Late-Day Panic-Bid Rescues Stocks From Worst Losing Streak In 7 Months

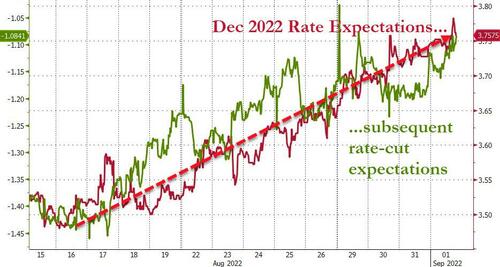

Better than expected jobless claims data combined with an ISM Manufacturing print that did not collapse were just enough good news to spark more hawkishness to be priced into markets as it offers no immediate relief from Powell’s pain…

Source: Bloomberg

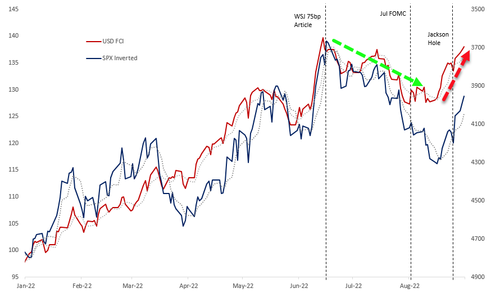

Some good news – for Jay Powell – is that financial conditions are tightening since he unleashed hell at J-Hole…

As one Goldman trader detailed: “We think the shift in tone from the July FOMC to Jackson Hole was a carefully curated effort to unwind the FCI loosening that transpired following the July signal that “it may be appropriate to slow the pace of hikes”.

Crucially he recognizes that “The fact that inflation remains well above target means that trading this range with a long bias remains a highly asymmetric strategy at this point in the cycle as any tactical risk bounce or rates rally will ultimately likely prove self-defeating given the repeated signal that the FOMC will lean against any easing of FCI whilst inflation remains elevated – either through “open mouth operations” or via policy rates.”

So be careful what you wish for.

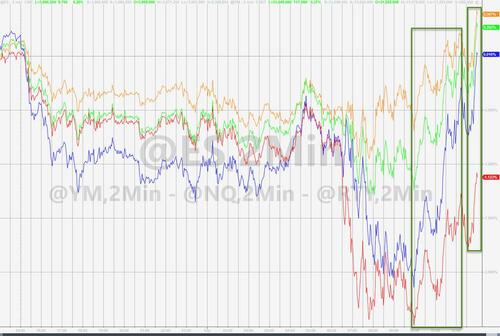

That hawkishness combined with yet another outlook warning from NVDA sparked weakness in futures which carried into the cash open at the start of the market’s historically worst-performing month. That weakness continued until data showed freight weakness is dramatic (bad news) and that seemed to spark an algo-buying-panic,which lifted the Dow, S&P, and Nasdaq into the green for the day ahead of payrolls tomorrow morning…

The S&P bounced intraday off its intermediate term trendline off the June lows…

And here is SpotGamma with further details on where today’s support came from…

There was a complete decoupling (amid low volumes and liquidity) between stocks and bonds in the afternoon…

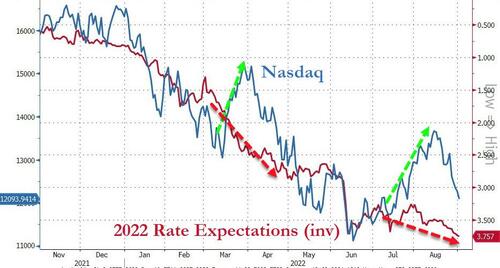

But there’s more ‘pain’ to come…

Source: Bloomberg

It’s been an ugly week for NVDA and that didn’t help overall sentiment…

Treasuries started September as they ended August – being dumped – with the long-end underperforming on the day (30Y +7bps, 2Y +1.5bps). Interestingly on the week, the belly (7Y) is underperforming (up b double the number of bps than the 2Y….

Source: Bloomberg

The 10Y Yield neared 3.30% today, its highest since June 21st (but below the cycle highs)…

Source: Bloomberg

…but the 2Y yield rose above the June highs to its highest since Nov 2007…

Source: Bloomberg

The dollar extended post-Powell gains today…

Source: Bloomberg

…pushing above the peak-COVID-crisis safe-haven peak…

Source: Bloomberg

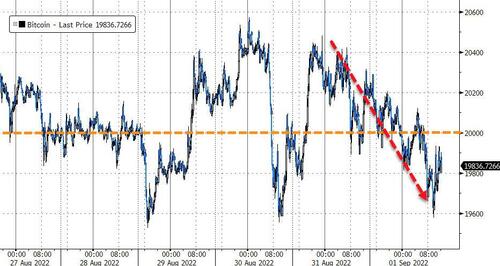

Cryptos were dumped again today, with Bitcoin back below $20,000…

Source: Bloomberg

Spot Gold tumbled back below $1700

Oil prices continued to slide with WTI back below $90…

Finally, in case you thought the economy was doing ok, we note that the Baltic Dry Index has been tumbling in the last couple of months (when historically it rises this time of year) and is now at its weakest since 2016 for this time of year…

Source: Bloomberg

In fact, as we tweeted earlier, the freight recession is now as bad as peak-COVID; but until inflation prints a 4 handle or payrolls print negative-one-million, Powell’s pain will continue.

Tyler Durden

Thu, 09/01/2022 – 16:01

via ZeroHedge News https://ift.tt/ItKFiz1 Tyler Durden