Dow Theory Reasserts Its Cyclically-Bearish Signal As BofA’s “Biggest Support” Level Looms

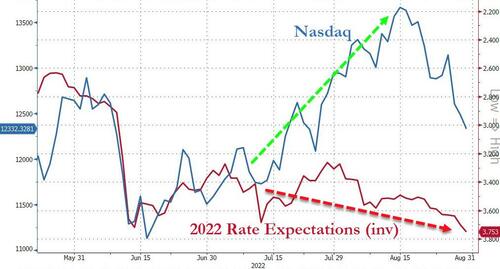

As US equity markets catch back down to the ‘no-pivot’ reality that short-term interest-rates (STIRs) have steadfastly stuck to, BofA’s Stephen Suttmeier notes that capitulation signals are now likely needed for any tactical low to be put in place again.

Today’s Kashari-pleasing plunge has pushed the S&P back below 4,000 and more notably below its 50DMA…

BofA’s Technical Research Strategist notes that after the “Jackson Hole” failure at downside gap resistance at 4195-4219, the SPX broke lower from a tactical head and shoulders top.

A NYSE 90% down day on 8/26 confirmed the breakdown on the SPX, but the NYSE ARMS Index (TRIN) did not show tactical capitulation on a close above 2.0.

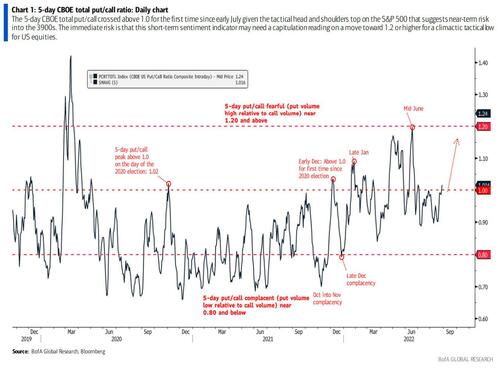

Two other indicators that may require capitulation for a climactic tactical low in US equities are the 5-day CBOE total put/call on a spike up toward 1.2 or higher…

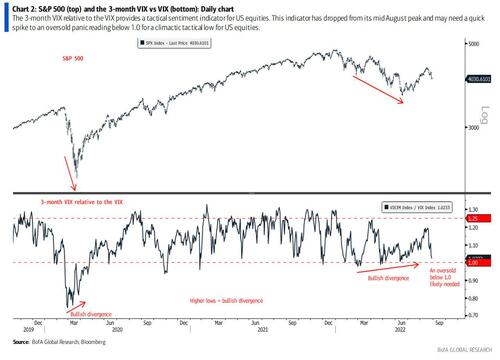

…and the 3-month VIX vs the VIX on a spike below 1.0…

In other words, until we see those indicators ‘capitulate’ to those levels, Powell’s “pain” remains in play tactically.

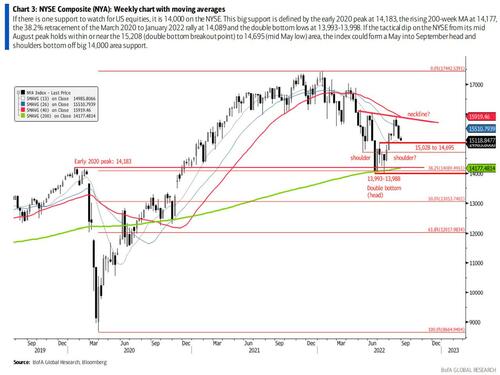

However, as Suttmeier details in his latest note, if there is one support to watch for US equities, it is 14,000 on the NYSE.

The NYSE Comp is the Rodney Dangerfield of US equity indices. It gets no respect. But, this broad-based index of US stocks and ADRs formed a double bottom from its rising 200-week moving average (MA) at the June and July lows, which is bullish. But, the big support is defined by the early 2020 peak at 14,183, the rising 200-week MA at 14,177, the 38.2% retracement of the March 2020 to January 2022 rally at 14,089 and the double bottom lows at 13,993-13,998.

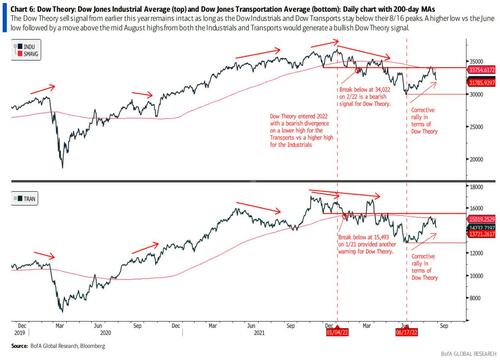

The Dow Theory sell signal from earlier this year remains intact as long as the Dow Industrials and Dow Transports stay below their 8/16 peaks.

To shift the regime into a bullish Dow Theory signal, a higher low vs the June low followed by a move above the mid August highs from both the Industrials and Transports is needed…

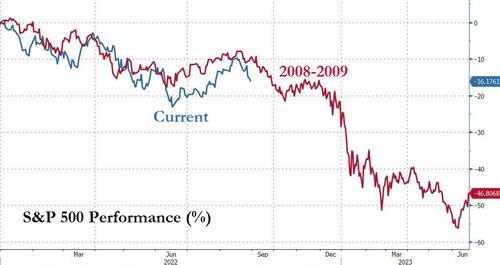

Of course, there is always the chance that this analog holds…

But, it’s different this time… because Powell just removed the Fed Put on this downswing (for now).

Tyler Durden

Tue, 08/30/2022 – 14:40

via ZeroHedge News https://ift.tt/moc7DEI Tyler Durden