“Little Interest In Dip-Buying At The Moment”

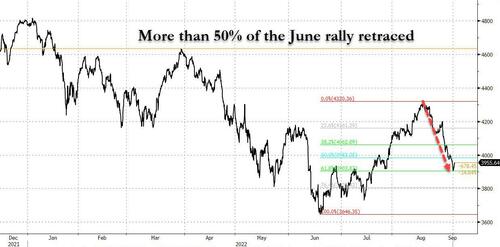

After a stellar July, August proved to be a dismal month for bulls, and investors are bracing for a continuation of volatility into September: according to Citi’s Chris Montagu, there is “little interest in dip buying at the moment” especially with US markets on track for a third consecutive weekly decline. The sell-off has also been gathering pace as “investors struggle to contend with the prospect of further interest rate rises against an increasingly weak economic backdrop,” with the growing uncertainty about corporate health causing the S&P 500 to give back more than half of its two-month advance through mid- August.

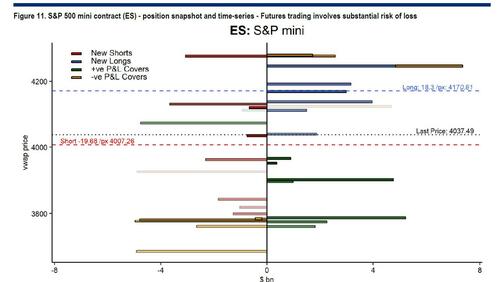

As Montagu writes in his latest Equity Markets positioning model, “US equity futures positioning switched marginally negative in the run-up to Monday’s close as markets declined after Powell’s Jackson Hole Hawkano. “

As shown in the chart below, futures net notional positioning flipped over the week, with S&P 500 positioning falling to (-$1.4bn); Nasdaq futures notional fell by a smaller margin (-$0.2bn), but on a normalized basis both are now negative.

S&P 500 net notional futures positioning fell by almost US$3.5BN, a drop which was primarily driven by a sizeable amount of long unwinds ($7.5BN), while for Nasdaq, shorts flows were modestly on the increase (fig 2). The rapid switch in market direction has driven existing longs into loss.

Citi also calculates that across both SPX and NDX futures, long positions are completely offside, with average losses of 4% and 6% respectively, although Citi sees the risk of forced unwinds as low given the relatively small positioning sizes.

Additionally, investor participation continues to be limited, with leverage levels across long and short positions almost exclusively below 3-year relatives. S&P 500 (+1.2) and Nasdaq (+0.9) ETF flow positioning continues to weaken in line with futures, both dipping on the week before.

Overall, the current trend of lighter activity and positioning remains, while a mix of market-moving events — the jobs report on Friday, inflation data in mid-September (the last one before the Fed’s next policy meeting) and seasonality trends that point to a historically weak month – are keeping investors from chasing the dips, especially since over the past 30 years, September has been the S&P 500’s second-weakest month of the year, with an average loss of 0.2% — trailing only August’s 0.3% decline.

“The key aspect of the headwinds, that is likely the hardest part to grapple with, is the uncertainty created by the next six months of tightening and then interest rates remaining static at the highest level in 15 years,” said Michael O’Rourke, chief market strategist at JonesTrading. “It will be hard to model how that will slow the economy and how such an environment will influence corporate earnings.”

Tyler Durden

Thu, 09/01/2022 – 15:40

via ZeroHedge News https://ift.tt/pEnIiN8 Tyler Durden