Shippers’ Revenge Is Coming For Truckload Carriers

By Craig Fuller, CEO of FreightWaves

The freight market is a pendulum — and when it swings, it may be the buyers or sellers of capacity that now have the power in rate negotiations. Ever since the summer of 2020, trucking companies have largely held all of the power in rate negotiations, based on their ability to squeeze their shipper customers for rate premiums.

If the trucking firms didn’t get a rate increase in a contract rate negotiation, they would simply move the capacity to the spot market to exploit market conditions and much higher spot rates. And whether these negotiations are made through direct confrontation or in a passive- aggressive manner through tender rejections, the outcome is largely the same.

Along the way, carrier executives convinced themselves that the freight market was “different this time” and their ability to have pricing power would remain in place indefinitely.

In the world of trucking, the market has two parties — a buyer and seller. While a buyer of capacity can be a broker that plays the role of both the buyer and seller, in every trucking transaction, you have a carrier (seller) and shipper (buyer) of capacity.

Over the past two years, not all trucking companies exploited market conditions; many of the more seasoned players understood that the pricing power pendulum was temporary and would eventually revert back to give power to the shippers.

But, for those carriers that did exploit market conditions for their favor, get ready for “shippers’ revenge.”

The freight market pendulum

Trucking companies gain all of their pricing power when capacity in a market is tight. If there is more freight demand than capacity to service loads offered, trucking companies are able to leverage this for freight rate concessions. Often, it works.

Last year, shippers faced unprecedented challenges trying to move massive volumes of cargo through their supply chains, disruptions due to raw material and component shortages, runaway inflation, and labor shortages. At the same time, everyone living through COVID has experienced an enormous amount of personal pressure and home-life challenges.

Trucking executives have also faced many of their own challenges and would be rightfully cynical about the plight of a supply chain executive who wasn’t able to empathize with their challenges.

But people that control supply chains are humans. They have egos and frustrations like everyone else. CFOs at shipper organizations have been putting pressure on supply chain executives to tackle inflationary cost acceleration throughout their operations.

And if the past few months have been any indication, the market pendulum has quickly shifted back in favor of the shippers.

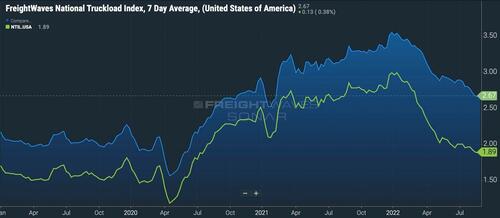

This is most obvious in truckload spot rates, which have collapsed since the start of the year. The National Truckload Index, available on SONAR, which tracks U.S. truckload spot rates on a daily basis, is reporting that the current spot rate for a truckload is down from $3.57/mile at the start of the year to $2.67/mile — a 25% reduction. Remove the price of diesel from the rate and the drop is even more dramatic, dropping from $2.99/mile to $1.89/mile — or a 37% reduction.

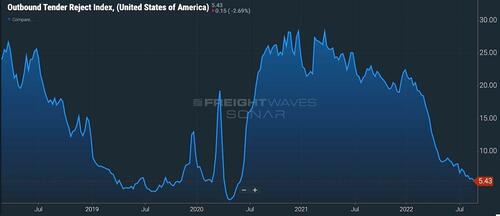

Spot rates are far more responsive to market conditions than contract rates, but following the Waterfall Theory of Freight and how tender rejection rates provide a reliable barometer for truckload capacity, we know that capacity is rapidly loosening and carriers are being less selective in which contracted loads they will accept.

SONAR’s outbound tender rejection index is now down to 5.43%, a new cycle low. Tender rejections haven’t been this low since May 24, 2020, in the earliest days of the COVID economy. Normally, when tender rejections drop, contract rates follow.

However, in this cycle, contract rates have dropped much more slowly than spot rates or tender rejections would suggest.

SONAR’s van contract rate index, which is derived as the national average contract rate from over $40 billion of actual contracted loads between shippers and carriers, is currently at $2.74/mile, down from a high of $2.98/mile set on June 3, 2022. The drop of $0.24/mile represents a 9% drop in two months — and reverses all of the contracted rate increases that carriers gained in the first half of 2022.

Shippers took a “wait and see” approach to contract rates, but that is over

Shippers were initially reluctant to renegotiate contract rates out of fear that they would lose capacity in the event of a capacity crunch. There was plenty of news for shippers to worry about and some analysts and market commentators warned that the drop in freight volume was either a temporary blip or a misreading of data.

Warnings about port strikes, rail strikes, labor shortages and a potential “tsunami of containers” as China reopened made every supply chain executive nervous about losing capacity. After all, not having capacity is far worse than paying more for it. Moreover, carriers reminded shippers that a pull-back in their commitments or rates would mean that carriers would reject any load tenders from that shipper.

But none of the warnings actually played out.

The railroads got back to work and settled their disputes, the West Coast ports have continued to operate unabated, and container imports bound for the U.S. actually dropped once China reopened. Furthermore, the U.S. goods economy also pulled back as consumers slowed their consumption of goods after facing record inflation and a post-COVID shift toward services.

The Federal Reserve, hell-bent on taming inflation that it largely caused, has focused almost singularly on smothering demand in an effort to control out-of-hand price hikes. There is no market that has felt the pain more than consumer discretionary purchases, which have an outsized role in driving the U.S. trucking economy.

Basically, for all of the warnings of rough waters ahead, supply chain professionals are navigating increasingly stable conditions. The storm had passed — and that fact has become glaringly apparent.

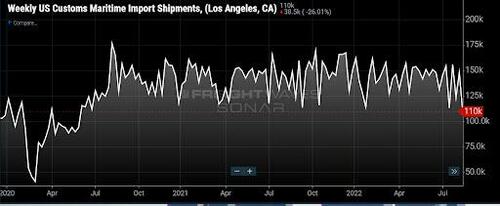

In fact, hope for a fourth quarter peak surge seems very unlikely, if you believe that import volume data is a reliable indicator of future truckload demand.

The Daily Watch, a morning email that is sent by FreightWaves to all current SONAR subscribers, reported that the ports of Los Angeles/Long Beach are seeing the lowest weekly maritime import shipments since 2020. The note states:

“Using SONAR’s WCSTM tickers, we monitor U.S. maritime imports coming into a trucking market for a given week. By this measure, the Los Angeles trucking market (WCSTM.LAX — measures all U.S. ports within that trucking market — in this case, including Los Angeles and Long Beach) saw the lowest weekly total for maritime import shipments since June 2020. While Los Angeles and Long Beach (LAX/LGB) have both kept a steady stream of import volumes through the first seven months of 2022, the weakness in aggregate U.S. import demand is finally beginning to materialize at these ports as well. Other U.S. West Coast ports such as Oakland and the Northwest Seaport Alliance (Seattle/Tacoma) have been posting significant year-over-year (y/y) declines in maritime import volumes for the past two months. Now, LAX/LGB will be joining the downward trend in significant y/y declines. This does not bode well for surface-side transportation markets, in which the ports of LAX/LGB feed a massive amount of demand from U.S. imports from overseas. July 2022 was likely the last month that the Port of Los Angeles will publish any y/y gains in loaded imports for the foreseeable future.”

Shippers, recognizing that the market is “out of the woods” will seek revenge on carriers that sought record increases or didn’t service their loads over the past two years.

With shippers realizing that a repeat of the 2021 capacity crunch is unlikely, they will go out and try to claw back as much as possible of the rate increases that they offered carriers over the past year. Carriers will find it incredibly difficult to withstand this pressure, as rejecting a decrease in contract rates will likely mean that a competitor will haul the freight at the newly negotiated price.

Freight brokers we’ve spoken with have suggested that this is part of their strategy. In essence, they seek to pick off the freight that truckload carriers have under contract, undercutting the rates by more than 30%. As long as the broker can service the load consistently and there isn’t a threat of an imminent service failure, the broker can hold onto the freight, albeit at the reduced price.

For the winning broker and shipper, it is a win/win, but for the incumbent carrier, it will end up losing.

Contract rates will continue to fall and could easily drop to $2.25/mile

A few months ago, the controversy in the trucking market was whether the freight market was in a recession or if it was a short-term blip. It is pretty clear that the recession camp has won and the market fundamentals will continue to be challenging.

Now the question is how far back could contract rates revert before we see a bottom? While it is incredibly hard to predict exact numbers, FreightWaves does have some historical data to draw from.

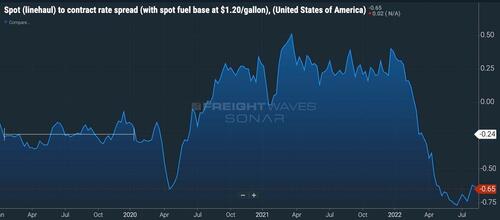

We can point to the spread indices inside of SONAR, which measure the difference between the current contract and spot trucking rates. The indices tend to stay within a tight range, largely because contract and spot inevitably follow one another. This is due to the fact that spot and contract capacity tends to be fungible between the two markets.

RATES12.USA, a SONAR index that measures the spread of contract and spot with a $1.20 fuel-surcharge base, is currently at $0.65/mile. Pre-COVID, the average was $0.24/mile.

If the index reverts back to normal patterns, contract rates will settle back to $2.25/mile before fuel surcharges.

This additional 20% drop would still put the truckload contract rates well above pre-COVID levels — but well off the highs.

Trucking carriers will cry foul, threatening that it is likely to put them out of business since they’ve had to eat massive cost increases over the past two years.

But the market doesn’t care; it only worries about the laws of supply and demand. However, for some shippers, the past two years have felt personal and now it’s their chance to get revenge.

Tyler Durden

Thu, 09/01/2022 – 15:19

via ZeroHedge News https://ift.tt/Eu6sLHY Tyler Durden