Morgan Stanley Turns Even More Bearish, As Accelerated Fed Tightening Sparks Bear Market

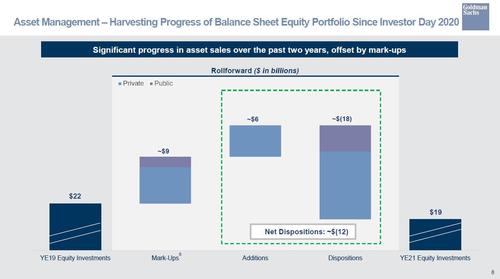

Having warned for months that the market is set to snap, unlike some of his peers like – for example – Goldman’s David Kostin who has been uber bullish throughout 2021 even though we learned yesterday that the bank was quietly selling, pardon, “harvesting” billions in stock positions for a third consecutive quarter…

… Morgan Stanley’s notoriously bearish chief equity strategist, Michael Wilson has reasons for a victory lap now that many of his peers are scrambling to come up with reasons to turn bearish just weeks after they published their 2022 year-end S&P targets which for 95% of them were above 5,000.

However, Wilson has no time for such flights of fancy, because while we wait for street consensus to follow Wilson into the dark side (giving the all clear to buy stonks), he has decided that to keep differentiating himself he has to be even more bearish, and sure enough in his latest weekly warm up note, he writes that Morgan Stanley’s new Fed forecast “simply brings forward our call for lower equity valuations and raises the risk in the first half of the year” as the median stock “remains expensive even though the most egregiously priced stocks have corrected.”

Here are the details.

Last week, Morgan Stanley’s economics team adjusted its forecasts on Fed policy “given the more hawkish tone in the most recent Fed minutes and commentary from Chair Powell and other governors” and joined the rest of the street in expecting the Fed to fully exit QE by April, increase rates by 25bps 4 times in 2022 and begin balance sheet normalization in the middle of the year. That – needless to say, is a lot of tightening, and fits with Wilson’s general bearish outlook for 2022 published in November. To recall, his Fire and Ice narrative assumed the Fed was behind the curve and would need to catch up in a hurry given the dramatic move in inflation we’ve experienced during this pandemic. As discussed on Friday, consumer confidence measures suggest inflation is the number one concern right now, making this a political issue as much as an economic one especially for Biden, as his rating is now crashing.

And as Biden just said during his press conference, “it is “appropriate for the Federal Reserve to recalibrate” the support that is now necessary to fight inflation, so expect the Fed to keep pushing until financial conditions tighten.

What all that means for equity markets is obvious, but just in case it isn’t, Wilson explains: valuations will have to come down this year via a combination of higher back end rates and higher equity risk premiums. And so, the changes to the bank’s Fed forecast simply mean “it is likely to happen faster now, making the handoff between lower earnings and higher earnings less seamless.”

To be sure, Wilson’s outlook for 2022 already incorporated a fairly hawkish Fed, and while that hawkishness has only increased it doesn’t change the bank’s year-end targets, which are already among the lowest on Wall Street:

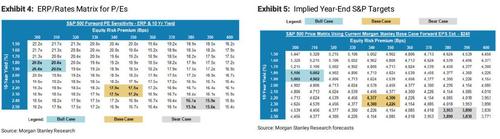

Specifically, our base case year-end target for the S&P 500 is 4400, which compares to the median forecast of approximately 4800-4900. This target assumes a meaningfully lower P/E of 18x forward 12-month EPS of $245 at the end of 2022 (down from ~21x today). Our EPS forecast is largely in line with the Street while our target P/E is approximately 10% lower.

The faster taper and hike schedule brings this valuation risk forward to the first half of the year – and considering that the S&P is now just above 4,500 and could drop below 4,400 tomorrow, one can add that the valuation risk has been “brought forward to this month.” Furthermore, given the much more aggressive timetable for quantitative tightening, we could even see an overshoot to the downside of what Wilson thinks is “fair value.” And what is that?

Our current projected P/E for the S&P 500 is 18x by the end of the year. This target P/E assumed a 10-year Treasury yield of 2.10% and an equity risk premium of 345bps. With our new rates forecast of 2.20% by 2Q and a much more aggressive time line on asset purchase reductions, we think the equity risk premium could easily reach 345bps in the next several months from today’s 300bps, particularly if our forecast for falling PMIs pans out. Assuming an equity risk premium of 345bps and 2.2% 10-year gets us to a P/E of ~17.5x by the second quarter of the year. If we roll forward the consensus earnings forecast we get $230 in NTM EPS by the end of 2Q. 17.5x $230 is 4000.

Bottom line, Wilson predicts that the bringing forward of tapering and rate hikes is likely to lead to a 10-20% correction in 1H22 for the S&P 500.

For those who have a different perspective, below are two tables from Wilson that allow readers to make their own assumptions on both rates and ERP to arrive at the price/earnings ratio that makes sense for the overall market as the Fed attempts to exit this period of extraordinary monetary policy more rapidly. The second table translates these P/E into year-end bull, base, and bear targets for the S&P 500 assuming $245 in EPS for 2023.

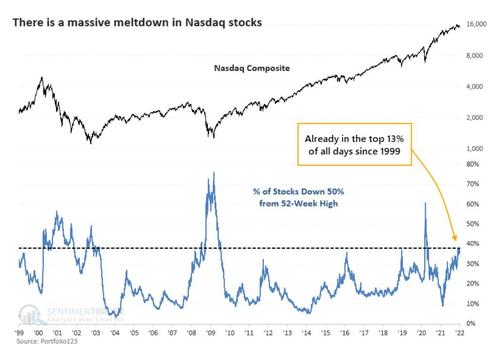

What little good news Wilson had to clients, is that markets have been adjusting for months to this new reality, with 40% of the Nasdaq having corrected by 50% or more.

As we’ve noted many times, the breadth of the market remains poor as it goes through the classic rolling correction under the surface as the index grinds higher. This phenomenon is largely due to the relentless inflows from retail investors into equities. On one hand, this rotation from bonds to stocks from asset owners makes perfect sense in a world of rising prices. After all, stocks are a decent hedge against inflation, and much better than owning fixed income. However, certain stocks fit that billing better than others. In its simplest form, it means value over growth stocks or short duration over long.

And while Wilson was completely on board with that view a year ago, he is not as convinced that it’s going to be as smooth a ride in 2022: “First, the Fed is going the other direction now, and quickly. Second, growth is now decelerating rather than accelerating. Furthermore, it’s decelerating faster than many think, and has a ways to go in our view.” Regular ZH readers will not be in the “many” group as we have extensively discussed precisely this accelerated slowdown over the past few months.

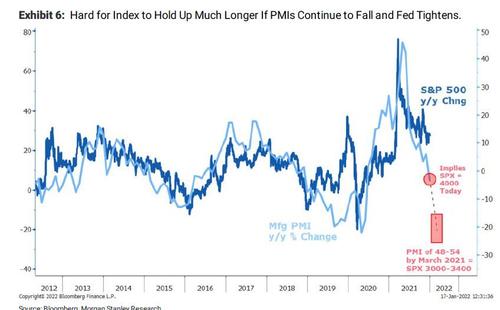

Wilson agrees, having made the case for months that PMIs and earnings revision breadth are both likely to fall more than the consensus currently expects. Both of these metrics have a high correlation to stock prices. In the case of PMIs, stocks have already held up better than they should have.

In many ways this looks a lot like late 2019/early 2020, the last time we had such a wide divergence. This has been caused by the extraordinary monetary accommodation from the Fed over the past 6 months, policy that appears way too loose relative to the current economic conditions. And with that policy now changing at an accelerated rate, Wilson expects the relationship between stocks and the PMIs to realign.

Tyler Durden

Wed, 01/19/2022 – 18:05

via ZeroHedge News https://ift.tt/3GJDNzf Tyler Durden