Morgan Stanley Reports Disappointing Revenues But Stock Jumps On Subdued Banker Pay

Unlike most other big banks reporting Q4 earnings, some of which beat on sales and trading, other missed, the common theme was the surge in expenses, i.e., compensation, with JPMorgan and Goldman stock punished due to the unexpected spike in banker wages. But that wasn’t the case at Morgan Stanley, which this morning was the 6th and final bank to report Q4 earnings, which beat on the top and bottom line (despite some rather mixed results by operating group, including misses in FICC, Investment Banking, Wealth Management, Equity and Fixed Income underwriting) reported expenses that came in well below expectations and rose just 1% compared to last year, well below the double digit increase observed by other banks. This, to a Wall Street that had suddenly freaked out about how much it is paying itself, was the best news of the week and MS shares rose shares rose as much as 4.8% in premarket trading.

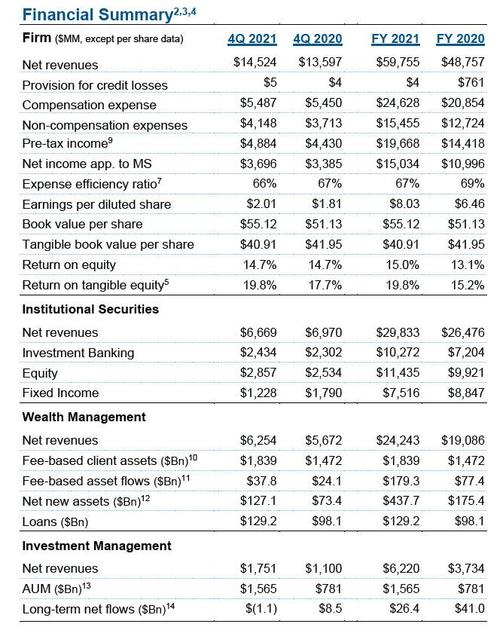

Here is what Morgan Stanley reported for Q4 2021:

- Net revenue $14.52 billion, +6.8% y/y, beating the estimate of $14.44 billion

- Adjusted EPS $2.08 vs. $1.92 y/y, beating the estimate of $1.94 (unadjusted EPS $2.01 vs. $1.81 y/y)

- Net income rose 9% to $3.7 billion, up from $3.385 billion, and beating the estimate of $3.46 billion.

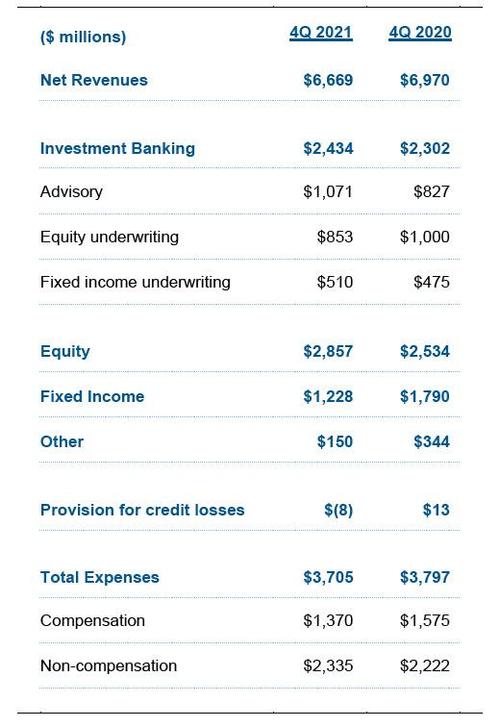

Drilling into the various revenue streams:

- Equities sales & trading revenue $2.86 billion, +13% y/y, beating the estimate $2.49 billion

- FICC sales & trading revenue $1.23 billion, -31% y/y, missing the estimate $1.44 billion

- Institutional Investment Banking revenue $2.43 billion, +5.7% y/y, missing the estimate $2.47 billion

- Wealth management net revenue $6.25 billion, +10% y/y, missing the estimate $6.27 billion

- Advisory revenue $1.07 billion, beating the estimate $1.06 billion

- Equity underwriting rev. $853 million, missing the estimate $901.2 million

- Fixed Income Underwriting revenue $510 million, missing the estimate $510.5 million

Indeed, as the bank revealed, equities-trading revenue only advanced 13% in the fourth quarter, thanks to a one-time $225 million gain on an investment. If it hadn’t been for this, the bank would have missed on the top line.

“2021 was an outstanding year for our firm. We delivered record net revenues of $60 billion and a ROTCE of 20%, with stand-out results in each of our business segments. Wealth Management grew client assets by nearly $1 trillion to $4.9 trillion this year, with $438 billion in net new assets. Combined with Investment Management, we now have $6.5 trillion in client assets. Our integrated investment bank has continued to gain wallet share. We have a sustainable business model with scale, capital flexibility, momentum and growth.” CEO James Gorman said in a statement.

And yet investors were quick to ignore these mixed signals, because the results matched Morgan Stanley’s biggest competitors, which also reported slowdowns in their trading businesses, just as bonus payouts for star traders and bankers weighed on expenses. And while Morgan Stanley’s non-interest expenses for the year rose 19%, this was driven mostly by costs related to integrating the recent acquisition of E-trade, and at $9.64BN was still below the estimate of $9.77BN.

Meanwhile, compensation expenses of $5.49 billion rose only +0.7% y/y, far below the estimate of $5.81 billion; non-compensation expenses were a far more modest $4.15 billion. In its investment bank, non-interest expenses only rose 9%, indicating compensation increases for its bankers might be less generous than at rival Goldman Sachs, where partners are set to receive multi-million “one-time” bonuses.

“We had revenue growth and strong expense discipline,” Chief Financial Officer Sharon Yeshaya said in an interview. On the trading and dealmaking outlook, Yeshaya said it’s a more difficult business to forecast, noting volatility from central-bank rate moves is “the unknown we grapple with.”

Investment Banking revenues up 6% from a year ago:

- Advisory revenues increased from a year ago driven by higher completed M&A transactions.

- Equity underwriting revenues decreased from a year ago due to declines in follow-on offerings and blocks, partially offset by higher revenues from private placements.

- Fixed income underwriting revenues increased from a year ago driven by higher securitized products and non-investment grade issuances.

Equity net revenues up 13% from a year ago:

- Equity net revenues increased from a year ago driven by higher prime brokerage revenues as a result of higher client balances, and also included a significant mark-to-market gain of $225 million on a strategic investment, partially offset by declines in cash equities and derivatives.

Fixed Income net revenues down 31% from a year ago:

- Fixed Income net revenues decreased from a year ago driven by a challenging trading environment in rates and lower volumes and tighter bid-offer spreads in credit.

Wealth-management revenue was nearly in line with estimates at $6.25 billion, a 10% gain for a business that the bank is betting can deliver higher net-interest income this year amid rising rates. The business, along with investment management, contributes more than half of Morgan Stanley’s revenue, and is less volatile than the institutional-securities business that houses traders and dealmakers. Inflows totaled $438 billion for the year for its wealth unit.

In other news, the Firm repurchased $2.8 billion of its stock and declared a $0.70 quarterly dividend per share.

The bank also raised its target for return on tangible common equity, saying it now expects the metric to reach more than 20% over the long term, lifting it from a previous target of 17%. It also expects an additional $500 million in net interest income from its wealth-management business this year, based on market expectations for Federal Reserve interest-rate hikes.

Commentators had generally favorable comments on the bank’s quarter, despite what were clearly mixed revenue numbers:

Evercore ISI, Glenn Schorr (Outperform, PT $120)

- “4Q showed more of the signs of why investors like MS including strong organic growth in Wealth Mgmt, great growth in client assets, some IB wallet share gains, reasonable expenses, solid 8% book growth, an almost 20% ROTCE and good excess capital.”

JPMorgan, Kian Abouhossein (Overweight, PT $108)

- “Overall, we see the results as solid with good cost control”… that shares should be “relatively strong today” after the results

Vital Knowledge, Adam Crisafulli

- “This is a mixed-to-disappointing report w/softness in investment banking fees and FICC revenue.”

- “Expenses within the investment bank were controlled very well, but they were elevated in the Global Wealth Management unit”

The market seems to agree with this positive sentiment, and the stock is higher premarket by over 6% – after losing 8.3% in the past two trading sessions – mostly on the bank’s success at containing expenses.

The bank’s strategic update presentation is below (pdf link)

Tyler Durden

Wed, 01/19/2022 – 09:12

via ZeroHedge News https://ift.tt/3fE3jdr Tyler Durden