Shades Of 2008 As Oil Decouples From Everything

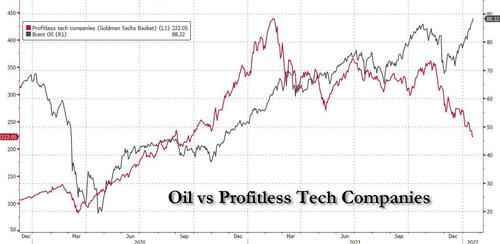

While stocks – especially long-duration, zero-profit tech names – have struggled mightily in recent months (and are now down 50% from their all time high last February) as the sharp increase in real rates has put pressure on long duration pockets of the market, commodities led by oil have continued to rally.

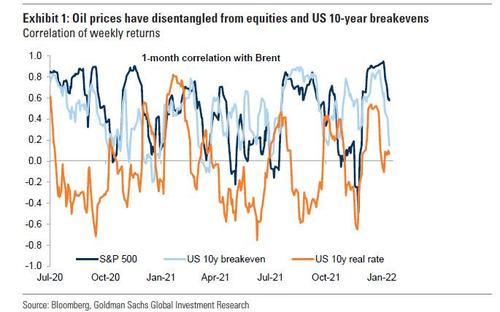

But, as Goldman notes overnight, oil prices have not only diverged from equities, but also from US 10y breakeven inflation.

And while Goldman speculates that the decoupling between oil and breakevens suggests the recent energy rally might be more idiosyncratic and supply-driven rather than linked to broad reflation, an alternative explanation is that the rise in nominal rates has been misinterpreted and instead of real rates rising, it should be on the back of breakevens.

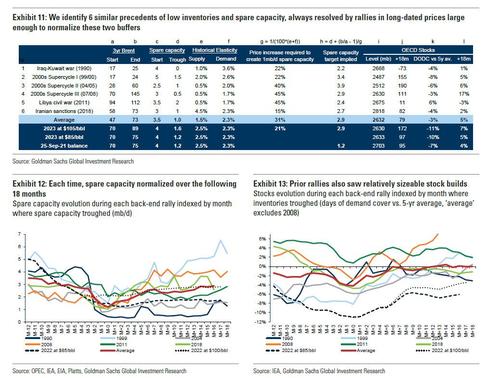

In either case, Goldman’s commodities team expects scarcity pricing likely to continue in 2022. As a reminder, yesterday we noted that according to the bank, while commodity prices have rallied materially in 2021, little has been achieved in resolving imbalances through either demand destruction or supply increases. As such, Goldman’s commodity analysts raised their oil price forecasts significantly through 2023 and expect Brent to reach 105$/bbl in 12m.

Likewise, option markets have started to price a larger upside tail for oil prices into year-end, with the implied probability of the Dec 2022 Brent future price being above 100$/bbl now standing at 20%.

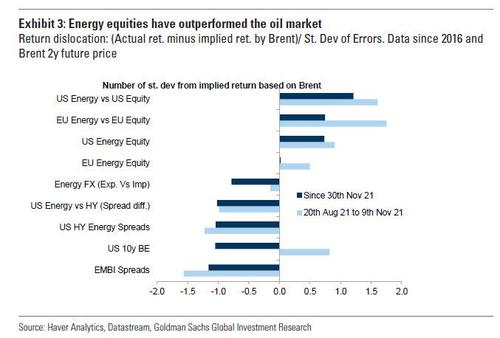

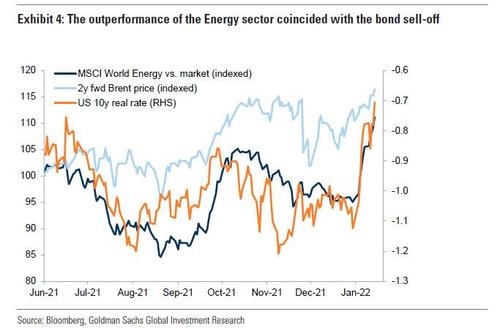

Going back to Goldman, the bank writes that when looking at the performance across energy-exposed assets, the recent oil rally is similar to that in H2 2021…

… where energy-exposed credit and FX have lagged their beta to longer-dated oil prices, while US 10y breakevens underperformed since December. In contrast to most of 2021, energy equities outperformed oil prices, especially relative to the market (however that follows a period in which energy equities underperformed dramatically). Even so, most of the energy sector outperformance can be explained by the rise in real rates: indeed, as Goldman notes, “the sector lagged the oil market at first and later caught up during the value rotation triggered by the bond sell-off.”

And while Goldman will not bring itself to say it, the recent divergence between stocks and oil is reminiscent of another key period in time.

But first, a quick reminder of the current economic situation: last week’s core CPI rose 5.5%, above consensus and the highest level since 1991, while retail sales decreased by more than expected in the same month. Subsequent economic data including industrial production and the Empire Fed both came in far below expectations, suggesting that the US is already sliding into stagflation, or worse, a recession. Meanwhile, China, despite the Q4 GDP growth coming in well above expectations, the PBOC cut policy rates by 10bps.

Confirming the US economic slowdown which by now is obvious to all but career economists and central bankers is the latest Goldman economic surprise index, which just went negative in the US.

Almost as if the economy is redlining and just like one other notable period in time, China is preemptively turning on the afterburners because it knows that like that other time it will have to bail out the world.

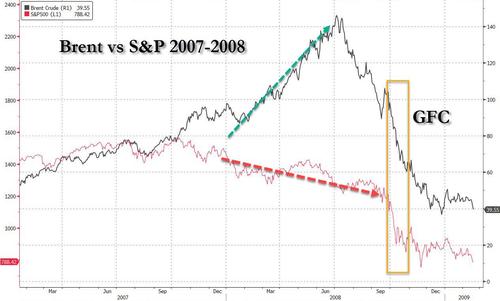

What time are we referring to? Why 2007-2008 of course, when we saw a similar divergence between equities and oil, coupled with rising inflation, although back then inflation was nowhere near as high, not even in the housing market where the bubble was about to burst.

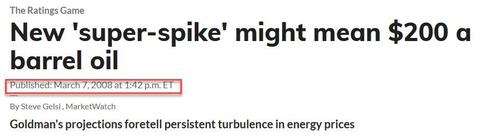

And another flashback: back then, Goldman – which just has published an outlier oil price forecast – sent shockwaves around the market with its March 2008 forecast for $200 oil.

Goldman got it halfway right… and then the inflation shock unleashed from soaring oil prices crashed everything.

So with oil storming higher and steamrolling everything in its path as money flees high-growth tech names and parks itself in the best performing assets of 2022 – oil and energy stocks – are we set for a repeat of the fireworks from late 2008?

Goldman now sees oil hitting $105 in 2023. Things starting to smell an awful lot like summer of 2008, only this time the deflationary shockwave comes out of China pic.twitter.com/fxPh274eM4

— zerohedge (@zerohedge) January 18, 2022

Tyler Durden

Wed, 01/19/2022 – 13:00

via ZeroHedge News https://ift.tt/3AlJsJB Tyler Durden