Stocks & Bonds Tumble As Rate-Hike Odds Rise

Higher than expected labor costs and the corresponding tumble in productivity prompted combination of recession fears and inflation anxiety with the market pricing in more tightening in the short-term and then more easing after the recession hits…

Source: Bloomberg

Notably the Q1 rate-cut expectations are fading, notably almost back to zero probability of the cut…

Source: Bloomberg

Stocks did not like that and long-duration Nasdaq stocks sank notably with Small Caps worst on the day. The Dow was the least ugly horse

Treasuries were all sold today, reversing Monday’s gains with both 10Y and 30Y remaining lower in yield on the week. Today saw the short-end underperform (2Y +7bps, 30Y +2bps)…

Source: Bloomberg

Notably all yields are still higher from Friday’s payrolls print.

The yield curve flattened significantly with 2s10s trading as inverted as -49bps….

Source: Bloomberg

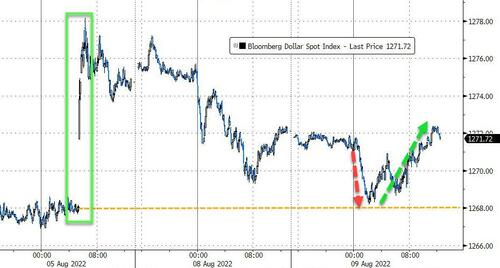

The dollar ended unchanged after some early weakness (testing down to pre-payrolls levels) was reversed…

Source: Bloomberg

Crypto slipped lower on the day with bitcoin testing down to $23k…

Source: Bloomberg

Gold pushed back above $1800 today…

Oil ended very marginally lower after testing above $92…

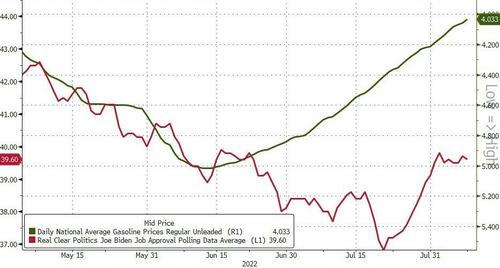

Finally, US retail pump prices fell to 5 month lows…

Source: Bloomberg

And while President Biden’s approval rating has bounced, it remains notably divergent from gas prices.

Tyler Durden

Tue, 08/09/2022 – 16:00

via ZeroHedge News https://ift.tt/SYVouXH Tyler Durden