Arabia first mentioned seriously that it was willing to consider funding itself partly in Chinese yuan, raising the possibility of closer financial ties between the two countries. At these meetings, according to comments at the time from then-Saudi Energy Minister, Khalid al-Falih, it was also decided that Saudi Arabia and China would establish a US$20 billion investment fund on a 50:50 basis that would invest in sectors such as infrastructure, energy, mining, and materials, among other areas. The Jeddah meetings in August 2017 followed a landmark visit to China by Saudi Arabia’s King Salman in March of that year during which around US$65 billion of business deals were signed in sectors including oil refining, petrochemicals, light manufacturing, and electronics.

With Russia having already positioned itself as being vital for the efficacy of any future OPEC policies and deals in the aftermath of the 2014-2016 Oil Price War, China through its ‘One Belt, One Road’ (OBOR) program – with all of its associated investment – was and remains ideally placed to pick-up influence across the region as the U.S. eases back. Moreover, for the oil-producing countries of the Middle East, China is not a threat to their positions in the global oil sector, as the U.S. is through its shale oil sector, but rather remains a notable end consumer. The fact that the OBOR-related investments made by China come with considerable caveats allowing Beijing to secure key strategic tracts of land or sea in lieu of debts owed or investments made – including Iran’s major airports and naval ports under the 25-year deal with China, Sri Lanka’s Hambantota Port, and Djibouti’s Doraleh Port – may be regarded by these Middle Eastern states as being little different to the conditions attached to U.S. investment since the end of the Second World War. For the U.S., though, news just before Christmas that Saudi Arabia is now actively manufacturing its own ballistic missiles with the help of China, may not be regarded as part of a reasonable rebalancing of power in the Middle East, especially in light of Washington’s current and ongoing efforts to address Iran’s nuclear ambitions.

Tyler Durden

Wed, 01/19/2022 – 05:00

via ZeroHedge News https://ift.tt/3tEPcwB Tyler Durden