Stocks & Bonds Sink As Post-Powell “Pain” Continues

Despite a smorgasbord of opinion on just what Jay Powell said on Friday – as “Powell Pivot” bulls desperately enter the various Kubler-Ross-ian stages of grief over their dead narrative – The Fed president’s words were unequivocally hawkish and that was reflected in more positioning adjustments today.

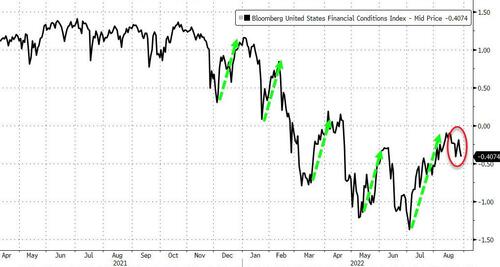

Financial Conditions have begun to tighten from their ridiculous easing shift… as per Powell’s plan (but there’s a lot more “pain” to come)…

Source: Bloomberg

The odds of a 75bps hike in September have risen to 75%…

Source: Bloomberg

As bond rate-hikes and rate-cuts shifted more hawkishly today…

Source: Bloomberg

Futures opened down hard extending Friday’s weakness, staged a slow recovery, dumped lower after the cash open, staged another comeback to get the S&P green (after Europe closed) briefly before sliding back…

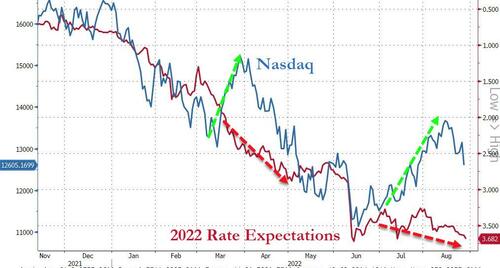

The Nasdaq is down around 5% post-Powell.

The Dow found support today at its 50DMA and the S&P and Nasdaq traded between the 50- and 100-DMA…

Treasury yields were higher across the curve today with the mid- to long-end underperforming (2Y +3bps, 10Y +7bps). Post-Powell, the long-end is flat while the belly is notably higher in yield

Source: Bloomberg

The dollar gave back most of its overnight gains but managed to hold Friday’s hawkish spike returns…

Source: Bloomberg

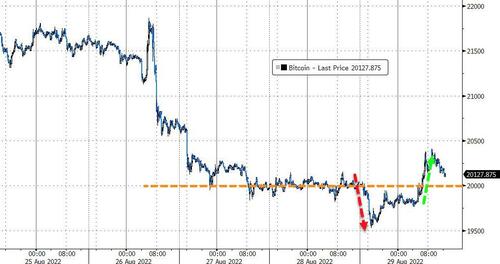

Bitcoin tumbled back below $20,000 overnight but buyers stepped in…

Source: Bloomberg

Dr.Copper continued its slide lower…

NatGas was noisy amid idiotic comments on emergency plans from EU leaders…

Crude prices pushed higher amid Iraq headlines

Uranium extended its gains today as the Swiss join the Japanese and Germans in possibly maybe admitting the nuclear power is the solution…

Gold bounced back from overnight ugliness to close unchanged…

Finally, for a sense of just how far this de-risking could go, we note that STIRs never drank the ‘Pivot’ Kool-Aid and – just as we saw in the March equity squeeze- are likely to be the anchor of reality that stocks have to fall to for pain to slow…

Source: Bloomberg

Bear in mind that this drop in risk assets is what Powell needs – an actual tightening of financial conditions – and should dip-buyer step back in again on hopes that Powell’s “pain” will only last a brief moment, he will re-appear in his most hawkish suit and unleash reality once again until inflation (and speculative longs bank-rolls) are good and dead.

Tyler Durden

Mon, 08/29/2022 – 16:00

via ZeroHedge News https://ift.tt/pYTjaXM Tyler Durden