Larry McDonald: We Are In The Early Innings Of A Colossal “Growth To Value” Rotation

By Larry McDonald, author of the Bear Traps Report

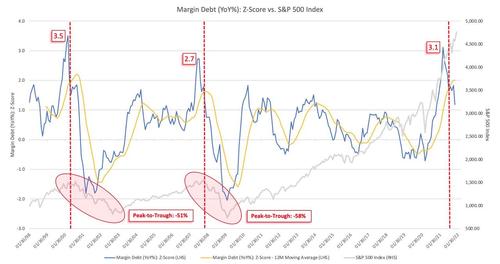

As risk rises, correlation moves toward “one” across asset classes, and leverage comes out of equities. Case in point, margin debt is falling at the fastest pace since Lehman’s failure, from $350B to $200B in recent months.

At the same time tertiary parts of the market lead the pain brigade as the contagion oozes up towards the crown jewels. Yes, the “safe havens” are the last to give way. We are seeing tradable capitulation bottoms forming in the early pain trades (China Tech, Biotechs , Gold Miners, and some ARK names) while large cap and mega cap equities the beloved hide outs have some serious catching up to do in the weeks ahead.

The market’ s security blankets have become treacherous, while the perceived spots to avoid are coming out of extreme capitulation selling. In the blink of an eye value names are the MOST overbought in at least a decade. Overdone for sure in the near term BUT a sign of migration in the early innings of a colossal “growth to value” rotation. One which will last years, NOT months.

Since Q2 2020, at least five covid variants from beta to alpha to delta to omicron have arrived on the global stage. Each time growth stocks, and the U.S. dollar have been saved by the bell. As we pull back the curtain, the sight of “growth to value” tremors are picking up with intensity as they arrive on stage. The virus’ ability to come to the aid of the U.S. dollar, bonds and Big Tech is fleeting like a gazelle on the Serengeti plains. High speed in the midday sun, indeed.

Our most significant conviction call for 2022 is in the precious metals space. If the Fed actually gets aggressive with rate hikes they bring forward recession risk. That ensures a shorted hiking cycle a very BULLISH outcome for gold and silver miners. If they soften their proposed rate hike policy path from here that´s again is BULLISH gold and silver.

We see Goldilocks not too hot, not too cold lost in the woods in 2022. The team of Newmont NEM, Barrick GOLD, Hecla HL, and GDX equities are our highest conviction longs of 2022.

As we look at ESG side effects and energy a black swan just appeared in the sky over the weekend. The Tonga volcanic eruption has launched an enormous amount of ash into the atmosphere. The lessons from the eruptions Mount Pinatubo (1991) and St. Helens (1980) point to an impact on global temperatures for up to two years. Looking back to the Ben Franklin era in North America, there was a volcano that cooled the planet enough to ruin crops. An entire planting season in New England went bust. In the days and weeks to come we must keep an eye on follow on implications.

One thing is certain, after a near $2T partially ESG driven capex cleanse from oil and gas exploration levels at multi decade lows – any significant impacts on the demand side could trigger a “2008 like” super spike in oil. There is little room for error.

Nasdaq Risk

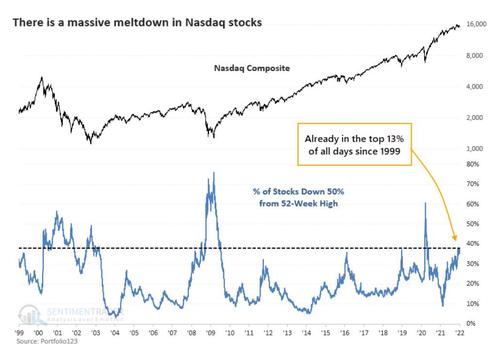

Contagion is moving UPSTREAM. The probability of a Nasdaq large cap equity crash, say a 20-30% drawdown is very high. We know most of the Nasdaq has already crashed, we recently noted 1300 stocks are off 50% or more.

The Fed is digging in tech stocks will be for sale until the Fed softens its stance; 3-4 rate hikes and QT (balance sheet run off) in 2022 gets you a 10k Nasdaq vs. 15.5k now. We are coming into the Fed´s quiet period this weekend. On top of that, a long weekend and the taper is accelerating this week as well. Stocks are saying too much, Mr. Powell.

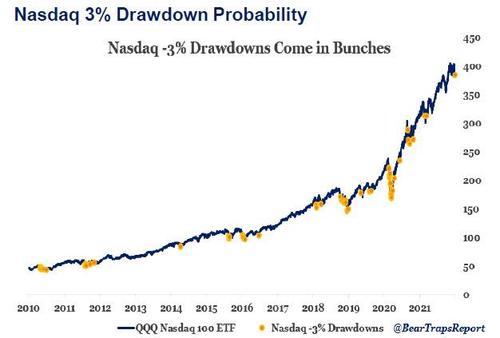

Large tremors rarely happen in isolation. Over the past decade, the Nasdaq has had 55 separate – 3% drawdowns in one trading day. 55 occurrences in the past 3,022 trading days is a probability of roughly 1.8%. However, 23 of these 54 occurrences happened within 10 trading days of each other (41.8%). While 36 occurrences happened within 30 trading days of each other (65.4%). This means although 3% daily drawdowns in the Nasdaq are a rare event, there is roughly a 67% chance we see one in the next ~30 days. Ten days have passed since the last 3% drawdown and although we didn’t get another this week, just a pullback 2.5% on Thursday.

Tyler Durden

Wed, 01/19/2022 – 13:40

via ZeroHedge News https://ift.tt/33CO2ai Tyler Durden