Futures Rebound On Report Biden To Roll Back Chinese Tariffs Soon

After Friday’s torrid surge, which some speculated was due to pension funds tactically delaying their month-end buying until the start of the next month coupled with another major squeeze as recession fears overflowed and the market priced in a whopping 15bps of rate cuts in Q1 2023 due to the start of the Biden recession (because bad news is again good news), futures initially dipped before recovering most of their losses after the WSJ reported that Biden is “expected to roll back some tariffs on Chinese imports soon, a decision constrained by competing policy aims: addressing inflation and maintaining economic pressure on Beijing.” Maybe, but all the decision which also weakened the dollar, will show is that as expected all along, the president – or rather his son – was in China’s pocket from the very beginning.

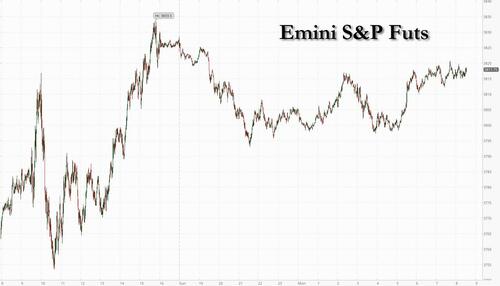

In any case, after dropping below 3,800, S&P futures bounced and were trading near session highs, if still down 0.2% from Friday’s high, when US stocks capped their 11th decline in 13 weeks (Let’s go, Brandon). Today’s illiquid session, which sees US cash markets closed due to the July 4 holiday, has also seen Nasdaq futures down 0.4% while Dow futs were down -0.1%.

After a catastrophic first half and the first bear market since Covid, stocks remain in the grip of the worst selloff in at least three decades as increasing chances of a global recession are spooking investors. At the same time, sticky inflation has left little room for the Federal Reserve to apply brakes on monetary tightening. This toxic combination presents markets a trading challenge not seen since the late 1970s, and only a massive recession, one which eliminates the risk of inflation and ushers in aggressive Fed easing can help save the day.

The MSCI All-Country World Index plunged 21% in the first half, the worst YTD losses since at least 1988. Similarly, the 14% loss in the Bloomberg Global Aggregate Index of investment-grade debt was its worst performance since 1990, the earliest date for which records are available.

“The market has begun to worry more about economic growth than just liquidity withdrawal and inflation,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “Unlike previous downturns, inflation is much higher and unemployment is much lower. These dynamics delay any potential dovish central-bank pivot despite the rapid shift in front-end rate expectations over the past week.”

Across the Atlantic, European stocks rose 0.9% for the first time in four days as dip-buyers emerged, and returned to best levels after a choppy start. Euro Stoxx 50 rose as much as 0.75%, with CAC outperforming. Energy, healthcare and telecoms are the strongest Stoxx 600 sectors. Banks that are most sensitive to economic conditions, including Spanish and Italians lenders as well as Germany’s Commerzbank, underperformed on Monday as investors remain concerned about an economic slowdown and high inflation. Among the worst performers are Sabadell -3.1%, Intesa -2.9%, Banco BPM. Italian bonds tumbled with investors watching domestic political tensions. Here are the biggest European movers:

- AO World shares slump as much as 18%, to the lowest since March 2020, after the Sunday Times reported that credit insurer Atradius has reduced cover for suppliers to AO World.

- Shop Apotheke falls 13%, the sharpest intraday decline since May 10, after Oddo downgrades the stock to neutral from outperform.

- Grafton shares drop as much as 8.8%, the most in more than two years, after the building and home products supplier announces that CEO Gavin Slark is stepping down.

- Ashmore shares drop as much as 4.7% after Numis cut its recommendation on the emerging-market fund manager to hold from add, saying the investment outlook is poor and performance is weak.

- Maisons du Monde shares drop as much as 7.5% to the lowest level since May 2020 after being downgraded to reduce from hold at Kepler Cheuvreux, in a note called “Between a rock and a hard place.”

- SBB falls as much as 8.2% Monday, giving up some of Friday’s 10% gain, having announced the sale of 25% of its shares in Solon Eiendom Holding AS to OBOS.

- Polish banks fall after Poland’s ruling party leader threatened lenders with additional tax on their profits if they don’t increase interest on household deposits.

- Alior Bank falls 4.9%, Bank Handlowy -4.5%, Millennium -4.1%

- Waberer’s gains as much as 27%, the biggest intraday jump on record, after owners that together control a majority of the Hungarian hauler filed a buyout offer at HUF2,336 per share.

Earlier in the session, Asian equities edged higher amid optimism the region’s earnings will prove resilient as the reporting season gets underway. The MSCI Asia Pacific Index climbed as much as 0.8%, buoyed by consumer discretionary shares as most sectors advanced. Benchmarks in Australia and Japan were among the best performers in the region. Bucking the trend, Indonesia’s stock gauge slumped more than 2% as a decline in commodity prices caused traders to book profits on Asia’s top-performing market this year. While recession concerns have been weighing on global stock markets, falling commodity prices may ease inflationary pressure in Asia. China’s progress toward economic reopening may also help Asian stocks recover from their worst first half in three decades. “We are less threatened by inflation in the region, so a lot of corporations in Asia are going to see a better time in terms of earnings” as valuations have fallen, Vicki Chi, a fund manager at Robeco, told Bloomberg Television. China’s shares closed modestly higher as the nation races to quash a new virus flareup that risks spilling over into one of its most economically significant regions.

In China, officials were trying to repel a Covid flareup that could buffet an economically significant region. That’s another test of Beijing’s strategy of trying to eliminate the pathogen with mass testing and disruptive lockdowns. Separately, developer Shimao Group Holdings Ltd. said it didn’t pay a $1 billion dollar note that matured Sunday, among the biggest dollar payment failures so far this year in China.

In FX, the dollar dipped after the WSJ report that Biden may announce a decision to cut Chinese tariffs this week; at the same time the USD/CNH dropped 0.2% near 6.68, and EMFX caught a small bid with ZAR outperforming.

Bitcoin hovered above the $19,000 level.

Fixed income traded heavy with curves bear flattening. Short end of the German curve underperforms, cheapening ~11bps in 2s and 5s. Gilts outperform bunds by ~2bps. Italian bonds slid before a meeting between Prime Minister Mario Draghi and Five Star leader Giuseppe Conte to settle weeks of political tensions. The nation’s 10-year yield jumped 12 basis points to 3.21%, widening its spread over German bunds to 1.90 percentage points. Cash Treasuries are closed for Independence Day, T-note futures are range-bound.

In commodities, crude futures extended their rebound from the recent hammering, rising over $15 to trade $109.44 while Brent rose to $113.3. Most base metals trade in the green; LME nickel rises 3.7%, outperforming peers. LME lead lags, dropping 0.4%. Spot gold falls roughly $6 to trade near $1,806/oz.

* * *

DB’s Jim Reid concludes the overnight wrap

Happy Independence Day to all of our US readers. It’s nice that we can be friends again after 246 years. Although I hope relations haven’t been strained by me publishing the chart over recent weeks that US 10yr treasuries (and earlier proxies) have seen their worst H1 for 244 years and just after the divorce.

Having said that the week ended with a monster rally in bonds, and although it’ll likely be on the quieter side in markets today, we won’t be able to escape the near-term recession risks for very long. The Atlanta Fed Q2 tracker is now at -2.08% after slumping into negative territory at the end of last week, and if this is close to the mark that would mean two negative quarters and a technical recession. The official definition is owned by the NBER and they will likely need more evidence before they would declare it as they look at a broader range of indicators than just headline growth. However we’ll likely know we’re in it before it’s declared so it’ll be crucial to work out if this is the start to a descent into bigger problems or if that’s still some months away. Note it continues to be “when not if”.

A big swing factor here could be employment and this week is jam packed with US labour data. Payrolls (Friday) will be the headliner but JOLTS (Wednesday), ADP and claims (Thursday) will also be very important. Labour markets remain strong around the world and although this is a generally a lagging indicator, we think some kind of turn should occur before we can declare what is absolutely the inevitable dive into recession.

Our economists expect payrolls to slow (+225k forecast vs. +390k previously) but with unemployment falling a tenth to 3.5%. In many ways JOLTS (Wednesday) is our favoured employment measure but it has the disadvantage of being a month behind so we’ll only get May’s data this week. In the report, job openings have remained roughly 4.5mn above where they were prior to the pandemic so unless this dips there will still be a lot of demand for labour and the tightness will continue, thus leaving the Fed with a huge dilemma as growth slows. June’s US services ISM on Wednesday will be watched for the headline growth implications and also the employment component which has been ‘only’ hovering around 50 in recent months.

Ironically the increased growth pessimism towards the end of last week stabilised equities as a big rally in bonds and a more dovish repricing of the Fed kicked in. 10yr Treasuries rallied -25.0bps last week (-13.3bps Friday), their largest weekly decline since March 2020, and although the S&P 500 finished -2.21% lower, it did rally +1.06% on Friday on lower yields as Fed expectations kicked in.

Back to the week ahead and we’ll see how central banks were thinking about this weak growth vs labour tightness dilemma in the minutes from the Fed’s (Wednesday) and ECB’s (Thursday) June meetings but this will be slightly dated in light of how rapidly the macro is evolving.

Elsewhere, trade and industrial data will be due from key economies globally. May trade data will be out for the US (Thursday), Germany (today), Japan and France (Friday). For the US, May factory orders will be released tomorrow, followed by June’s ISM services index on Wednesday. In Europe, the Eurozone’s PPI for May is due today, followed by May industrial production for Germany (Thursday) and France, June PMIs for Italy (Tuesday), and Germany’s May factory orders (Wednesday).

In Asia, the highlight will perhaps be the Caixin services and composite PMIs for China and the RBA meeting taking place tomorrow. Our economists expect the central bank to hike by +50bp. The full week ahead is in the day by day calendar at the end as usual.

This morning in Asia, markets are quiet with the Nikkei (+0.58%) leading the pack and with the Shanghai Composite (+0.14%) and CSI (+0.16%) swinging between gains and losses in early trade. Elsewhere, the Hang Seng (-0.63%) is lagging as the market resumes trading after a holiday on Friday. Meanwhile, the Kospi (-0.58%) is struggling a bit after paring its early morning gains. Over the weekend there has been some chattter of Covid-19 cases in China continuing to climb as new Coronavirus clusters emerged in eastern cities. So one to watch over the next few days.

Recapping last week now, and it marked the end of an ignominious first half for markets, which is an understatement if anything. See our H1, Q2 and June performance review here but in short, the S&P 500 had its worst start to the year in six decades, falling in return terms for consecutive quarters for the first time since the GFC, while 10yr Treasuries returned their worst first half since 1788.

Zooming in on the week in isolation, a nasty cocktail of underwhelming production, spending, and confidence figures, mixed with still stubbornly high inflation led to a risk sell-off but with a rare recent flight to quality into bonds.

Starting in Europe, ECB President Lagarde noted she did not believe we would return to the low environment world that defined the years running up to the pandemic, which, along with other ECB speakers throughout the week, continued to lay the groundwork for the hiking cycle to begin in July. Indeed, Eurozone CPI increased to 8.6% YoY, edging expectations of 8.5% even if German inflation temporarily eased. The STOXX 600 tumbled -1.40% (-0.02% Friday), which saw banks fall even more (-5.00%, -0.40% Friday).

10yr bund yields fell -21.0bps (-10.4bps Friday) while the 2yr rallied -29.7bps (-13.3bps Friday), bringing their decline to -57.8bps over the last two weeks, the largest two week decline since August 2011, on the prospect of a global growth slowdown that would stymie the ECB’s hiking cycle. In a sign of how volatile things have been, the weekly decline in 2yr yields was topped just back in March this year. On the periphery, 10yr BTPs kept pace, falling -37.2bps (-17.3bps Friday). Indeed, President Lagarde emphasised the ECB could use flexibility in reinvesting PEPP redemptions to support implementation starting this month.

In the US, consumer confidence sagged while inflation expectations climbed. Meanwhile, every regional Fed manufacturing index is now in contractionary territory, though PMIs and ISM Manufacturing figures remain in expansion, printing at 52.7 and 53.0, respectively on Friday. Piling on to the poor near-term outlook, however, ISM New Orders fell into contraction zone at 49.2 versus 52.0 expectations. Meanwhile, core PCE managed to still print at 6.3% YoY. That mix is driving grave comments from Fed officials. Chair Powell re-emphasised that this hiking cycle would cause some pain, while SF Fed President Daly noted a Fed-induced recession was now in her outlook – a rare comment from a Fed official.

It seems it’s also the market’s outlook. 10yr Treasuries rallied -25.0bps (-13.3bps Friday), their largest weekly decline since March 2020 when the pandemic first gripped global markets. That corresponded with a modest flattening in the 2s10s yield curve, but the shock lower was more or less parallel, as markets reduced the amount of tightening they believed the Fed would impart this cycle, with 2yr yields down -23.0bps (-12.0bps Friday), also the largest decline since March 2020.

With that mix, it’s perhaps unsurprising that the S&P 500 gave up ground over the week, closing -2.21% lower (+1.06% Friday). Utilities outperformed given the terrible risk sentiment, gaining +4.11% (+2.48% Friday), while mega-cap FANG+ (-5.42%, +0.92% Friday) and tech-heavy NASDAQ (-4.13%, +0.90% Friday) had a rougher time.

Brent futures fell -1.48% (-2.93% Friday) in light of the slowing global growth narrative, registering their first monthly decline (-6.54%) since November when Omicron drove slowing global demand fears. In Europe, natural gas prices climbed +15.0% (+2.26 Friday), as supply constraints look set to grip markets, between a failing compressor in Norway and fears that Russia’s planned maintenance period (July 11-21) for the Nordstream pipeline will be opportunistically used to restrict supply thereafter.

Tyler Durden

Mon, 07/04/2022 – 09:04

via ZeroHedge News https://ift.tt/J7U0Toj Tyler Durden